I titled a column last month, “Where is 2022 headed?” But as the calendar turned to the new year, many farmers I spoke with at the 2022 Farm Futures Ag Business Summit a couple weeks ago were already looking ahead to 2023 – and with good reason.

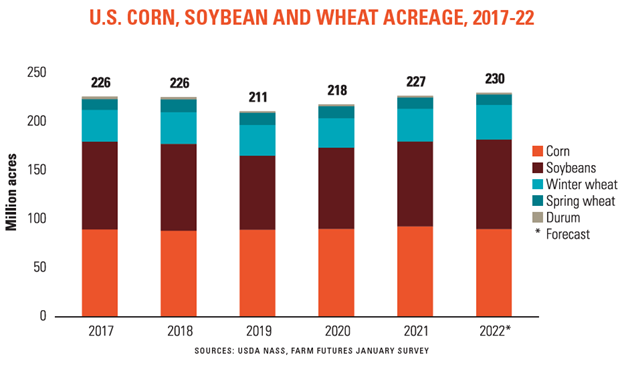

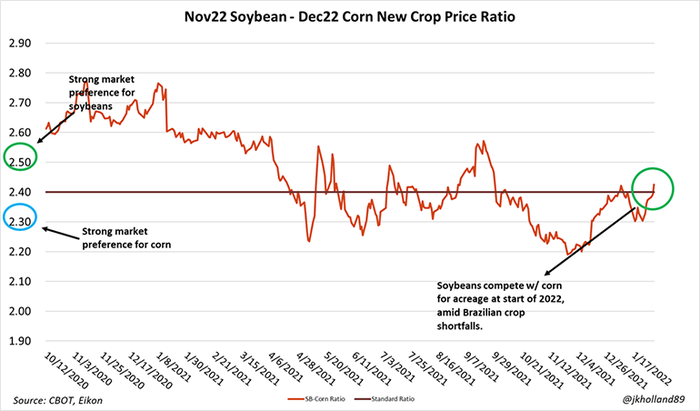

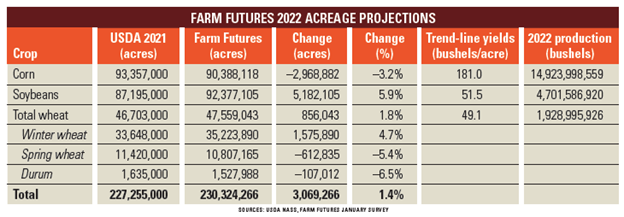

Our team’s first look at 2022 acreage suggests soybean acres are going to top corn this year if fertilizer prices remain high. While supply pressure will ease slightly in these forecasts, U.S. grain prices could remain profitable as tight stocks persist.

The January 2022 Farm Futures survey found U.S. farmers expect to plant 92.4 million acres of soybeans this spring and only 90.4 million acres of corn. It would top last year’s corn-soybean acreage outlay of 180.6 million acres as the highest combined corn and soybean acreage on record.

If realized, it will be only the third time in U.S. history in which soybean acres have surpassed those of corn and the first time since 2008-2009 that input costs have had such a significant impact on acreage allocations.

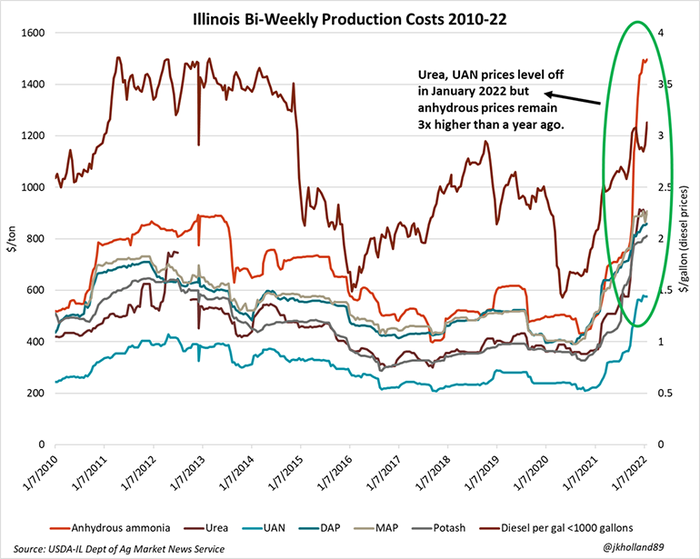

High fertilizer costs to drive 2022 acreage

Fertilizer costs to harvest 200 bushel per acre corn based on retailer quotes from USDA’s Illinois Department of Ag Market News Service pegged 2022 per acre corn production costs at $213-$236/acre. Those same prices six months earlier stood at $126-$149/acre, representing a staggering 58%-69% increase in fertilizer expenses in just six months.

To be sure, profit potential for corn remains in the black, especially in the “I” states where inputs are easy to source off of the Mississippi River Valley. But as drought and trucker shortages continue to plague soil and economic conditions west of the Mississippi River, acreage outlays in the Plains are increasingly less certain than in prior years.

While corn futures markets tried to claw back some acres from soybeans during January 2022, much of the acreage suspense will occur in regions where soil temperatures stay warmer through the winter and in South America where uncertainty persists about Brazilian soybean yields. The January 2022 Farm Futures survey found around half of farmer respondents looking to purchase some inputs this spring, with fuel (66%) and potash (33%) hovering at the top of farmers’ lists.

But two other inputs on growers’ spring shopping lists provide some glaring indicators of 2022 acreage intentions. Over 33% of growers planned to buy UAN fertilizer this spring and an additional 29% will purchase urea ahead of spring planting activities.

These spring applications are more characteristic of regions with warmer winter soils, thus favoring soybean acreage. And with 66% of growers still planning to apply nitrogen this spring, farmers look poised to plant more soybeans than corn for the first time since 2018.

Price implications from acreage shift

USDA’s baseline forecasts suggest trendline corn yields rising to 181.0 bushels per acre in 2022, topping 2021’s record of 177.0 bpa. This would put 2022 corn production at 14.92 billion bushels – the third largest on record.

But even with a high yielding crop, corn stocks will remain historically tight, keeping prices competitive in the new crop year. Corn supplies in 2022/23 will closely mirror those of 2021/22, easing 0.2% on the year to 10.6%. It will be the ninth tightest ending corn supply in U.S. history.

Soybeans will see more supply easing than corn, likely to levels that could alleviate much of the current stock tightness impacting the domestic market. Farm Futures projects that with an estimated 2022/23 soybean crop of 4.7 billion bushels – surpassing 2021’s as the largest on record – and a demand forecast of 4.5 billion bushels adopted from USDA’s baseline projections, soybean stocks-to-use ratios will grow from 8.0% this year to 12.6% in 2022/23.

While that could open the door to lower prices, the extra supply availability could renew international export interest in U.S. soybeans, which has suffered in 2021/22 on the heels of a strong Brazilian crop and easing import demand from China.

Wheat has the most price optimism for all three crops. Using USDA demand estimates for 2022/23, ending wheat stocks under these forecasts will fall to 610 million bushels. That will tighten the stocks-to-use ratio by 2.5% to 29.5% - the tightest wheat supply environment since 2013/14.

Unless Europe and Russia harvest bumper crops this summer – or Russia decides to play nice with its global neighbors – high wheat prices are likely here to stay.

Inflationary pressures

Inflation rose to 7% at the end of 2021, marking the highest rate of price increases the U.S. has experienced since June 1982. While mention of the ‘80s is enough to trigger most farmers into a panic, I see a few opportunities for farmers to capitalize on the economic environment.

At press time, the Federal Reserve had three interest rate hikes planned in 2022, another three in 2023, and two in 2024. The current federal funds rate hovers near zero. By the final rate increase in 2024, the Fed expects the fed funds rate will settle at 2.1%.

To be sure, 2.1% is not 0%. But it also not the 18% many farmers suffered on bank notes during the 80’s. Federal Reserve Chairman Jerome Powell has been notably dovish in taking action on interest rates, a stance that favors farmers reliant on credit resources.

For growers who may not have had the opportunity to book fertilizer last fall, there are still opportunities to capitalize on the current economic environment. The window is rapidly closing for low-cost credit, so investing in soil fertility ahead of this spring through available credit channels could be a timely way to take advantage of those last low rates, especially if input prices see a seasonal demand-driven increase.

This strategy is also a safe bet to ensure 2023 yields are ensured. Three things in farming are certain: 1) death 2) taxes and 3) corn prices will always fall before fertilizer prices. Farmers are already considering not just 2023 yields, but potentially lower grain revenues and high input costs.

Investing in yields this spring is a risk-averse way to protect profit margins not just in 2022, but also in 2023. Booking profitable grain sales now while corn and soybeans continue to hover near the $6/bushel and $14/bushel benchmarks, respectively, are also clever ways to strengthen working capital reserves for tighter margins to come next year.

Parting thoughts

USDA provides its first look at 2022 acreage intentions on March 31. While some trade estimates favor corn acreage to soybeans this year, it will take a substantial drop in retail fertilizer prices across the country – or a stronger rally in the corn futures markets – to persuade acreage on marginal land to invest in higher-costing corn in the coming weeks.

At any rate, expect the 2022 growing season to be another wild ride for growers.

About the Author(s)

You May Also Like