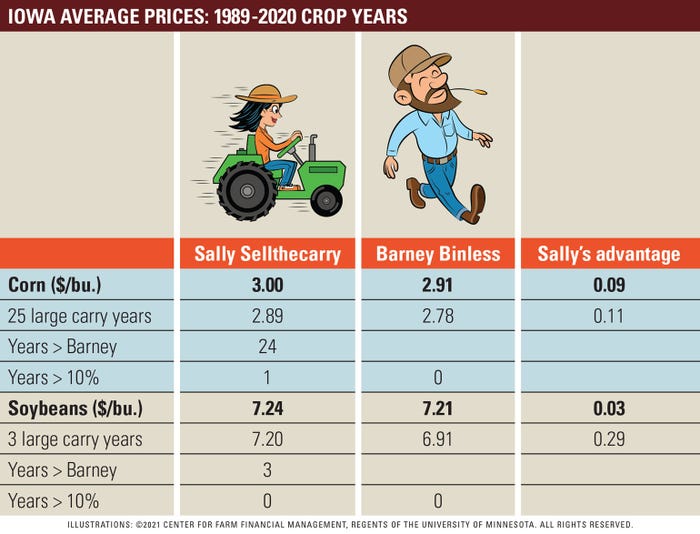

We already met May Sellers and her “go for it” strategy of holding unpriced grain in storage. Now we meet her polar opposite in risk management, Sally Sellthecarry.

Selling the carry is a marketing strategy for corn producers with on-farm storage. I specify corn because selling the carry only works when carrying charges are large and positive, i.e., deferred futures trade at a sizable premium to the nearby contract. Large carrying charges are common in the corn market, but not in soybeans. To sell the carry at harvest, Sally places grain in storage and sells the July contract. She does this in years when the carry from the December corn contract (or November soybean contract) to the following July contract is greater than 140% of interest costs.

Sally understands that a large carry in the futures market, combined with a generally stronger basis in late spring, is a low-risk way to add value to her crop. Her final price is the July futures prices sold at harvest less the actual cash basis for corn or soybeans sold in late May.

Like all my characters who store grain, Sally is limited to holding 80% of her harvest in on-farm storage – 20% is sold at the harvest price. Her final price is also net of variable storage costs, including interest on debt and in-and-out shrinkage costs (8 cents and 11 cents/bu., respectively, for corn and soybeans).

I focused on Sally’s actions when carrying charges are large. What does she do when carrying charges are small (<140% of interest costs)? If carrying charges are small or inverted, there is no incentive to store grain and sell the carry, so she simply sells at harvest. The current harvest is a good example. On October 15 (Barney’s harvest date in 2021), the carry from Dec’21 to Jul’22 was less than 14 cents/bu. and did not meet Sally’s criteria for a large carry. She followed Barney’s lead and sold corn at harvest.

Since 1989 in corn, Sally had a large carry to sell in 25 of 32 years. Her margin of victory is rarely large (greater than 10%) but she wins, as selling the carry beat Barney’s harvest price by an average of 11 cents/bu. In some years, selling the carry limited gains because cash prices trended higher into spring. For example, consider the 2018/19 crop year. Sally sold the carry and beat Barney by 15 cents, but she could have made another 23 cents by not hedging and holding grain unpriced into spring. Then again, in the following year her sell the carry strategy saved her from disaster as prices crashed in the spring of 2020. Hers is a conservative approach to storing and pricing grain.

Does selling the carry sound like a dull strategy? Yes. But your local grain elevator does it in a routine manner to help pay for the investment in storage capacity. Sally’s sell the carry strategy may be dull, but it is also effective.

Meet the rest of the crew:

Ed Usset is a grain market economist at the University of Minnesota, and author of the book “Grain Marketing Is Simple (It’s Just Not Easy).” Reach Usset at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like