As November begins most farmers are power washing and putting equipment back into the shop or shed for the year. This is usually a time where everyone takes a little breather from work and focuses on family, finances, budgeting, end establishing a marketing plan for the coming year.

The market also transitions from a season of intense stress as it tries to determine how each week's weather will affect yield and balance that with projected demand at a fair economic value, to a market that has a more stable environment with a known supply and demand. The imbalance of speculators to end users that drives summer volatility typically abates during the winter as the market becomes focused on moving just high enough to inspire farmer selling, followed by a price low enough to inspire end user buying. This is typically called the distribution phase of the market and is often met with a sideways or rangebound pattern.

Seasonal low established

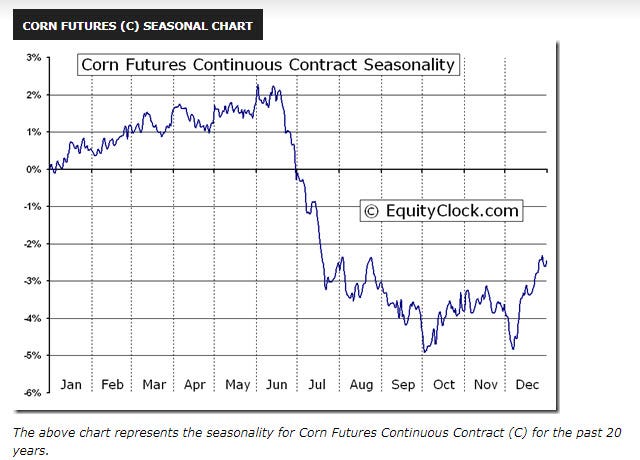

It is likely that the $5.06 price traded on October 13th was the fall low this year. This would match up very closely to the seasonal low that normally occurs in the first week of October according to this 20-year seasonal chart.

Based on the seasonality of the market, you could expect a sideways distribution range until the market moves higher into the spring. This would make logical sense in the coming six months as history tells us to expect a significant shift away from corn acres given price of inputs. One way to resolve or prevent such a shift would be to lower fertilizer and chemical expenses. This is not likely given the fact that input prices have risen due to long term macro reasons. The tariffs placed a few years ago, the labor issues worldwide associated with Covid, and the world’s logistic issues are not easily solved. Since the industry cannot stand more than a 3-million acre shift away from corn, we believe the market will adjust to provide producers more incentive to produce corn and less incentive to produce beans or other commodities. Obviously, that argument would lean towards a higher corn price; however, it could also be accomplished by lowering other commodity prices. Therefore, your marketing plan should include both possibilities.

Profit keys for 2022

As we transition from the harvest season and into the marketing season, our consulting business has been very busy working with producers establishing budgets and determining profitability. We highly recommended buying inputs back in August. Yet getting those nitrogen units down has been a challenge for many and some product might re-price at double the values they were bought at. These are challenges that must be addressed head on.

We have also recommended protecting price on 50% of 2022 soybean with some built in open upside features in order to lock in a profit despite where prices go. This is a comfortable position and is allowing us to maintain a larger long position of corn while we let this market resolved the dilemma we see coming.

Micro issues that could move the market out of the coming distribution phase would include:

USDA supply demand table released November 9th, weekly export shipments of corn needing to move closer to 50 mbu versus the current rate of 30, weekly soybean exports shipments needing to decline or USDA will need to raise exports, participation by funds during the holidays, the January Annual Crop Production, Supply-Demand and Quarterly Stocks report, and of course, South American weather.

All of these micro influences are of course monitored during our weekly video broadcasts by our team of experts. We invite you to listen in or to give us a call at any time.

Reach Bill Biedermann at 815-893-7443 or [email protected].

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading infromation and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like