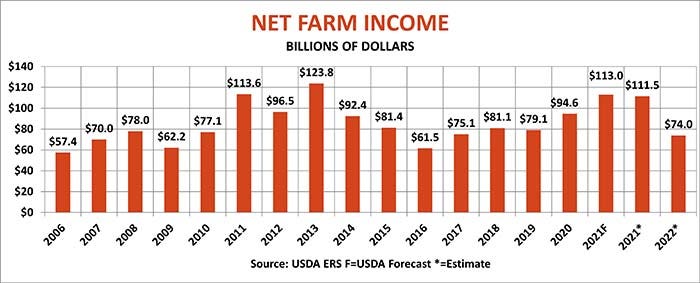

It’s time to give thanks, and U.S. farmers have reason to be grateful. But if too much turkey and stuffing loosens your belt on Thanksgiving, get ready to tighten it for New Year’s Eve. Estimates of net farm income for 2021 should remain among the best ever when USDA updates its forecasts Dec. 1. But the outlook for next year isn’t so bright, with early indications suggesting profits could fall by 30% or more.

USDA’s Economic Research Service won’t put out its first take on 2022 financials until February. But based on projections for crop and livestock production and prices released earlier this month it appears farmers should get ready for a year reduced expectations.

The government’s most recent financial estimates came out in June, when NFI was forecast at $113 billion for 2021. Since then, potential crop receipts fell due to lower production and prices, with oilseed receipts suffering a big hit and corn also falling. Those setbacks should be mostly offset by better fortunes in the livestock sector, which could knock income down to $111.5 billion, still the most since farm profits hit an all-time high of $123.8 billion in 2013.

The news doesn’t look nearly as favorable for 2022. Based on USDA’s latest projections about production and prices, income could drop to $74 billion next year. That would be the lowest since 2016, and down $37.5 billion from my revised 2021 figure.

Net farm income explained

Net farm income adjusts calendar year cash receipts and expenses to account for changes in inventories because farmers hold different year-end totals of crops and livestock from year to year. Predicting how much production will be held over from one year to the next is never easy to predict, and that’s just one of the challenges in making these income forecasts. Depreciation can also be tricky and estimates for government payments can change dramatically depending on the winds from Washington.

Compensation for the impact of trade wars swelled direct payments to record levels in 2020, while COVID-19 aid and disaster relief should keep support strong in 2021. But without new spending or shifts in funds from the new infrastructure bill, the tax bills farmers pay could be more than they receive back from Uncle Sam.

And that’s just the start of the uncertainty about your financial outlook.

What will farmers plant?

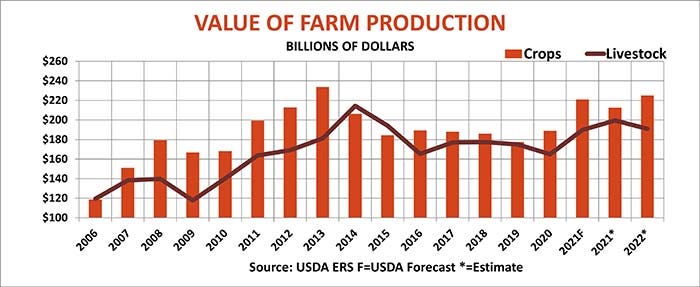

USDA’s first forecast for 2022 acreage, production and prices called for growers to plant 92 million acres of corn and 87.5 million acres of soybeans, totals that could change depending on profit potential, input availability and weather. Seedings of both crops could go up due to strong projected returns but USDA’s forecast for average cash corn prices of $4.80 a bushel could be fifty cents too high. Otherwise, total feed grain revenues, which also includes sorghum, oats, and barley, could help boost the value of crop production to the highest since 2013.

Soybean revenues may turn out stronger than indicated by USDA’s initial 2022 supply and demand outlook. Still, oilseed receipts are likely to be much lower than the $55.9 billion USDA forecast in June for 2021.

Livestock revenues also look like they could be down after bouncing back in 2021 from the chaos caused by the pandemic’s impact on demand and supply chains. Most of the downgrade comes from lower beef and pork production, while poultry, eggs and milk receipts look slightly higher.

Expense explosion

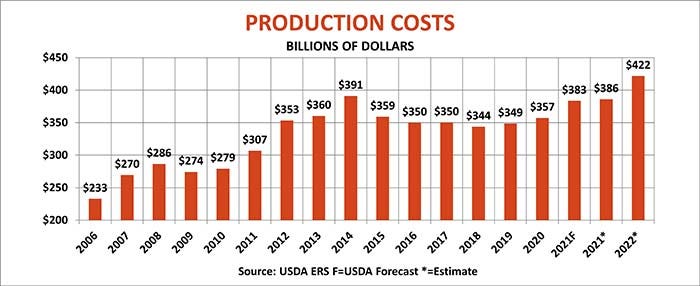

Inflation, as measured by the Consumer Price Index, rose the most in October since the end of 1990. The rally in grain prices over the past year was both a cause and an effect of the commodity boom prompted by post-pandemic demand, supply chain bottlenecks and massive government stimulus. While that helps on the revenue side of income statements, the other side of the ledger followed suit, and then some.

Indeed, while 2022 revenues look to be up 3.1%, production expenses could jump 9.3% as everything from seed to feed costs more. But the biggest drain on profits is likely to be from fertilizer. Nitrogen markets moved higher again last week after India booked more than expected at its latest tender but paid dearly to secure supplies. So, unless prices break in time for planting, farmers’ fertilizer bills next year could be up 50%.

Rising interest rates should only add to the price tag for growing crops, with machinery depreciation also likely to increase as farmers plow profits back into more expensive equipment to upgrade their lines after years of holding pat.

Of course, this is just a first look at the year ahead, subject to a lot of potential revisions. But it’s another reminder that profits are never guaranteed in agriculture.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like