Last week, I wrote about clients who bought September wheat puts with September wheat futures right at $11.00. People were paying 59 cents per bushel for the right to sell September wheat futures at $10.00 and 26 cents for the right to sell September wheat at $9.00.

Why would anybody pay so much money for the right to sell September wheat $1 and $2 below the current price?

Why not just sell the September wheat futures at $11.00 and not spend $2,943.75 for the right to sell September wheat at $10? No brainer, right?

Well, yes and no.

Currently, one has to have $4,510 in their futures account to sell (or buy) one 5,000 bushel wheat futures contract. That is $1,566.25 more money tied-up than to buy the $10 put; i.e. less cash is tied up to buy the $10 put than to sell futures at any price.

If September wheat moves higher, the put option declines in value, but the buyer already paid full price for the put, so no one will require the buyer of the put to cover the loss. With the futures position, the initial margin deposit of $4,510 is really a down payment on $55,000 worth of wheat (5,000 bushels times $11.00). If wheat goes up one cent, that $55,000 worth of wheat increases to $55,050 (one cent times 5,000 bushels = $50). In which case the buyer of wheat futures at $11.00 now has $50 added to his account.

Guess where that $50 comes from? From the trader’s account that sold September wheat at $11.01; in this example that would be your hedge account! In that case, you have lost $50 in the futures market.

Where’s the premium?

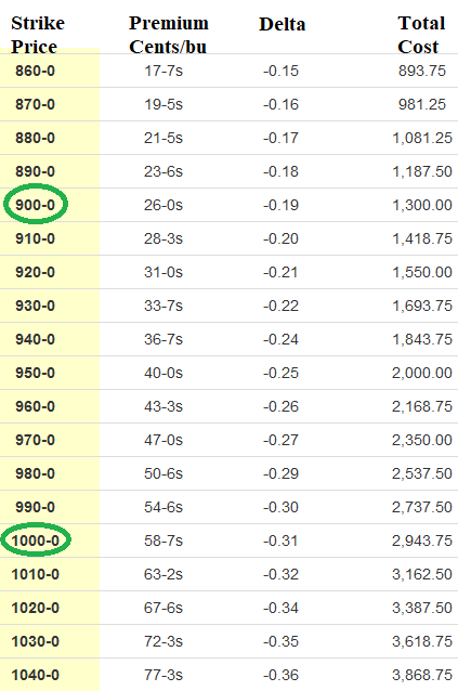

What happened to the premium of the $10 put if wheat futures price goes up one cent? Well, of course it lost value, but only 31 hundredths of a cent. How do we know that? Because the delta of the $10 September wheat put on April 14 was 0.31. The chart below is the same we showed last week, namely the September option settlement prices for April 14, the day before Good Friday. The delta column at the $10 strike price says 0.31 (=0.31%). The delta of an option is the percentage of the price change of the option for each 1% change in the price of the underlying futures contract. Had September futures price lost one cent, likewise, the value of the put option would have increased only 31 hundredths of a cent.

Why would the option premium increase if futures lost one cent? Think about it! This is not rocket science. The buyer of the put buys the right to sell futures at the strike price. As the futures price declines, the strike price never changes and more people are willing to pay up for every put option.

The reason the $10 put option premium changes about one-third the rate of the futures is because the $10 put option is a dollar out-of-the-money; meaning, if that put was exercised (exchanged for a futures contract), the resulting futures position would be losing $1.00; the futures short (sold) position would be $10 (the option’s strike price) with the futures price at $11.01 on the close.

Right now, September wheat is up 16¼ cents. Thus, the traders who sold September wheat futures have lost $812.50.

About how much did the owner of a $10 put lose so far today? $251.87 (delta of .31 times 16¼ cents times 5,000 bushels per contract)

About how much did the owner of $9 put lose so far? $154.37 (delta of .19 times 16¼ cents on 5,000-bu. contract)

If wheat goes to $25 this year like it did in 2008, would you rather own a put option or the short (sold) wheat futures?

This is part two in a series. For more, read:

Part one: Put options add value to your cash grain sales

Part three: Enhance profit opportunities with put options

Part four: Put options and no margin calls

Part five: When does a put option have no potential value?

Part six: Why are put options so expensive?

Part seven: Use puts to manage grain marketing risk

Part eight: What is time value of an option?

Part nine: How to calculate time value of an option

Part ten: Use puts with Hedge-to-Arrive to increase farm income

Part eleven: Sample timeline to explain how wheat puts work

Wright is an Ohio-based grain marketing consultant. Contact him at (937) 605-1061 or [email protected]. Read more insights at www.wrightonthemarket.com.

No one associated with Wright on the Market is a cash grain broker nor a futures market broker. All information presented is researched and believed to be true and correct, but nothing is 100% in this business.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like