The month of March can be an interesting month in terms of grain prices and price movement. The regular monthly supply and demand report is now behind us and trade is wondering “what’s next” in terms of pertinent market news.

The March USDA WASDE report was mostly in line with industry projections for the U.S. supply and demand projections The USDA made minor adjustments for the U.S. grain crop. The bottom line, US ending stocks of old crop grain remain tight, which will likely keep old crop U.S. grain prices firm overall until harvest.

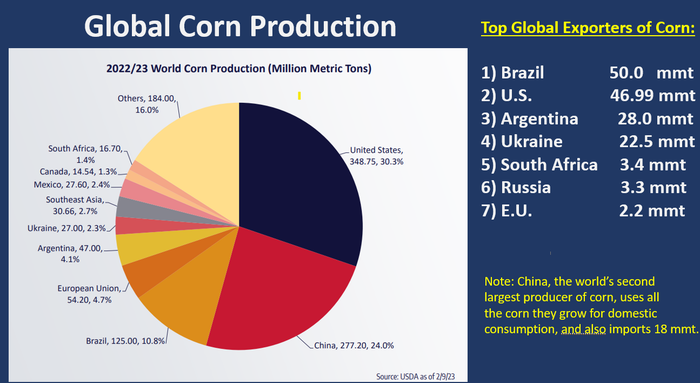

What did catch my eye on this report, was the South American production numbers for corn. The drought in Argentina has taken a toll on their crops. USDA estimated Argentina’s 2022/23 corn crop at 40.0 mmt. This was substantially lower than pre-report expectations of 43.4 mmt and sharply lower than the 47.0 printed on the February report.

USDA estimated Brazil 2022/23 corn crop at 125.0 mmt, nearly in line with expectations of 124.8 mmt and unchanged from the February report. While I didn’t expect USDA to make any adjustments to the Brazil corn crop on this report, it is something that must be monitored in the weeks and months ahead.

Why Brazilian corn production is important

The focus for the coming weeks will now turn to weather watching in Brazil regarding that second crop corn, or the Safrinha crop. This is the corn crop that is planted right behind the soybean harvest, and accounts for nearly 75% of the total Brazilian corn production number.

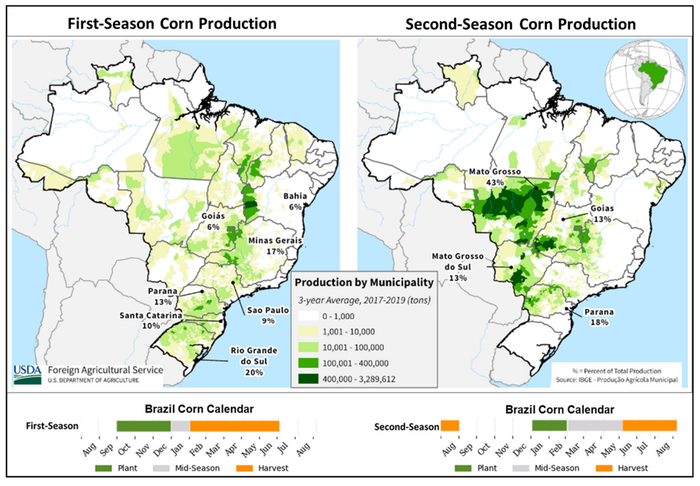

Here is a map that compares first crop corn production in Brazil with second crop corn production.

The images for the second crop corn show where the production levels are most abundant, and essentially where we need to weather watch in the coming weeks and months.

Thanks to double cropping, Brazil continues to slowly raise the amount of corn they grow. For this crop year, Brazilian total corn acreage is expected to grow 2.5% to 55 million acres, according to Conab.

The 2022-2023 Brazil corn crop is projected to be a record of 4.941 billion bushels (equivalent to 125 million tons), an increase of nearly 10% over the previous harvest, which suffered due to drought. (By comparison, the U.S. grew a 13.7 billion bushel corn crop last year.)

Brazil's top corn-producing states

Brazil is expected to grow 125 mmt of corn this year, assuming normal weather and perfect growing conditions. Here are the top producing states:

The largest by size and total corn production is Mato Grosso, which grows nearly 44% of overall corn production. (Mato Grosso is a large state, coming in at 900,000 square kilometers. To put into perspective; the entire states of Illinois, Indiana, Iowa, Ohio, Nebraska and South Dakota could fit inside Mato Grosso.)

The next largest producing state is Paraná, which grows approximately 17% of total Brazil corn.

The third largest corn producing state is Mato Grosso do Sul at nearly 14%, followed by Goiás at 12% and Minas Gerais at just under 5%.

These five Brazilian states represent nearly 90% of the total corn produced in Brazil according to Conab.

Right now, the market is assuming a record corn crop from Brazil, and keep in mind that assumed perfection is priced into the market already.

The plot thickens as the corn is slow to get planted

There is however, one slight glitch in this potential record corn crop coming out of Brazil. This Brazil corn crop is still trying to get planted, and it is off to a very slow start.

Brazil has suffered persistent rains over the past few weeks, which has delayed the soybean harvest and is also delayed the Safrinha planting.

It is said that for best odds of phenomenal corn production in Brazil, that second crop corn needs to be planted by Feb. 22. Well, it’s the second week of March and it looks like a large portion of Brazil’s Safrinha corn is going to be planted extremely late, outside that “ideal” window. That is a big deal.

I find it interesting that the market is pricing in a record corn crop out of Brazil, and yet odds are actually working against the reality of record production occurring because the crop is late to get planted and is definitely outside of that ideal planting window.

A late planted Safrinha crop faces increased odds of that the maturing crop will encounter yield-reducing weather, such as heat or dryness (as is a normal threat in Brazil for that time of year) and early frost.

Dr. Cordonnier said this week that Brazil's Safrinha corn was 70% planted as of late last week compared to 80% last year. That means that essentially nearly 30% of the Safrinha crop will be planted outside of the ideal window.

What this means for U.S. farmers

Brazil’s corn crop will likely be smaller than expected, which will bring down global carryout levels. If perception is that the Safrinha crop is smaller, that would likely make corn prices rally in the coming weeks and months. It also might affect U.S. corn exports.

While the U.S. is still the world’s largest corn producer. Brazil continues to grow their overall production and is now a fierce export competitor of the United States. In fact, Brazil is now the leading global exporter of corn.

A late planted corn crop in Brazil means it will get harvested late. The world was relying on that Safrinha crop to fill the void when the U.S. runs out of corn in mid-August and before harvest begins in mid to late September. That window of void in the United States is usually when the Safrinha crop is able to get exported. Not so much this year.

If this late planted crop in Brazil shows any sign of struggle in terms of weather, corn futures prices will respond, and quickly. It will put more pressure on the United States to grow a large crop this summer and will likely allow our old crop corn export pace to increase, as well.

Keep an eye on this developing story. It is one that has potential to awake this corn market.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

BrazilAbout the Author(s)

You May Also Like