As we approach the March 31 Prospective Plantings report from USDA, let’s take a look at one of the most significant factors playing into corn and soybean markets over the past year or so – fertilizer expenses.

In our March 2023 Farm Futures survey, nearly 80% of farmer respondents expect this year’s profits will be lower than last year’s. For those growers bracing for lower profits this year, 35% of respondents cite higher input costs as the primary cause.

On Friday and Thursday of last week, respectively, two very important datasets – Purdue University’s 2023 crop budget and Illinois USDA’s bi-weekly retail production costs report – were published to the market that offered insights into how farmers may make planting decisions this year.

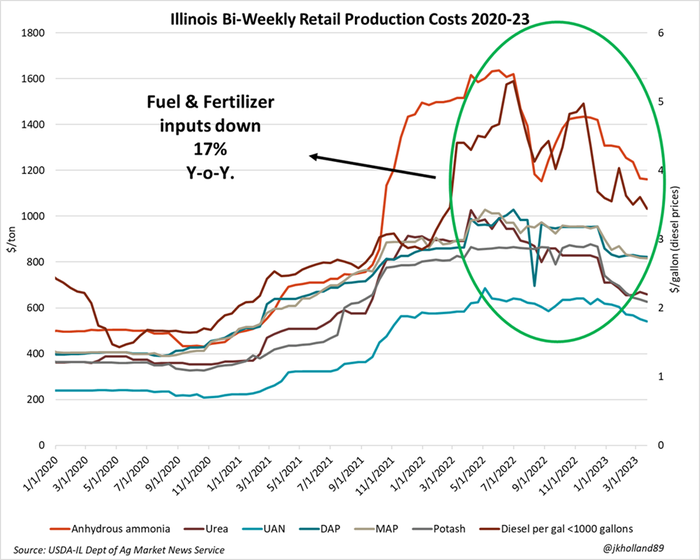

The Illinois USDA report provides a look at how rapidly input prices have fallen over the past year. Most notably, anhydrous ammonia and urea prices are down 23% and 26% from a year ago. Also noteworthy – MAP and potash prices are 23% and 22%, respectively, lower than this time last year.

Fertilizer costs in Farm Country have fallen dramatically from 2022’s highs following Russia’s invasion of Ukraine. Global reshuffling, prevent plant acres, and demand destruction (i.e. high prices killing high prices) helped give inventories a chance to restock at the end of the 2022 growing season and those downward trends have continued into late March 2023.

The nitrogen conundrum

On the surface, the lower nitrogen prices seem like a prime opportunity for corn expansion. But there’s more than meets the eye here. Anhydrous ammonia can only be applied in the most cost-effective (and with the highest yield potential) when soils are cold – below 50 degrees. Spring is running about three weeks ahead of schedule in southern regions of the Midwest while snowpack remains heavy in the Northern Plains and Upper Midwest where corn acres could potentially be in flux.

Urea fertilizer is not stable on its own, meaning that it requires an additive to be properly absorbed into the soil in order to be captured by the plant. It may be cheaper right now, but it is still a higher-risk management strategy for corn growers this year.

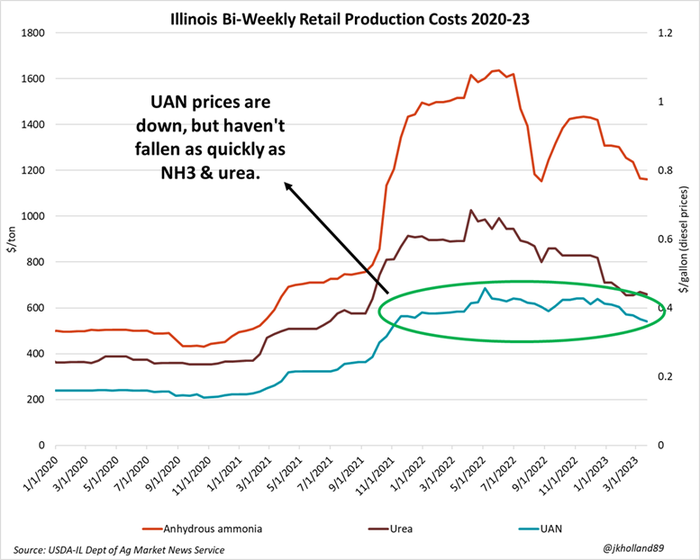

Liquid UAN is primarily the nitrogen fertilizer of choice in the spring, especially in warmer climates and in areas where applications may be running behind schedule. But UAN prices haven’t fallen as rapidly or by as much as its anhydrous and urea counterparts. Those higher prices could be a barrier to entry to more corn acres this spring, especially in areas outside of the “I”-states where nitrogen fertilizer prices tend to be quoted higher.

These high UAN prices could be a barrier to more corn acres being planted this spring, especially in areas outside the “I”-state corridor – especially in the Northern Plains – where nitrogen supplies tend to run more expensive and aren’t as much of a guarantee of high yields as in the fertile and lush Eastern Corn Belt.

Many farmers who may have applied anhydrous ammonia last fall may not be bothered by the acreage discussion this year – they’ve likely already locked into corn acres. But on the flip side, growers in the Upper Midwest may be biting their nails as heavy snowpack threatens to push back spring nitrogen applications.

We know from recent history that more prevent plant acres are typically correlated with lower fertilizer consumption. So while price is always a consideration, weather creates an added layer of complexity to the discussion.

Crop budget implications

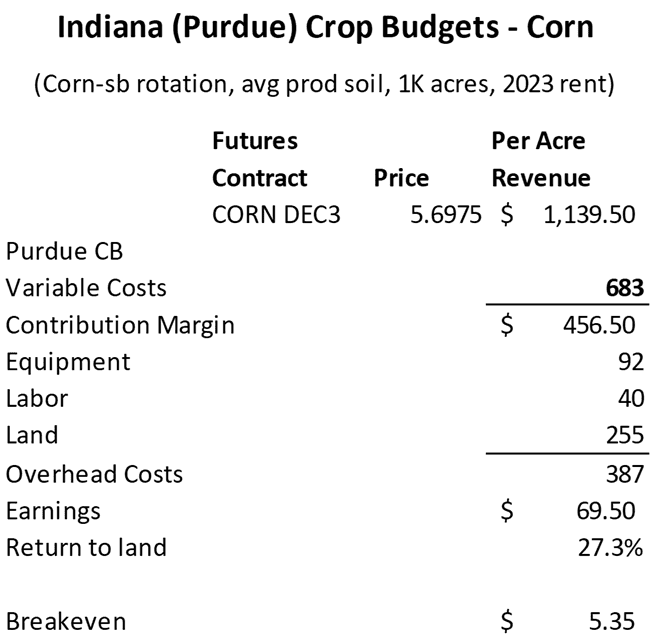

The Purdue University crop budgets captured this dynamic in their latest update. Note – I don’t use Purdue’s budgets because I’m biased (well…). As you know, I was a cost accountant back in the day and Purdue’s budgets are structured in a way that prioritizes the operational expenses when considering returns from yields. Since I focus on cost management that drives higher revenues in this role, in my past roles, and on my family’s farm, this is my crop budget tool of choice.

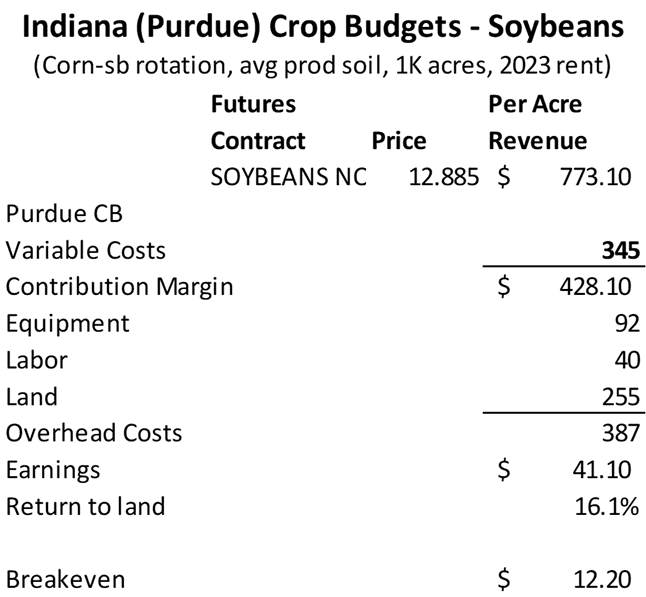

Purdue only cut its per acre corn costs by 2% from its January 2023 estimates to reflect this dynamic. It’s likely also accounting for the fact that many growers in the “I”-state corridor likely also pre-purchased fertilizers last fall when prices were higher. Soybean per acre costs were only cut 1%.

But falling commodity prices are a more significant item to watch in Purdue’s budgets. I do a little redneck math to factor in current prices for new crop corn (Dec23) and soybean (Nov23) contracts, which still point to favorable per acre earnings results for both crops.

For corn, yesterday’s price of $5.69/bushel puts 2023 per acre corn earnings at $69.50 an acre. That’s a 27% return to land and puts the break even for corn acres at $5.35/bushel. For soybeans, Tuesday’s $12.97/bushel results in $45.90/acre in earnings with an 18% return to land investment. Soybean’s breakeven has more flexibility than corn due to lower yields and the absence of nitrogen input costs, leaving it at $12.20/bushel.

The 2023 acreage battle

Even though soybean revenues have given up quite a bit of ground to its corn counterparts in recent weeks amid the banking sector meltdown-fueled soybean selloff, soybean earnings are still plenty competitive with corn this season. For drought stressed regions of the country, higher cost corn inputs may be a riskier gamble this year relative to more drought-hearty crops like soybeans.

Corn faces its own problems from the demand side of the market. March 1 cattle on feed inventories were a staggering 4.5% lower than the same time a year ago – the smallest March 1 reading since 2017. About 46% of U.S. cattle inventory is currently located in areas under drought, primarily on the Plains.

As planting approaches, cattle producers may opt for more drought-hearty and affordable crops like sorghum as soil moisture on the Plains remains depleted. And it is important to keep in mind that these budgets change throughout different locations in the Heartland. Fertilizer costs continue to be a major driver of 2023 crop decisions – we will see how it all plays out on Friday.

Want to learn more about market considerations for Plant 2023? Market analyst Jacqueline Holland explores factors behind the acreage battle ahead of the March 31 Prospective Planting reports:

The 2023 acreage battle heats up

Read more about:

FertilizerAbout the Author(s)

You May Also Like