As October came to a close, Kansas City wheat futures had risen to seven-year highs while Minneapolis futures traded above the $10/bushel benchmark for the first time since 2012. It’s a great time to be selling wheat – if there is any left in storage across the Heartland.

International demand drove prices higher last week, especially as more buyers were on the hunt for high protein content wheat varieties. Crop shortfalls due to drought in the U.S. Northern Plains and Pacific Northwest played a key role in this scarcity dynamic, especially after protein-laden varieties grown in these regions burst onto the export scene last year.

But there’s good reason to think that slim supplies are propping up the current rallies. The September 30 Quarterly Grain Stocks report found Sept. 1, 2021 wheat supplies to be 1.78 billion bushels – the smallest volume for Sept. 1 since the same time in 2007/08, and a clear indicator that U.S. growers have already sold much of the 2021 crop.

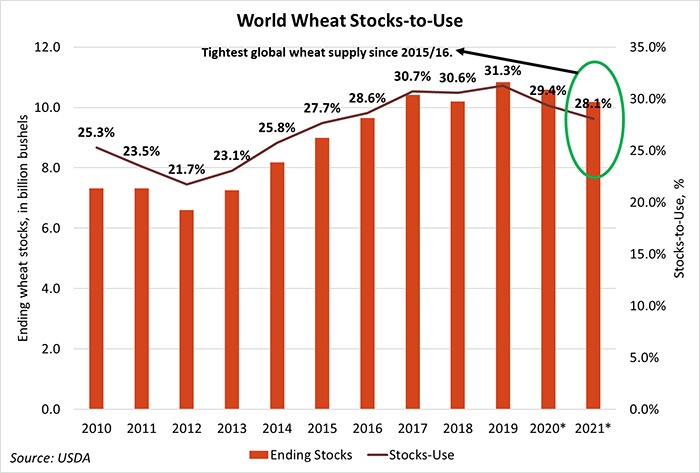

And global supplies continue to shrink on smaller crops in the Western Hemisphere and the Middle East. USDA’s forecasts for 2021/22 global wheat stocks have tightened by 721 million bushels since June 2021 estimates to 10.2 billion bushels. It is the tightest wheat global wheat supply in six years.

With winter wheat sowing for 2022 crops largely finished, market focus will likely turn to exports as the new calendar year approaches. While white and hard red spring wheat varieties are not likely to see a consecutive year of rapid export paces due to crop shortfalls earlier this year, soft and hard red winter wheat shipments are likely to rise on more readily available supplies.

Soft wheat exports thrive

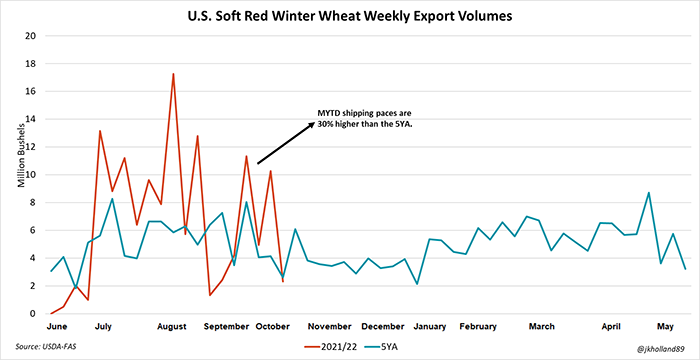

USDA expects that 2021/22 soft red winter wheat exports will rise by 51 million bushels from last year’s volumes to 120 million bushels. Marketing year to date shipments are already 37% higher than the same time a year ago, despite slower export paces in September due to terminal closures at the U.S. Gulf following Hurricane Ida.

China’s presence has been noticeably absent in the U.S. wheat export market so far in the 2021/22 campaign. While its purchases of soft red winter wheat have doubled since last year, it has not yet purchased any high-priced hard red spring wheat. China has purchased 75% less hard red winter wheat in the first half of the marketing year compared to a year prior.

However, slower Chinese shipments may not completely upend the U.S. wheat export forecast. Despite total marketing year to date shipping volumes being down 19% from a year ago, other top buyers - Mexico, the Philippines, Japan and Nigeria - have already taken delivery of 15% more bushels than the same time last year.

More opportunities ahead

Plus, with high Russian soft wheat prices and the European Union potentially over shipping its exportable wheat supply, the U.S. stands in favorable position as the world’s residual supplier of wheat. Typically, U.S. wheat exports hit seasonal loading highs between mid-April to late September.

But with limited exportable supplies available on the world market, that timing could shift this year. At the very least, it remains highly likely that U.S. wheat exports leading up to 2022 harvest activities will see higher volumes than usual, provided global and domestic economic uncertainty do not overprice the dollar for global wheat buyers.

USDA expects Iran to lead the charge on higher import paces this year. Iran is only the 14th largest wheat importer in the world, accounting for 2% of global wheat purchases. But the Middle Eastern country is expected to import an extra 73 million bushels of wheat this year, bringing its total to 165 million bushels.

Even with smaller anticipated global food consumption of wheat in the 2021/22 marketing year, high international wheat consumption will likely continue to keep stocks tight and cash bids high. Farmers with wheat in storage have the luxury of calling the shots on booking profitable sales between now and the start of harvest on the 2022 crop.

And they could very easily buy acres away from corn and soybean producers next spring. It’s a great time to be a wheat grower – make sure you are capitalizing on it!

About the Author(s)

You May Also Like