CONAB, Brazil’s National Supply Company (federal agriculture agency), released its January report this week. While it reduced the size of the country’s soybean crop, as we expected, it did not reduce it nearly enough.

CONAB pegged the soybean crop at 140.5 MMT, down nearly 2.3 MMT from last month. CONAB seems well behind the curve as the state of Paraná says their crop has lost nearly 8 MMT alone. While Paraná may have had the worst of it, Mato Grosso do Sul, Sao Paulo and Rio Grande do Sul will all see major yield losses from drought and hot weather on top of that.

Related: La Niña damages crops in Southern Brazil

Granted, there has been a lot of soybeans replanted in the South, but replanting rarely yields as well.

Corn distress

The first corn crop in Brazil is in the same situation with yield losses approaching 10 MMT. That is 400 million bushels the domestic market will have to source from somewhere else either through imports, demand rationing, or alternative products.

All of this helps keep Brazil’s domestic prices elevated with corn trading around $7.20 on the B3 trading exchange.

The state of Rio Grande do Sul is facing yield losses of 60% or more. Most of the corn harvested up until this point has been directed towards silage as it does not meet grain quality standards. Farmers and ag groups are already mobilizing for government support to help farmers during this challenging time.

Yield results are slowly beginning to trickle in. One region in the southern part of Mato Grosso do Sul reported yields between 8 and 27 bpa. These are not isolated incidents, rather they make up roughly two-thirds of the yields in that region. The other third expects better yields in the 40 to 45 bpa range, which will pay the bills but it’s still a 30% yield loss.

Most of these fields had potential for 65+ bpa at the start of the season. There will likely be some areas that won’t be worth harvesting. Many of these farmers will be focused on planting the second crop of corn which will look to begin this week. Assuming decent yields, prices remain elevated giving farmers the opportunity for profitability to help offset their loss in soybeans.

I have seen Mato Grosso report some good yields starting out. This will help offset some of the losses in Brazil’s soybean crop, but not all. Many crop projections are calling for a soybean crop of 131 MMT to 134 MMT.

Relief in sight?

The forecast does not show much relief yet for Rio Grande do Sul. There are some scattered showers for Paraná and surrounding states later this week. But Rio Grande do Sul will have to wait until next week where GFS models show stronger chances for precipitation.

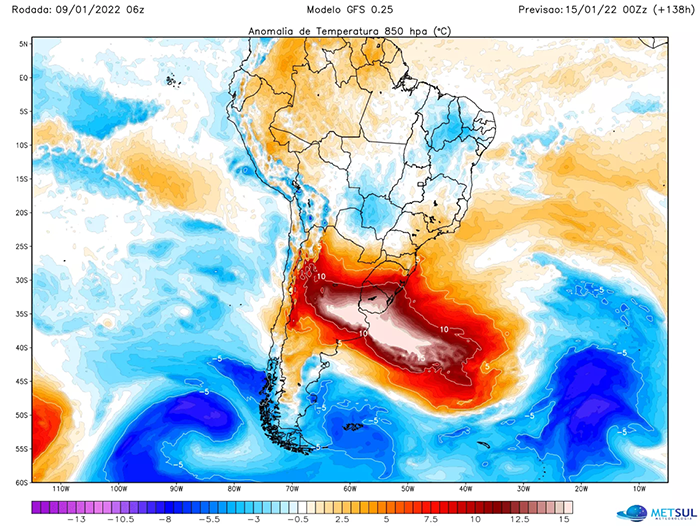

To add insult to injury, the latest threat lately has been extremely hot temperatures. Argentina is burning up. Heat waves described as “exceptional and uncommon” reached record temperatures of 116 degrees F in certain regions of Rio Grande do Sul, Uruguay and Argentina over the weekend. The season could already be described as unusually hot going into this week. Many cities are expected to set new temperature records not seen for several decades. Buenos Aires is expected to reach a new temperature record over 100 degrees not seen since 1995. This will only accelerate evaporation rates with what little moisture is left.

Despite dry weather in the South, more than enough rains are falling to the North. Areas of Minas Gerais and Bahia have been experiencing flooding in some areas, so much so it has displaced people from their homes. My family’s farm has received a month’s worth of rainfall in the first ten days of the year. Most of the flood areas are not in crop production regions and so are not expected to have a negative yield impact. However, they could have an impact on livestock and the people living there.

I am still looking for a weather pattern change in the second half of January where Southern Brazil turns wetter and Northern Brazil turns drier. This would help later planted beans in the South and facilitate the soybean harvest and second crop of corn planting to the North.

Matthew Kruse is President of Commstock Investments. He can be reached at [email protected].

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

BrazilAbout the Author(s)

You May Also Like