It’s been another week where Brazil’s Safrinha second crop corn saw favorable weather with adequate rainfall. As much as 30% of the second crop of corn is considered “safe” and past the critical point as it has enough moisture to finish its current grain filling stage.

With adequate rainfall for the next three weeks, that percentage could increase to 75% by the end of the month. If that happens, Brazil is likely assured to reach its projection of 86 MMT for the second crop. In other words, Brazil does not need rain to maximize its entire crop to be able to reach its production estimates.

While some second crop corn planted in January is in its grain filling stage, some corn was planted less than 30 days ago. This will need rain well into May. If adequate rainfall continues into May, the country will easily surpass that 86 MMT threshold, especially if corn acres are increased as we expect they will be.

While not impossible, I would be surprised if adequate rainfall continued through the end of May.

Brazil’s forecast

Weather forecasts show strong rainfall in the Southern part of Brazil, which will only work to the benefit of second crop corn in Parana, the second largest state for Safrinha corn production. For the first half of April, most of Mato Grosso should receive adequate showers; however, we see a drying out effect in the state of Goias and Minas Gerais, which combined make up 25% of the Safrinha crop as the third and fourth largest production states.

Moving into the middle of April, we see drier weather drift into Mato Grosso. This is completely normal as rainfall typically begins to recede in the month of April and shuts off in May.

The question is whether there will be enough moisture for the crop to limp to the end. Bear in mind that Brazil’s soils do not have near the water storage capacity that we do in the United States.

Brazil’s fertilizer worries

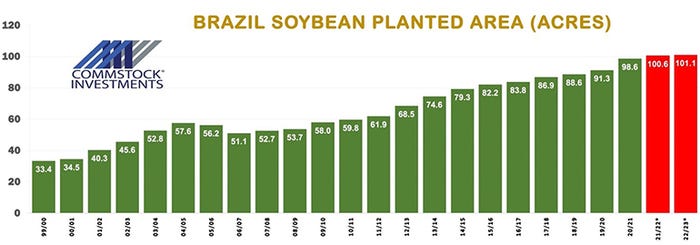

Related to Brazil’s soybean growth, we may have finally found the country’s Achilles heel. Brazilian soybean area has grown at a brisk pace of 7.5% on average per year during the last 20 years. It seemed nothing could stop its growth, not even low soybean prices or poor infrastructure. With the Russian invasion leading to fertilizer trade disruption, discussion is already focused on planted acres for next season.

Despite high grain prices margins have slimmed as input costs have increased by double digits in a matter of months, on top of already high costs. The Russian invasion into Ukraine caught the agriculture industry completely off guard as they have been highly reliant on fertilizer imports. One major ag lender in Brazil sees next season growth stalling out at only half of one percent (0.5%).

Click to expand

The bottom line is that while Brazil is experiencing record prices, fertilizer costs have gone up even more, squeezing producer margins. Furthermore, the cost to convert land from pasture or Cerrado to row crop production has more than doubled in the last few years from $640 per acre to nearly $1,500 per acre.

Any growth will most likely be from “inertia” made by past decisions before all of this volatility took place. Very few will have the appetite to expand based on initial projections. It is possible that soybeans may pick up some acres from either cotton or first crop corn, but that will likely be relatively small.

Matthew Kruse is President of Commstock Investments. He can be reached at 712-227-1110.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

BrazilAbout the Author(s)

You May Also Like