Coronavirus isn’t good for anyone. But Brazilian farmers might dislike it a bit less than the U.S. producer. Here’s why:

The latest news headlines on Coronavirus spooked investors. When they learn of an oil price war between Saudi Arabia and Russia, the quarantining of Italy (yes, the entire country of Italy), the cancellation of public events where crowds would gather -- they tend to wig out a bit.

Aside from people dying or at least getting sick, people will spend less. Investors worry about their money, and so they pull it out of stock markets and buy up safe things they know will withstand any crisis with most or all of their value intact. Things like gold or U.S. dollars. And that makes the value of things like gold or U.S. dollars rise.

A strong dollar

The benefit of a strong dollar to Brazilians, even though their currency is not the dollar, is that all soybeans in the world are priced in the dollar-equivalent of a world price set in Chicago. In the end, soybeans act like dollars. So if Brazil’s currency, the real, falls 10% against the dollar, the value of the Brazilian producer’s soybeans actually increases 10%.

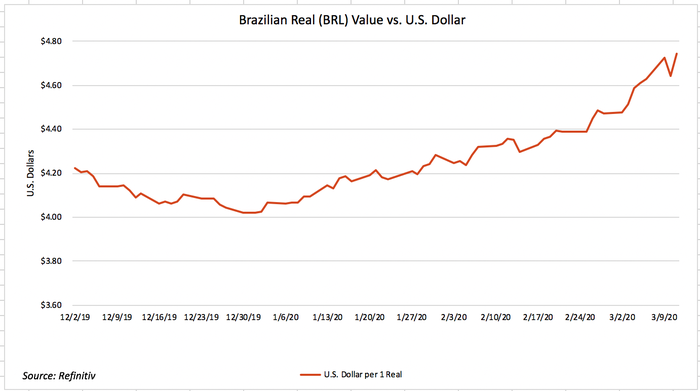

Right now, the U.S. dollar is worth about 15 to 17% more in Brazilian reais than it was on the first day of 2020.

The Brazilian real is weak compared to the dollar and March and April exports may double as a result. Prices have been hitting records right now for Brazilian farmers with anything left to sell.

Normally, that would be a mixed blessing: high crop prices now usually mean equally bloated inputs prices the next planting season. But September, October, November planting season in South America is a long way off. That would mean the same strength of the dollar that was good when you were a bean seller hurts you in the same measure when you become a fertilizer buyer.

But by then, who knows? Coronavirus could be just a bad memory-- at least for the season.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

Covid 19About the Author(s)

You May Also Like