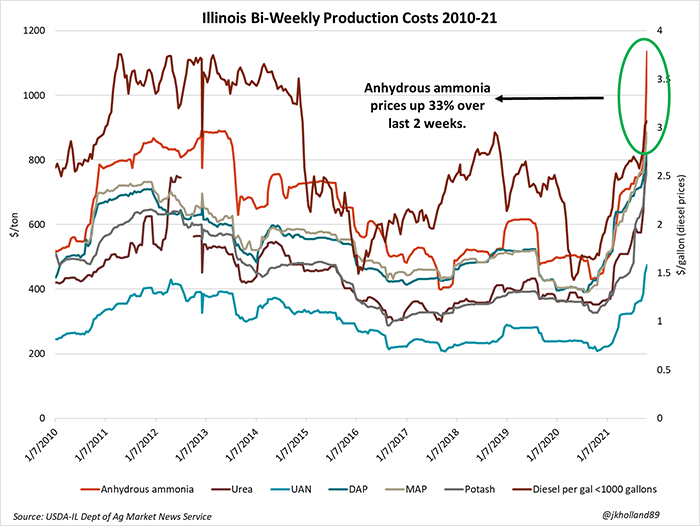

Illinois fertilizer prices topped $1,135/ton a week ago, though that is hardly a surprise at this point. Retail prices for the nitrogen fertilizer sold in Illinois have risen by a third over the past two weeks. And over the last year, prices for all major fertilizers are at least double from historic lows recorded a year ago.

Rising natural gas prices are a leading factor driving prices in the fertilizer complex higher and will be the best leading indicator in the months to come for any sign of falling input prices. Here are a few managerial considerations to ponder while evaluating how the 2022 season will shake out.

More acres, less supplies

USDA’s World Agricultural Outlook Board anticipates 2021/22 corn, soybean, and wheat harvested area to total nearly 1.4 billion acres. In the past two years, an additional 57 million acres of corn, soybeans, and wheat across the world have come into production – a 4.4% increase since 2019.

And those acres need supplemental nutrients to produce profitable yields. Current price levels are encouraging for fertilizer production expansion. But rising natural gas costs as energy supplies run dry mean that the global fertilizer production increase could be thwarted by looming energy shortages in Russia, China and the European Union.

NOAA is currently forecasting a warmer than normal winter across much of the Heartland. Temperatures in the Pacific Northwest and Northern Plains are likely to be cooler than usual. If an unexpected polar vortex hits late in the winter and energy reserves in the Gulf are not adequate, domestic fertilizer production could face more delays.

It will likely be another tight year of global fertilizer supplies as more world players such as India, Brazil, China and Russia compete with the U.S. for available fertilizer supplies. While spring 2022 shortage fears are still largely speculative, farmers are wise to plan for worst-case scenarios regarding 2022 fertilizer applications.

It marks a warranted shift in managerial focus from price risk to operational risk. As we have prominently seen over the past three growing cycles, crop quality and yield – thus revenues – are negatively impacted when farmers halt operations for any reason. And with a rapid rise in weather volatility, waiting on pesticide and fertilizer supplies next spring increases the risk for lower yields next fall.

Profits at risk?

Higher 2022 fertilizer prices have led to speculation around the Midwest that fewer corn acres will be planted in 2022. But I encourage growers to dig a little deeper into their crop budgets before succumbing to elevator gossip.

Even with higher fertilizer prices, both corn and soybean production remain profitable. Don’t sacrifice 2023 soil fertility and yields for cost savings in 2022, especially when crop budgets are likely already supporting profitable margins in 2022.

To offset the margin uncertainty, consider taking a more aggressive stance on booking crop sales in the coming weeks. The global uptick in corn and soybean supplies could limit corn and soybean price action before the 2022 planting season can begin. With both old and new crop futures trading at profitable prices, farmers can optimize risk management by booking enough sales to ensure 2022 costs are covered sooner rather than later.

2022 acreage debate underway

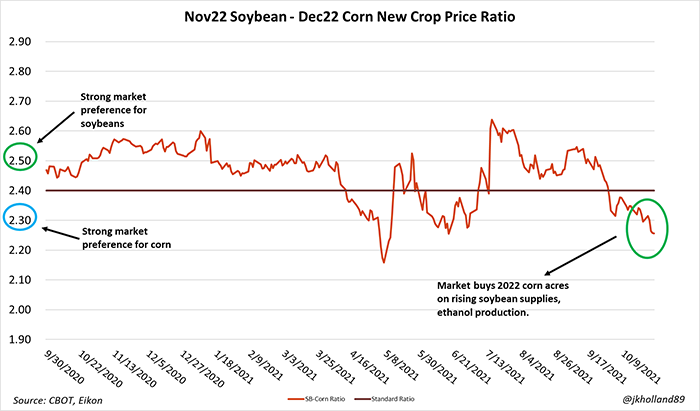

At press time, corn was emerging as a market favorite in the 2022 acreage debate. The new crop corn-soybean price ratio dropped below the 2.3 benchmark that signals a clear market preference for corn this past week, trading at a ratio of 2.26 the past three trading sessions of the week.

Despite the rising fertilizer costs, corn remains the more lucrative choice for farmers in 2022 at this point. It is largely a demand-driven phenomenon, a direct reversal of much of the market movement experienced over the past year which was largely driven by tightening corn and soybean forecasts in the U.S.

But both corn and soybean supplies have edged back from historically tight levels and large harvest totals anticipated this fall will add more breathing room for stocks. On the demand side, a bounce back in ethanol production and strong export prospects from China in the coming marketing year are reviving corn demand forecasts while soybean prospects hang in the balance of Chinese export purchases and domestic crushing rates – both of which are trending lower as of press time.

But both crops face stiff competition from alternative crops – perhaps more than last year. Wheat, cotton, sorghum and barley prices are surging due in large part to international demand. Acres outside of the “I” states have more options for profitable rotations in the coming year and that could hinder acreage expansion for corn and soybean crops.

Remember – inaction is still a decision, though it may not reap many rewards this year. With tighter operating margins, profit potential can quickly evaporate if farmers choose not to execute on booking sales. The global market is becoming more competitive for row crop production and a bird in hand is increasingly worth two in the bush.

About the Author(s)

You May Also Like