The USDA on January 12 will release a series of reports including Crop Production Annual Summary, Grain Stocks, World Agricultural Supply and Demand Estimates, and Winter Wheat and Canola Seedings. Let’s briefly highlight trade expectations.

The Crop Production Annual Summary will provide updated 2021 production totals and the market is expecting slightly larger corn and soybean crops relative to the last survey-based projections in November. The average trade guess for corn is 15.078 billion bushels (bbu) (with a range of 14.941-15.190) compared to 15.062 in November, while the average guess for soybeans is 4.434 bbu (from the range of 4.396-4.484) vs. 4.425 in November.

Turning to the Grain Stocks report, the average trade estimate for Dec. 1 corn stocks is 11.607 bbu (range 11.200-11.951) while soybeans are pegged at 3.128 bbu (2.975-3.227). The supply/demand report, meanwhile, will provide updated forecasts of 2021/22 U.S. carryout. At 1.483 bbu (range 1.359-1.600), the average estimate for corn is 10 million bushels (mbu) lower versus the December forecast. The average estimate for beans is 353 mbu (305-411), which is 13 mbu above the forecast of 340 mbu last month. Finally, average estimates for Winter Wheat Seedings are: HRW, 24.0 million acres (range of 23.2-25.0); SRW, 6.6 million (5.8-7.0); and White, 3.6 million (3.5-4.0). Total winter wheat planting estimates are 34.3 million acres (33.3-35.6).

Why so volatile?

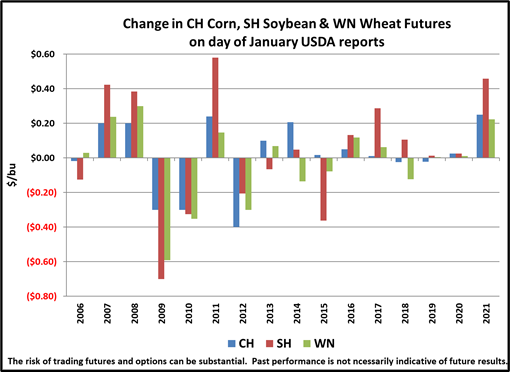

The chart depicts the change in March corn (CH) and March soybean futures (SH), along with Chicago SRW July wheat futures (WN) for the day that the reports are released.

At a glance, it’s clear that these reports have on many occasions contributed to a substantial increase in price volatility on the day that the data becomes available. Mid-January also marks a critical period for the South American growing season, which has also been directly linked to major market movement. As a student of the market, you understand that increased price volatility can represent potential opportunity. Your Advance Trading advisor is well prepared to partner with you in formulating and executing a risk management strategy that is the best fit for your operation.

Dave Fogel, vice president at ATI, adds: As the old saying goes, volatility equals opportunity. That can be true, but it requires preparation. I would assume that most forms of marketing will use some combination of a cash sale, a futures sale, or an option position. I further assume that most ’22 crop expected production has not been managed to date; meaning the farmer is long (unsold) in the market.

If you are not willing to price grain today via a futures sale, cash sale or long put option purchase, please ask yourself these questions:

At what level am I willing to execute?

Am I willing to risk lower prices if I don’t reach my objective? How much time are you willing to wait for your objectives to be hit?

Do you need to lower your objectives over time?

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like