“Naomi, why isn’t this wheat marketing going anywhere? Prices are just stuck. The wheat in Kansas is burning up and with the snow in the Northern Plains, that Spring Wheat may get planted late.” This was a statement a client said to me this week. I agreed with this commentary, and he is right, wheat futures do seem to be holding in a modest trading range.

As you all know, wheat prices and grain prices can react not only to actual supply and demand news for the grain and oilseed, but also to outside market influences. And right now in the short term, traders seem to be more focused on outside markets than supply and demand. Here are three outside market influencers that are demanding the spotlight at the moment:

Inflation

Yes, the “it” word from 2022 was part of the reason grain prices rallied as hedge funds were buying commodities as a hedge for inflation, as the global supplies of grains were dwindling and the Ukraine/Russia war was new and brought uncertainty to global production of grains.

Now the Fed and the world are doing their darndest to fight inflation and bring commodity prices back down. The consumer-price index, a closely watched measure of inflation, rose 5% last month (trade thought it would be 5.2%). This was viewed as welcome news as Americans might be seeing relief for their pocketbooks.

While inflation levels have been trending lower as commodity prices have fallen from their 2022 summer price highs, this 5% inflation number is still deemed too high, and the Fed wants that number to come down. The Fed’s most active strategy to fight high inflation is to keep raising interest rates.

Still higher interest rates to come?

Many questions still swirl about this topic. The Feds raised their benchmark federal funds rate by a quarter percentage point at each of their two meetings this year, most recently in March to a range between 4.75% and 5%.

While inflation has slowly been decreasing, inflation remains well above pre-pandemic levels. Over the past year, the Fed has raised rates at its fastest pace since the early 1980s to combat inflation.

The Fed has emphasized that further interest rate rises are likely to continue until it witnesses convincing evidence that inflation is slowing.

Fed officials have also said that they will pay close attention to other measures of economic activity (recent banking issues) before they make their next move.

The correlation between higher interest rates and “the funds”

We talk about the funds and how they can affect price movement in commodities. They are investing to make money, whether it be as buyers or sellers. Oftentimes, due to the large amount of commodities they are trading, their buying or selling can make large price swings in the marketplace.

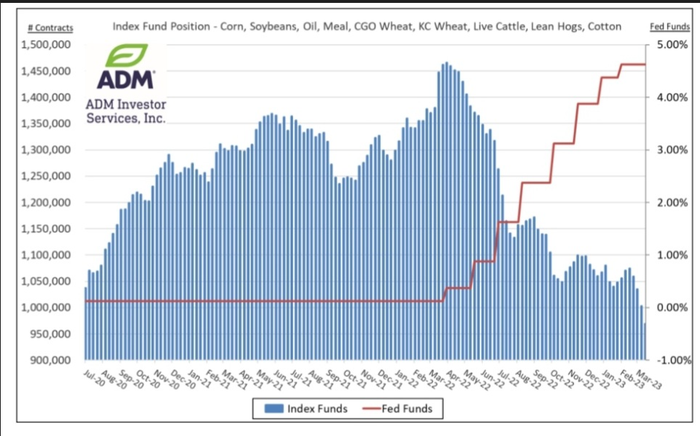

It is interesting to note that as the Fed has raised interest rates nine times over the past year in efforts to tame inflation, the funds have overall reduced their amount of activity in the commodity sector.

As the funds continue to exit long positions, the overall value of commodity prices has trended lower since the summer 2022 commodity price peak. This also helps to explain why crude oil futures, wheat futures, and corn futures have been mostly trading in lackluster trading patterns in recent weeks. There has been a lack of bullish or bearish fundamental news, and the funds just seem to refuse to participate. They are likely investing their money in other ventures.

Therefore, it is very important to monitor if the funds raise interest rates again at their upcoming meeting on May 2-3, 2023. If they raise interest rates again, that would be the tenth consecutive time in this tightening cycle. It would also likely keep the funds on the sidelines.

My personal hope is that the Feds leave interest rates unchanged for this cycle to allow more time to elapse to naturally see how the U.S. economy has fared with the recent aggressive hikes. But Fed Chairman Jerome Powell has made suggested in recent months that the central bank will not back off its inflation fight until price growth is slowing back to 2% overall inflation. (Hint: they also need Mother Nature to cooperate and provide a record U.S. grain and oilseed crop this summer, so commodity prices naturally come down on the perception of improved supply.)

My fear is that the Feds will just blindly raise interest rates higher because they feel they need to make a point, and then suddenly realize their actions were overzealous with policy makers then scrambling to pick up the pieces and right the situation.

The above factors are intertwined. The Feds need the farmers to raise a huge crop this summer to help raise supplies. If there is a large crop, that will drag commodity prices down. Farmers are dealing with high input costs and high interest rates that affect their loans for their farms. Farmers need high prices to break even or show slight profits on the books for 2023 and the crop they are about to plant.

The markets are slow to move because the funds are participating less as they wait to see what the Feds do regarding interest rates. It feels as though it may be one big cat-and-mouse game and quite frankly I’m not sure how to quantify who might be the winner or the loser when all is said and done.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like