The start of the 2022 growing season is just around the corner and with it comes more unknowns than the past two years combined. That’s not to say profit outlooks are in danger, because that does not yet appear to be the case.

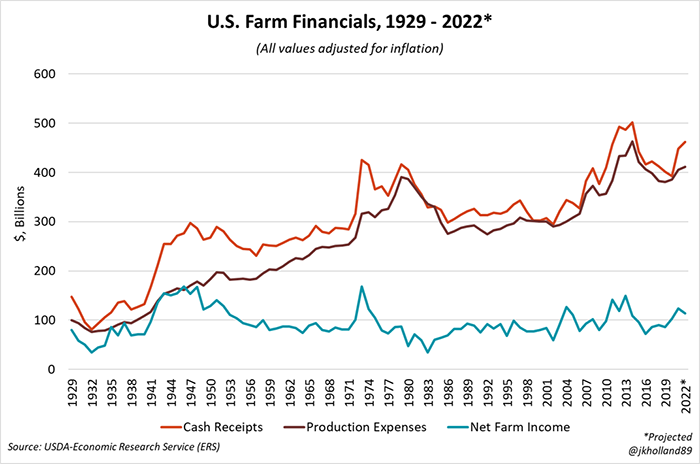

USDA’s first look at on-farm profitability released in early February pointed to a smaller net farm income in 2022, with the forecast falling 4.5% from 2021 to $113.7 billion this year on soaring production costs and lower government payments.

It is not as dire of a forecast as the initial reading would seem. Net farm income for 2022 will be the third largest annual net farm income in nominal terms in the history of the U.S. farm economy, trailing only 2013’s $123.7 billion and last year’s $119.1 billion net farm income hauls.

High commodity prices will help offset much of the price pain. USDA forecasts cash receipts from crops ($249B) and livestock ($213B) to total a record-breaking $462 billion this year. But for farmers struggling to navigate a high-cost environment and persistent supply chain issues, that fact likely offers little comfort especially as many operators begin to develop longer-term forecasts.

The cost factor

Most of the uncertainty lies within operational constraints. Securing inputs and equipment without causing planting delays will be farmers’ first operational challenge this year.

Input availability will be another challenge this spring, primarily for chemicals. While nitrogen costs have a fighting chance of easing slightly as stocks replenish, production challenges and raw materials costs for Roundup and Liberty pesticides continue to mount.

Costs are a factor too. USDA estimates 2022 production expenses will rise 5% on the year to nearly $411 billion – the highest level since 2015, when adjusted for inflation. A 12% annual increase in fertilizer costs will make up much of that surge, but the latest supply constraints on chemical inputs will likely deal another heavy blow to producers’ profit margins.

With interest rates slated to rise in March, utilizing the last bit of low-cost credit available to finance these soaring chemical investments may be the final best option for farmers to weather this latest supply chain storm.

More input headaches

Bayer issued letters to farmers late last week notifying them that “mechanical failures” and “technical problems” at a supplier would cause the maker of Roundup and RangerPro products to fall behind on production schedules for glyphosate orders and declaring a state of force majeure.

Bayer expects the situation to be temporary, noting that its annual glyphosate production is not likely to significantly change. But even if the company avoids short-changing farmers on chemical orders, transportation delays are still an ongoing risk.

And the ag chemical industry is still reeling after the February 2021 cold snap upended chemical production schedules in the U.S. Gulf. China’s Zero-Covid policy has also forced unscheduled plant closures, further tightening global supplies, especially for both glyphosate and glufosinate products.

In addition to potential shortages and delayed deliveries, the additional supply chain disruptions, shipping delays, and labor shortages have driven raw materials prices higher. These costs will be inevitably passed down to the farm gate this spring.

China manufactures many of the chemical inputs required for glyphosate and glufosinate production, as well as various other pesticide options for U.S. growers. Production costs for these products in China have risen anywhere between 10%-177% over the past year.

Farmers may need to hunt for available pre-blends, resort to conventional applications, or load up on pre-emergence treatments and go back and spot spray problem areas to combat the higher costs and availability issues. Before the season ramps up, pencil out a quick analysis of how each scenario could play out on your farm because it’s not certain how the chemical supply situation will play out.

Open, active, and timely communication with your ag retailer will be more critical this year than perhaps at any other point in recent memory. Keeping the planter running is the top priority this spring, so little victories such as those in these early days of the 2022 growing season could make the difference between average and bumper yields by the time next fall rolls around.

Supply and demand wrinkles

Acreage forecasts heading into the 2022 growing season have been murky at best, reflecting the rampant price volatility on both the cost and revenue side of farm production this year. The key factor impacting acreage this year, according to the January 2022 Farm Futures survey, will likely be input costs.

Wholesale nitrogen costs have eased since the beginning of 2022, though those price breaks have been slow to trickle down to the retailer level as of mid-February. Our team’s survey results suggest that high input costs will lead to higher soybean acreage in 2022. But if retailer prices do fall in the weeks leading up to planting, corn acres could see a bump.

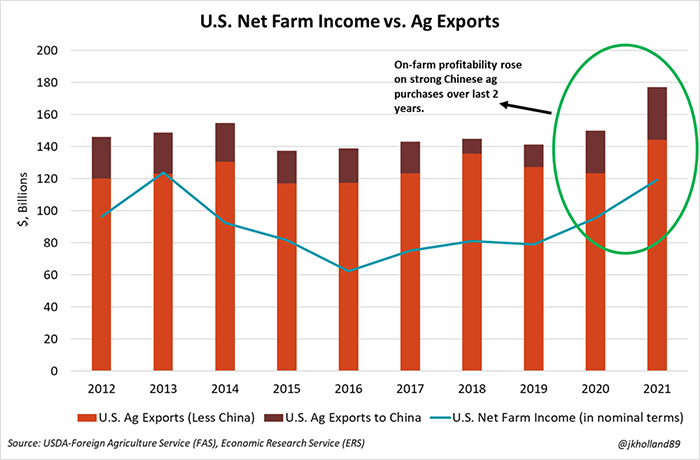

Some of this year’s uncertainty also lies with demand factors in the grain markets. China is slated to import 5% fewer combined corn, soybean and wheat bushels during the 2021/22 season, which could dampen global demand and price outlooks. The U.S. cattle herd shrunk 2% from year-ago volumes, limiting grain usage rates from one of the largest consumers.

But at the moment, supply dynamics are overpowering market prices. South American corn and soybean shortfalls and ongoing crop quality concerns for U.S. wheat have already offered bullish price movement for ag commodities so far this year even as Chinese purchases have waned. And even if China takes a break in this year’s grain purchases, its growing livestock herd and desire to comfortably feed its population will keep it at the international grain buying table for years to come.

At any rate, grain prices remain high enough to cover the rising input costs for the time being. Capitalizing on these bullish markets is a sure way to lock in 2022 profits even before the crop is in the ground. Of course, weather will always have the last say in how the chips fall. But even with heightened uncertainty, farming continues to have an optimistic – and profitable – future in 2022.

About the Author(s)

You May Also Like