With combines rolling across the Midwest, some 20 million bushels of 2021 crop corn and soybeans are quickly filling grain bins. But whether holding crops will actually add to their value remains highly uncertain as an unusual growing season comes to an end.

For starters, despite an export pipeline snarled by storms and the lingering effects of the pandemic, prices are at the best harvest level in a decade. And prospects for rallies face questions about whether China will continue to aggressively buy U.S. grain as its leaders reassert the grip of the Communist Party over the country’s businesses and people.

To be sure, some growers may have little choice except storage if their local basis is a train wreck due to big crops or shipping snafus. But choices aren’t clear-cut for most producers this year -- again.

Indeed, as I wrote last month (Grain storage lessons learned, Examine grain storage decisions now), simply using on-farm or commercial storage isn’t at all a cut-and-dried decision. Like last year, basis and spreads are complicating storage arithmetic, potentially limiting prospects for basis appreciation. And those hoping to replace harvest deliveries with options face more expensive premiums because of high implied volatilities and futures prices.

Farm Futures’ long-term study of storage strategies looks at performance based on prices from the first week of October to expiration of July options near the end of June. Here’s where markets stand at the start of their post-harvest journey, and why that’s important.

Corn’s turn in the hot seat

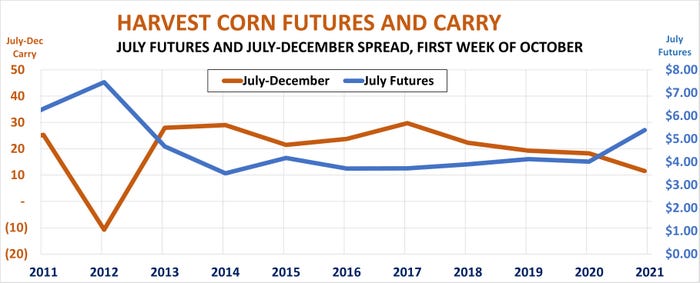

Corn futures exploded after the 2020 crop was safely tucked away, but the market sent mixed signals back at harvest. Record early export sales firmed basis to stronger than average levels at key Midwest locations included in our study. Carry, in this case the difference between December 2020 and July 2021 futures was a little smaller than normal, around 18 cents.

Bookings of 2021 crop corn are off to an even more promising start this fall. Despite prospects for good production and increasing carryout, basis is stronger, the tightest since the 2012 drought year, and July 2022 futures settled last week at only an 11.5-cent premium to nearby December 2021.

Tight carry and basis dim the allure of one normally profitable strategy for on-farm bins: the storage hedge, which involves selling July futures or hedge-to-arrive contracts to protect corn inventory. While this limits gains to basis appreciation, the strategy is the most consistent method for corn, beating the harvest cash price after costs more than 70% of the time since 1985, when ag options began trading again after a decades-long ban.

The market for puts and calls is also very different than a year ago. Implied volatility, a measure reflecting uncertainty in the market based on options premiums, was a little higher in 2020 than the previous three years, but below levels seen in times of bigger price moves. With July futures barely above $4, the combination of lower volatility and futures made options a relative bargain. An at-the-money July 2021 call sold for just 26 cents and a put at the same strike was 25 cents. This year the July 2022 at-the-money $5.40 put closed at 43 cents, with the call at 41.375 cents.

The huge futures rally into 2021 helped calls pay off handsomely, while the lower charge for puts to protect inventory were less of a drag on returns when they expired worthless. This year the bar is higher. A big rally could still happen if production turns out lower than expected or demand surprises. Otherwise calls may underperform.

Soybean outlook cloudy

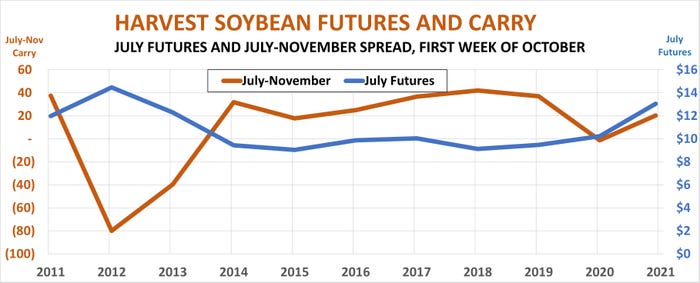

Foreign buyers had already booked more than 1.3 billion bushels of 2020 crop soybeans as October began a year ago. Shippers scrambling for supplies turned to futures to protect margins, sending November 2020 to a premium over July 2021. Stronger than average nearby basis and lack of carry stacked the deck against storage hedges for soybeans, which normally work only in years with big spreads and a weak cash market.

Bookings of 2021 crop soybeans this fall are good, but nowhere near last year’s level as questions emerge about China intentions to slow imports. This has increased carry from November 2021 to July 2022 to 20.25 cents. But with nearby basis decent, potential appreciation doesn’t appear to be enough to justify long-term storage hedges.

The big surprise with 2020 crop soybeans was the performance of owning the crop on the board. Selling cash at harvest and buying July 2021 futures – which is similar to a basis contract – was the top-earning strategy of those studied in our analysis. Basis appreciation wasn’t enough to boost returns from on-farm storage because post-harvest gains came mostly from futures.

Selling beans out of the field and buying the board could still be an alternative this year – the two strategies are fairly even in their long-term performance. But like corn, using soybean options this year will cost more due to higher futures and implied volatilities.

An at-the-money July 2022 call closed last week at 81.125 cents, compared to 54.75 cents a year ago, while a similar put costs 23 cents more.

Despite the uphill path facing both corn and soybean options, they do offer one big advantage. Cash prices are profitable enough for most growers to finance the purchase of this price insurance to limit losses. Holding crops unpriced, either in the bin or with futures, has downside risks compared to harvest values that could be painful if markets roll over on bearish news.

Knorr writes from Chicago, Ill. Email him at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like