February 8, 2022

Let’s pretend that you are Chief Financial Officer of ABC Truck Manufacturing company. Your responsibility in this role is to help make the financial decisions to maintain profitability and long-term financial success.

The industry has been experiencing cost increases that pressure margins. The cost to produce a truck last year was around $35,000 and this year is $40,000 per truck.

The industry has seen some flexibility, at least temporarily, to increase the price of their trucks. As of right now, for trucks you are taking orders on today, you can price the trucks at $57,500. There is a threat for increased competition from overseas suppliers and increased production from domestic suppliers that threatens to push prices back towards the cost of production, or possibly lower.

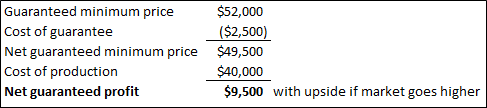

A company, Trusted Risk Management, approaches you with an offer. For your unsold production, they are willing to guarantee you a minimum price of $52,000 for your trucks with the flexibility to price the trucks at the market price with no limit on how high the price can go. The cost of this guarantee is around $2,500 per truck. Let’s look at the math:

As the CFO, you have another dilemma. For the trucks that you are selling, there is a potential that the market price can go significantly higher if computer chip shortages and other supply chain issues limit the availability of trucks. These price increases have the potential to be steep but questionable on how long they will last.

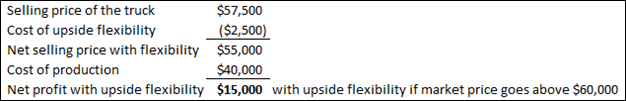

TRM approaches you with an offer to help you with your second dilemma. For the trucks that you are selling right now, they are offering you flexibility to capture higher prices on your trucks if the market price moves above $60,000. The cost of this flexibility is around $2,500 per truck. Let’s look at the math for this offer:

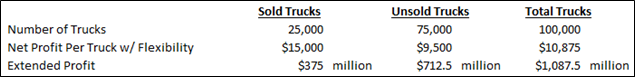

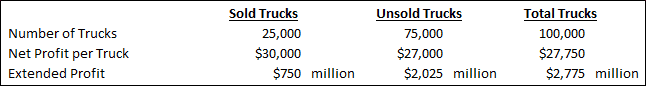

Understanding the details of these offers, you call in the Vice President of Sales and decide to sell 25,000 trucks (25% of your estimated 100,000 annual volume) and take TRM’s offer on upside flexibility. In addition, you take the guarantee on the minimum price on your unsold production of 75,000 trucks. Here is the math on what you have done:

As CFO, you have secured a profit of over $1 billion with the flexibility to increase profits if the market goes higher.

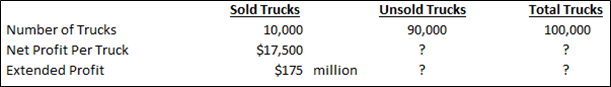

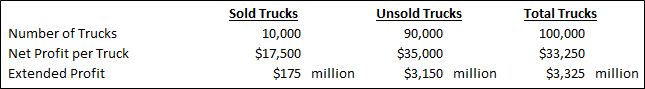

You have an old college roommate, Gambling Gary, that is CFO at XYZ Truck Manufacturing, another similar size truck manufacturing company. He did just enough work to barely get through college. He was kind of an arrogant guy who thought he knew everything. He is convinced that market prices are going higher and tells his sales department to limit sales to 10% of annual volume. Here’s the math on what he has done:

Gary has only secured a profit of $175 million on their annual production, betting big that the market will go higher.

Let’s look at some scenarios and see how this could play out.

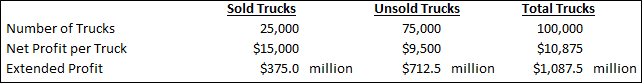

Market price goes to $75,000 per truck

For ABC Truck Manufacturing, we have the contract to add some flexibility to our sold trucks. We get to add the increase from $60,000 to $75,000, so net profit goes from $15,000 to $30,000 per truck. We also see our profit increase by the sales price increase on our unsold trucks. That profit goes from $9,500 to $27,000 per truck.

ABC Truck Manufacturing has a profit of $2.775 billion and you managed your risk while going through this crazy year.

How about XYZ Truck Manufacturing’s profit for the year?

Gary’s company did end up with a little bit better profitability in a year where prices would really take off. Let’s look at the other direction.

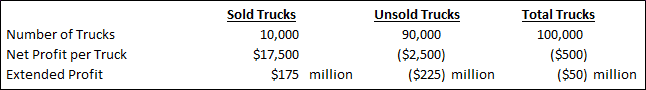

Market price goes to $37,500 per truck

As we have seen before, our profit we locked in was $1.0875 billion if the market went down. Here’s the math for ABC Truck Manufacturing:

How about XYZ Truck Manufacturing’s profit for the year:

On a decline in price of $20,000 per truck, Gary’s company lost $50 million dollars while ABC Truck Manufacturing had a profit of over $1 billion.

When Gary’s boss realizes this difference, what is the likelihood of Gary keeping his job for another year?

Here’s the point

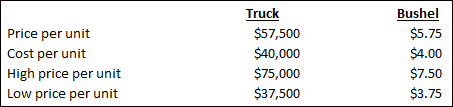

What’s the point of this game of pretend? Let’s look at some of the prices I used in the examples and compare them to something more applicable in your line of work –say, the price of corn.

Maybe while reading this, you thought that Gary was crazy to just wing it when you saw how much profit was at risk. What we need to do is look at that person in the mirror and ask ourselves if we are behaving like Gary in the current environment.

While ABC Truck Manufacturing may not have hit quite as high of a number as Gary did on an upward market, the bigger risk to our business is more often the declining market. We should always cheer for the market to go higher, but we need to also establish floors to help preserve the current profitability that the market is providing.

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like