The last three growing cycles have been nothing short of turbulent for U.S. row crop farmers. But growers are finding new ways to roll with the punches as Mother Nature and volatile markets continue to sow uncertainty when making management decisions at the farm level.

What else is on farmers’ minds ahead of this week’s USDA reports? The August 2021 Farm Futures survey provides a few insights as to where farmers think markets and profit outlooks are heading as harvest approaches.

The August 2021 Farm Futures survey was conducted via email questionnaire July 13 – Aug. 1, 2021. A total of 737 growers from across the country responded. The survey’s margin of error was calculated at 3%.

Related: Bryce Knorr - Grain storage lessons learned

Lower prevent plant acreage in 2021

Planting season for 2021 prevented much fewer obstacles to farmers – particularly in the Northern Plains – than in 2020 and especially than 2019. Only 6% of survey respondents reported certifying acres as prevented from planting for crop insurance, down from 10% a year earlier thanks to dryer conditions earlier this spring.

Profitable row crop futures prices paired with the improved planting conditions paved the way for higher corn and soybean acreages this year. This spring’s total corn and soybean acreage of 180.2 million acres marked the largest combined corn and soybean planted acreage since 2017. That year, the largest combined acreage was planted, totaling 180.3 million acres.

Barring any additional weather snafus this year, 62% of survey respondents do not expect to receive revenue or weather payments in 2021. About 11% of growers plagued by drought anticipate insurance payments to be paid out for weather disaster relief. Another 17% of respondents only expect to receive a marginal amount of insurance payments which are not likely to cover premiums costs.

Anticipating USDA yields

In an earlier article, the August 2021 Farm Futures survey predicted 2021 corn yields would come in at 178.7 bushels per acre while soybean yields averaged 51.3 bushels per acre. Read more about the supply and demand impacts of those estimates here.

Why do these results vary from USDA’s current projections of 179.5 bpa for corn and 50.8 bpa for soybeans?

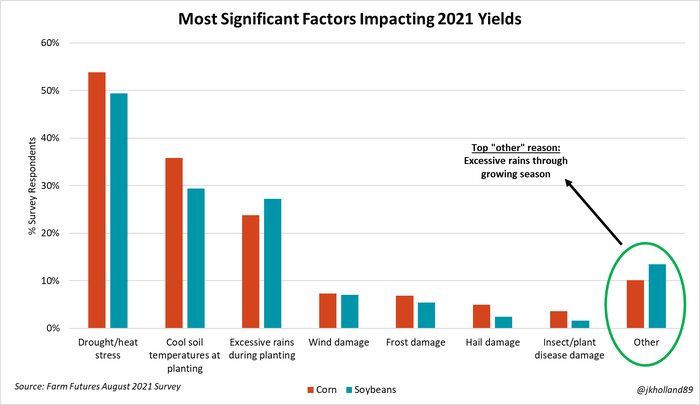

To be sure, crop conditions across the Heartland are variable for a wide array of reasons. Drought in the Upper Midwest will likely play a significant role in lower yield estimates with 54% and 49% of corn and soybean growers, respectively, in the Farm Futures’ survey citing heat and drought stress as having the most significant impact on yields.

But other factors in differing areas of the Midwest have also impacted crop yields this year. Excessive rains and cool soil temperatures during planting could potentially hold back corn yields more so than those of soybeans by the time combines begin rolling this fall.

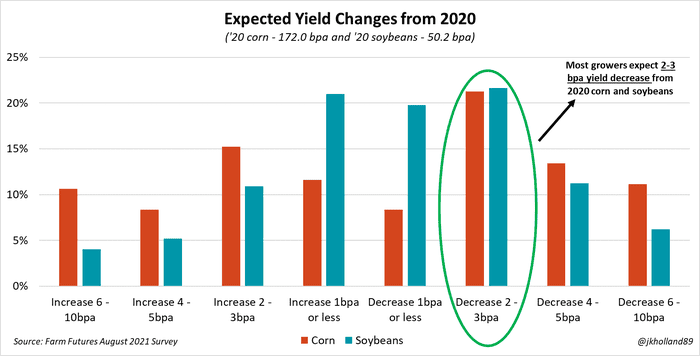

Most farmers are confident USDA’s 2021 soybean yields will not likely depart drastically from 2020’s yield of 50.2 bpa. The Farm Futures survey found 41% of surveyed growers expect the final tally for 2021 soybean yields to range within 1 bpa of 50.2 bpa, with an additional 33% anticipating no more than a 3 bpa yield adjustment for the 2021 crop.

Farmers expect to see more variance from USDA’s 2021 corn projections relative to those of 2020 by the time yields are finalized next January. Only 20% of respondents expect to see USDA revise 2021 yields 1 bushel higher or lower than 2020’s yield of 172.0 bpa. Another 36% predict revisions to range between 2-3 bpa. The remainder anticipate revisions ranging from 4-10 bpa.

New year, new marketing plans

An unprecedented export season and growing domestic usage rates has left little old crop in bins across the countryside this summer. Farm Futures readers report only 7% of 2020 corn crops remain in storage (6% on farm, 1% off farm). Soybean stocks are slightly tighter at 6% (4% on farm, 2% off farm) remaining. Only 4% of 2020 wheat supplies were left over once harvest began earlier this summer (3% on farm, 1% off farm).

Most growers are not looking to modify existing grain storage structures next year as favorable basis offerings ease concerns about capturing storage premiums. High construction costs are likely another factor holding back grain bin construction in 2022. Only 9% of survey respondents indicated they would add grain bins next year.

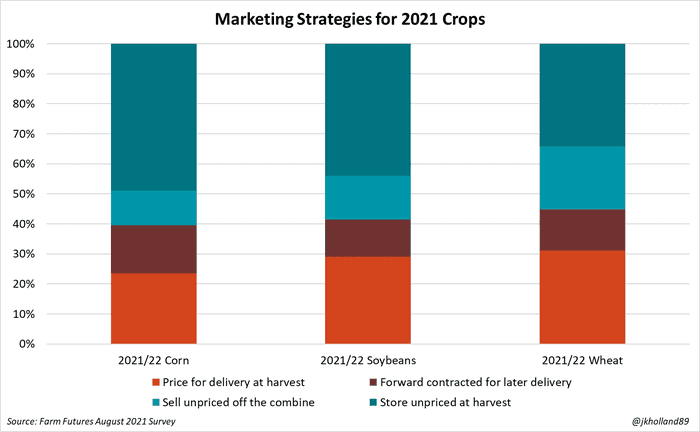

The majority of corn, soybean, and wheat growers expect to store their crops unpriced at harvest. Only 13% of survey respondents indicated they would use puts to protect unpriced stored grain ahead of this fall.

But many have already priced crops for harvest delivery. And while only 3% of corn growers and 1% of wheat producers are likely to buy back prior sales with futures or options, a staggering 22% of soybean growers expect to use various hedging strategies to capture pricing opportunities through the 2021/22 marketing year.

Corn, soy, and wheat growers expect to have at least half of 2021 crops sold by December 31, 2021. Soybean (58%) and wheat (63%) sales are likely to be more aggressive than those of corn (52%) by year end.

Futures price expectations

In an era of tight supplies, how do farmers think futures prices will respond in the upcoming 2021/22 marketing year?

At the time the survey was conducted, new crop corn futures prices ranged between $5.00-$5.40/bushel. New crop soybean prices hovered between $12.90-$13.10/bushel during the same time period. And as harvest approaches, farmers are not exactly counting on a harvest price rally.

About 66% of survey respondents expected new crop corn prices to be lower than July prices by the end of October 2021. Another 59% of Farm Futures growers anticipate soybean prices to be lower by Halloween 2021 than in July.

But farmers are more bullish about price prospects as the marketing year progresses. Survey respondents expect prices will rise by the beginning of 2022 with even higher hopes of better prices by the end of March 2022 compared to July 2021 prices.

About 56% of respondents think that corn prices will be higher than July 2021 prices by New Year’s and 65% believe prices will be higher by the March 31, 2022 Acreage Intentions report. Soybean growers are more optimistic about prices as supplies tighten, with 61% of survey respondents expecting higher soy prices by January 2022 and 63% anticipating soybean prices to be higher than those of July 2021 by the end of March 2022.

Profits hold steady despite higher inputs

Farmers anticipate another year of strong commodity prices to buffer profit outlooks in 2021/22. In the August 2021 Farm Futures survey, 39% of respondents do not expect profits in 2022 to change significantly from those recorded in 2021. Only 29% of surveyed growers expect profit margins to increase year over year in 2022.

But 32% of farmers believe profits will fall in 2022 compared to 2021. Of those growers expecting losses, 85% cited high input costs as a leading factor for lower profits next year. And farmers are not expecting input prices to go down anytime soon.

About 87% of surveyed producers expect that input prices will be higher in Spring 2022 compared to Fall 2021, decreasing the likelihood that farmers will delay 2022 fertilizer purchases until next spring. That could put pressure on ag retailers this fall if more growers decide to apply nutrients following harvest instead of later next spring.

Over 92% of respondents anticipate higher nitrogen prices next year. Growers expect the biggest price increase to be seen in phosphate fertilizers as trade flows continue to adjust to the countervailing tariffs dispute between the U.S., Russia and Morocco.

Farm Futures survey respondents expect an average increase of 26% for phosphate prices in 2022 as phosphate stocks continue to remain tight and production costs increase.

Inflation remains a key concern

Farmers overwhelmingly expect higher costs of operating and overhead in 2022 compared to 2021. While 41% of respondents believe the Federal Reserve will leave interest rates unchanged in 2022, 57% think that the Fed will raise rates to combat rising inflation.

About the Author(s)

You May Also Like