Farmers in the state of Parana could begin planting soybeans as of last Saturday, Sept. 10. While there has been adequate rainfall, farmers are somewhat hesitant as last year saw drought creep in right after planting, damaging early-planted crops.

To add to the drama temperatures are a bit cooler than normal, and producers would like the soils to warm up a bit.

Last year’s drought had consequences, resulting in several producers unable to deliver on their contracts. Grain traders allowed them to push deliveries back a year and so it will be critical for farmers to produce well and make good on those commitments; otherwise debt obligations will accumulate.

At any rate, we still expect the 2022/23 soybean planting season to have a quick start.

Wait for rainfall?

Mato Grosso also passed its Sept. 15 moratorium on planting, and so may begin to plant soybeans as well. Farmers will likely wait for more rainfall confirmation before getting too far ahead of themselves. The first half of September has been dry, but they shouldn’t have to wait much longer, as precipitation appears to begin building in Mato Grosso next week.

The same cannot be said for the Southernmost state of Rio Grande do Sul and neighboring Argentina, which shows very dry conditions for the next six weeks. This is not good news for many Brazilian corn producers as an estimated 60% of first crop corn has already been planted in that state. These farmers are looking to get their first crop of corn in as early as possible so they could harvest and follow up with a second crop of soybeans at the end of the year.

Dry weather worries

Everyone will be watching Southern Brazil very closely to see if there is a repeat of dry weather this year, which last year cut Brazil’s soybean crop by 20 MMT. So far, September is expected to have average rainfall in the South. Historical rainfall levels are usually fairly high this time of year in Rio Grande do Sul, so a reduction in rainfall would not necessarily mean widespread drought.

More soybeans

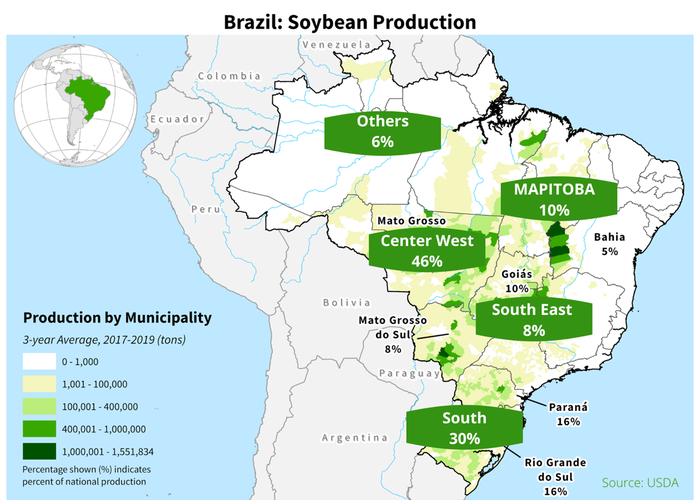

Soybean production can be found in roughly 19 of Brazil’s 26 states. It is no secret that production has pushed North in the last 40 years. That trend continues with the Center West region of Brazil expected to represent 46% of the national production in the 2022/23 season. The Southern part of the country still commands 30.5% of Brazil’s production, but their share has been steadily dropping. Last year it was 32%. The Southeast region represents only 8% and the Northeast region of MAPITOBA represents 10%. The northern most region of Brazil which falls into most of the Amazonian basis, represents just 6%.

Click to expand map

While Brazil’s crop prospects get larger every year, their soybean balance sheet continues to remain relatively tight. Brazil’s larger crop always manages to be more of a problem for global prices, rather than within Brazil. That is because while Brazil may grow more, they continue to export any excess production, dumping it on the global market.

This is also why Brazil has invested so much in their port capacity, while their domestic infrastructure has languished. They need to get it out of the country. They expect exports to reach nearly 92 MMT next season after falling off this year from drought.

Matthew Kruse is President of Commstock Investments. Subscribe to their report at www.commstock.com.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

BrazilAbout the Author(s)

You May Also Like