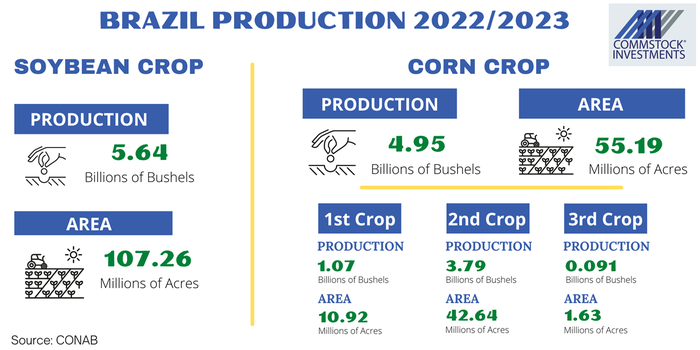

Brazil’s CONAB made some minor adjustments to their December crop report. They increased soybean area by 400,000 acres to 107.2 million acres. This was mostly offset by reducing projected soybeans yield by 0.2 bushels from 52.7 bushels per acre to 52.5 bpa.

We have pointed out in recent reports that 52.7 bpa would be a new yield record and seems unlikely. Even 52.5 bpa would beat the current yield record set by the 2020-21 crop at 52.4 bpa.

We remain skeptical regarding Brazil’s ability to reach new yield records when they are expanding soybean acres sharply by 4.6% while reducing fertilizer investments. However, as someone told me once, “rain covers up a lot of mistakes,” and it has been raining very well for the majority of Brazil’s growing areas.

Cuts to corn production

CONAB made similar adjustments to the corn, also reducing yield estimates by nearly 0.5 bpa to 89.5 bpa overall for the three crops. This reduced Brazil corn yield prospects by nearly 600,000 tons to 125.8 MMT overall.

Most of this reduction came from the first crop which was reduced by over 900,000 metric tons, much of which not surprisingly came from Rio Grande do Sul which has been the only state experiencing dry weather so far this year. They did offset some of the loss by boosting the size of the third corn crop by 500,000 tons.

These changes are all fairly insignificant compared to the second crop of corn which will begin planting next month. IMEA announced that they believe virtually 100% of the second crop of corn will be planted within the “ideal” time frame this year as farmers have made major investments in larger equipment and the soybean crop was planted on time.

While the size of Brazil’s second crop of corn is far from certain, it does have the wind at its back.

Weather watch

Rainfall outlook in Brazil continues to remain positive favoring the eastern side of the growing belt. Rainfall builds in Mato Grosso this weekend and on into next week.

The only state with a noticeably lower rainfall levels continues to be Rio Grande do Sul. While RGDS is projected to be the second largest soybean producing state, it still only represents 14% of Brazil’s total output and could be made up elsewhere.

There are regions of RGDS that are reportedly expecting 80% losses or more in corn as there has not been enough precipitation for grain fill or the ears simply didn’t form at all. This will likely be ignored by the market as the affected area is not large enough to make a difference to the overall production.

Check out our latest webinar on Brazilian crop prospects giving a complete overview of the 2022/23 season:

Matthew Kruse is President of Commstock Investments. Subscribe to their report at www.commstock.com.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

BrazilAbout the Author(s)

You May Also Like