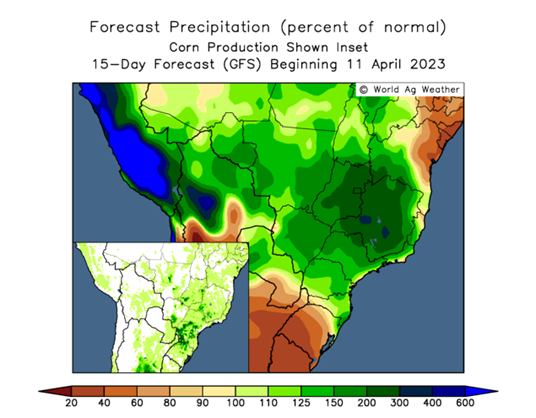

Most of Brazil’s primary growing regions will see sufficient rainfall in the immediate forecast, including the second crop corn (safrinha) regions. Mato Grosso and Parana should see 1 to 3 inches of rain in the next ten days. Brazil’s second crop of corn continues to flourish for the most part. Mato Grosso’s crop was predominately planted within the ideal window and so it is possible we will see CONAB increase their corn production estimate in that state. IMEA has pegged the safrinha corn crop in Mato Grosso at 46.4 MMT, nearly 2 MMT higher than CONAB at 44.6 MMT.

Meanwhile, the only sizable region with yield risk is in Paraná. It is Brazil’s second largest producer of second crop corn, representing nearly 17% of production. DERAL, the state’s agricultural statistics agency, placed Paraná’s production at 14.7 MMT, almost 1 MMT below CONAB, Brazil’s Ministry of Agriculture. Rainfall continues to advance the crop in that state, but it is at much higher risk as so much of it was planted in March. It is also at risk of frost damage in the May/June timeframe. It seems unlikely for the later planted corn to reach full maturity completely unscathed. At some point chances are that the crop will run out of moisture, but for the time being it is developing normally.

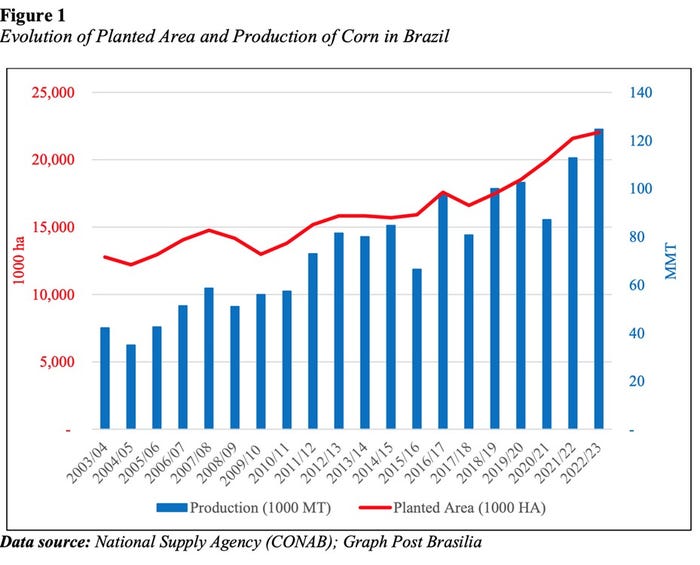

The USDA April WASDE update placed Brazil’s corn crop at 125 MMT. Some private estimates see Brazil’s overall corn crop growing to 131 MMT. Analysts may be getting ahead of themselves. Much of this will come down to whether the rainy season extends itself through May or not.

Mato Grosso will still likely have a monster crop. But that can be partially offset in Paraná. Additionally, the first crop of corn will likely need to be downgraded further due to drought issues in RGDS (Rio Grande do Sul).

Brazil remains on track to surpass the U.S. as the world's largest corn exporter. The country has already shipped out 10 MMT this season compared to 3.5 MMT during the same period last year. It needs to ship out at least 50 MMT to be able to reach the #1 spot.

Corn shipments will likely slow down now as soybeans export season takes over. They will pick up again in July. China is already making corn purchases for the July delivery timeframe.

Soybean harvest home stretch

The soybean harvest in Brazil is on the final stretch. They should get most everything wrapped up by the end of the month. We should finish this week on our family farm where yields have been average. Our determining factor for yield this season was actually too much rainfall and not enough sunlight.

Brazil still has roughly 60% of its soybean crop unsold. That is 90 MMT of soybeans waiting to be transacted. This is going to weigh on prices for some time. Farmers were coming off of some very profitable seasons. They may have experienced ‘recency bias,’ which is the tendency to overemphasize the importance of recent experiences when estimating future events. The last several years saw markets reward Brazilian farmers who stored their grain in the off-season. That has not been the case this season, where prices have pulled back following another record productions season.

USDA increased its Brazil soybean crop projection by 1 MMT, to 154 MMT. This was more than offset by a 5 MMT reduction in Argentina’s soybean crop. We still see room for additional cuts for both Argentina and Brazil’s soybean crop estimates.

Argentina’s ‘ag dollar’ program

Argentina initiated their “Ag Dollar” program twice last year. It was so successful we stated at the time that it would have to continue if they wanted farmers to sell their grain. That is now happening. As Argentina’s inflation rate approaches 100% per year, farmers have been hoarding their production like never before.

The government is starved for U.S. dollars and the only way they have been able to get farmers to speed up sales is by providing them a temporary, yet preferential exchange rate for one month, typically 30% above the official rate. This gets farmers to make sales at prices otherwise unavailable. It also brings sorely needed U.S. dollars into the country. They expect to trigger as much as 250 million bushels in sales.

Matthew Kruse is President of Commstock Investments. Subscribe to their report at www.commstock.com.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

BrazilAbout the Author(s)

You May Also Like