Russia’s invasion into Ukraine in late February brought a lot of attention to Black Sea grain markets – and with good reason.

Countries around the world slapped Russia with economic sanctions in response to limit trade and economic development. Most notably to international agricultural markets, Russian grain exports lost access to the all-important SWIFT global bank payment system, which allows foreign entities to trade grain shipments in dollar denominations.

Pre-conflict trade flows

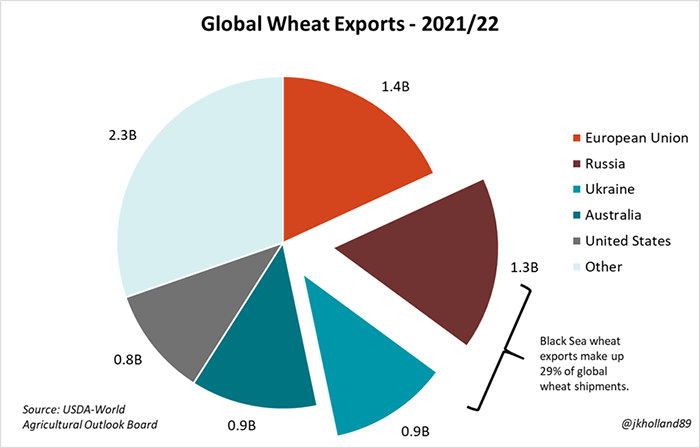

Why is this such a big deal? Prior to the conflict, Russia and Ukraine were expected to combine for 29% of global wheat exports in 2021/22, the second and fourth largest global wheat exporters, respectively. In comparison, U.S. wheat exports only account for 11% of total world exportable supplies.

At press time in early March, Ukrainian grain terminals in the Black Sea remained closed as citizens rallied to fight Russian military advances, with hopes of reopening once the conflict had been resolved. Russian wheat shipments also ground to a halt as exporters no longer had access to SWIFT. Russia’s blocked access to SWIFT left no international buyers willing to even consider booking new sales of Russian wheat.

With the all-important Black Sea wheat market under lockdown, global wheat buyers have scrambled to find readily available wheat sources, which was the chief driver of the post-invasion price surge in the wheat markets.

Middle Eastern and African countries heavily depend upon Black Sea grain exports for food and feed, especially as Northern African countries face a debilitating drought. These countries comprised about 90% of Russia’s wheat exports and 60% of Ukrainian wheat shipments between October 2021 and February 2022.

They account for 22% the world’s coarse grain import volumes in 2021/22 – the largest cluster of grain buyers in the world.

A pivot to new markets?

With Black Sea terminals largely shuttered and 2022 planting and production forecasts in limbo for Russian and Ukrainian spring wheat crops, these buyers are likely to shift to supplies in the European Union, Australia, and North and South America. And this will not be as simple of a fix as it sounds.

Soft wheat shipments out of the E.U. got off to a rapid start last summer. Drought damage to wheat crops in the Canadian Prairies and U.S. Northern Plains left North American wheat supplies in short order last summer. And as a La Niña-induced drought continues to batter Brazil and Argentina, it seems unlikely South America will have the supplies necessary to pick up Black Sea orders over the next two months.

April and May will likely see the most upward price pressure from these supply dynamics in the global wheat market as buyers await Northern Hemisphere harvests. While high wheat prices could deter some food demand from the global marketplace, high alternative feed prices point to a continued uptick in global livestock feed demand for wheat over the next few months.

As Middle East and African buyers wait for harvest in the Northern Hemisphere to begin – and the Russian-Ukrainian conflict to abate – these buyers are likely to look away from the Black Sea and to countries with readily available wheat supplies, particularly Australia and India.

After three consecutive years of drought-plagued crop shortfalls, Australia has produced bumper crops over the past two growing seasons and is likely to be the key beneficiary of greater export sales amid Black Sea disruptions.

A robust wheat crop last year on the heels of four prior years of consecutive bumper crops has left Indian wheat with a wheat surplus available to export. India’s exportable wheat supplies are double the size from last year.

And as shipments from the Black Sea remain stalled amid the ongoing military conflict and economic sanctions, Indian wheat could provide a low-cost option to Asian buyers who typically rely on Black Sea grain shipments. Southeast Asia is expected to snap up 13% of this year’s global coarse grain exports, trailing the North African and Middle Eastern region as well as China as the world’s third largest grain buyer.

Looking forward

The result of these price dynamics has sent Chicago wheat prices soaring nearly 35% higher over the past two weeks to $10.51/bushel. Kansas City futures rose 31% higher in that same time period to $10.595/bushel at last glance. And as fears about limited access to Russian spring wheat crops sink into the market, Minneapolis futures have surged over a dollar per bushel higher to $10.5475/bushel over the past two weeks.

As of press time in early March, global markets will not have access to Russian or Ukrainian wheat supplies. Even if the conflict is resolved, planting, harvest, and supply chain disruptions could keep exportable wheat supplies tight in the Black Sea region and across the world as demand continues accelerate.

U.S. wheat is typically considered a residual supplier to the global marketplace but could see an uptick in shipping volumes as it welcomes non-traditional buyers. Peak export season for U.S. wheat typically begins to ramp up in mid-April. This year’s season could be more bullish than expected, which will reward growers with last minute supplies to sell before harvest begins this summer.

About the Author(s)

You May Also Like