September 13, 2021

Harvest has officially started in many places across the corn belt. Growers have meticulously made their crop plans. They planned the seed population, weed/insect management, equipment maintenance and likely a couple hundred more decisions to grow this crop.

With all the planning and effort that has gone into the production side of this year’s crop, what efforts have been done to manage the marketing side? Hopefully that plan doesn’t look like this:

Least favorite job

As a grower, coming up with the marketing plan is likely one of the least favorite parts of the job. It feels more rewarding to see the fruits of our labor come across the yield monitor in the combine. However, if you look at “Revenue” line item on your income statement, that marketing plan more than likely has the largest impact to your operation’s finances.

The cause of this reluctance to work on a marketing plan can be for multiple reasons. Maybe the thought is the market has been so high for so long that I will do fine no matter what happens. The 2008 and 2014 crop years were tough lessons for growers who wear ��“bullish blinders”.

Another reason for this reluctance could be FOMO - fear of missing out - if prices move higher, like what they did for the 2020 crop. A third reason may be due to not understanding what tools are out there to use in a marketing plan, or not knowing what the advantages and risks are of using those tools.

Where prices can go from here is impossible to predict. If you look at changes in yield alone, there are some wild differences it what the ending stocks for the crops can look like.

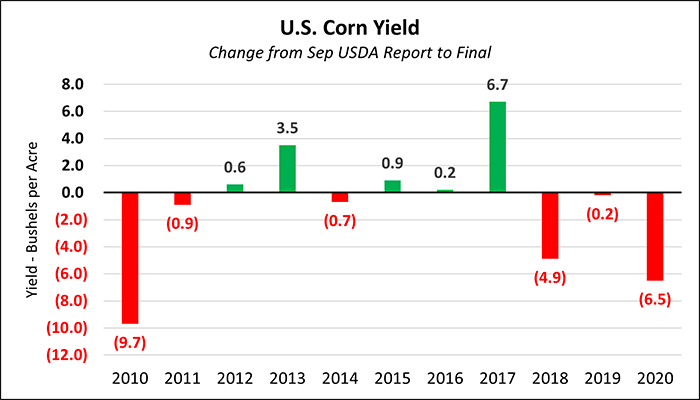

Below is a chart of the yield changes from the September USDA report to the final yield for the crop year.

On corn, the average increase has been 2.4 bushels per acre (bpa) and the average decrease has been 3.8 bpa. Applying that to the current projected harvested acres could mean 200 million more bushels and a 1.6 billion carryout (assuming no change in demand), or 325 million less bushels and a 1.1 billion bushel carryout.

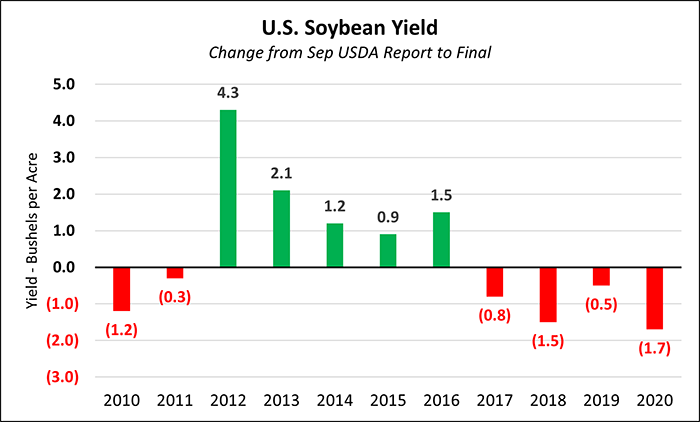

Below is the same chart for beans showing the yield changes from the September USDA report to the final yield for the crop year.

For soybeans, the average increase has been 2.0 bushels per acre (bpa) and the average decrease has been 1.0 bpa. Applying that to the current projected harvested acres could mean 170-million more bushels and over a 350-million bushel carryout (assuming no change in demand), or 85 million less bushels and around a 100-million bushel carryout.

What’s your plan?

Do some what-if scenario planning. Sit back and ask yourself, if corn prices set back $1 or more per bushel, how am I positioned? At the same time, you need to ask yourself if corn rallies $1 or more, am I situated to capture the rally on enough bushels to make enough of an impact to my bottom line?

Is a plan for the 2021 crop enough?

Soon after the 2021 crop is harvested, further plans and actions for the 2022 crop will be right around the corner. This might include fall nitrogen application and seed decisions. Rising input costs for the 2022 crop has been on the top of growers’ minds over the last 6 to 9 months as commodity prices have risen. There is a hesitancy to do anything for marketing the 2022 crop given the concern of higher input costs. The question you need to ask yourself is, do I have the risk that crop prices can fall despite higher input costs?

The market doesn’t promise you profitability. In the last 15 years on Sept. 15, nearby corn futures have been above $5 only three times. It might be a good time to start to develop that plan for 2022 by getting some floors in place while keeping upside flexibility.

Capitalize on opportunities when the market gives them to you.

With lower input cost for 2021 and higher crop prices, there are good profitable marketing decisions that can be made. There are also great starting points for marketing decisions on the 2022 crop. Don’t get caught with the risk that prices can fall on both crops. There is nothing more frustrating than missing out on good opportunities across multiple crop years. You may need to capitalize on the 2021 crop year to build up some working capital to face the next couple years.

The first step is creating that plan and stress-testing it across multiple market scenarios. Again, I will ask the question: “What’s your plan?”

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like