“Will I ever get another chance to price my new crop corn or soybeans at higher values?” a farmer recently asked, who was feeling dismayed at missing earlier price opportunities.

The recent price sell off by the funds left him feeling helpless and frustrated. His question prompted me to dig up historical and seasonal price patterns for new crop corn and soybeans as we head into spring and early summer.

The results are eye opening and encouraging!

New crop corn

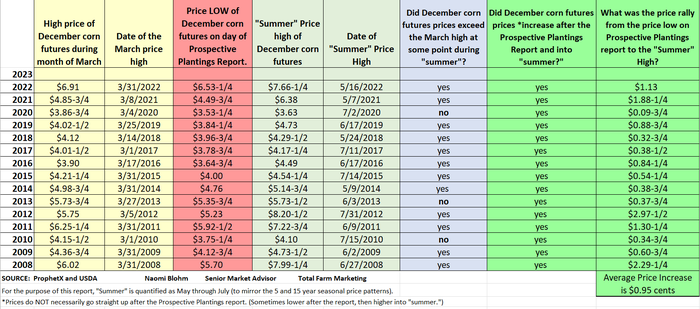

With the Prospective Planting Report and Quarterly Stocks report coming this Friday, many have questioned whether or not new crop corn prices will rally. Looking at seasonals, and historical price data, there are good odds for a price increase heading into late spring/early summer.

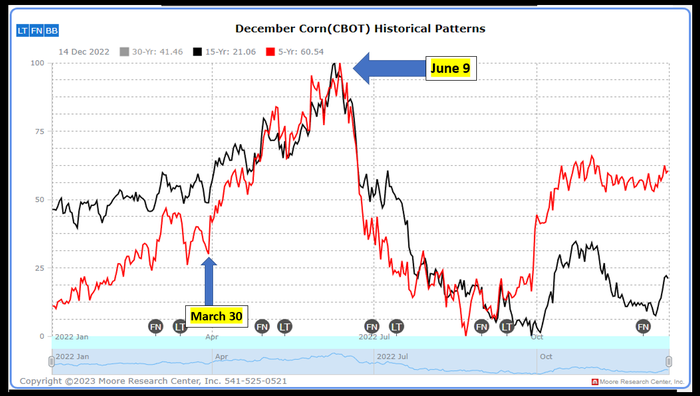

While past performance is not indicative of future results, the seasonal chart for December corn futures suggests that new crop corn prices will find an early spring price low soon and will then have a tendency to show a price increase into early summer.

Please take note of the late May/early June window – that is when we will look to heavily focus on new crop cash sales!!

What I also found interesting is that when looking at the low price of December corn futures on the day of the Prospective Plantings report, to the summer high price, the average rally over the past fifteen years has been 95 cents!

15 out of 15 years, December corn futures rallied after the Prospective Plantings report. (Not necessarily straight up, or immediately, but it has rallied.)

And 12 out of the past 15 years, the summer high price exceeded the price high that the December corn futures contract showed during the month of March.

Please make sure you use this information as a benefit to focus on cash sales in the future!

New crop soybeans

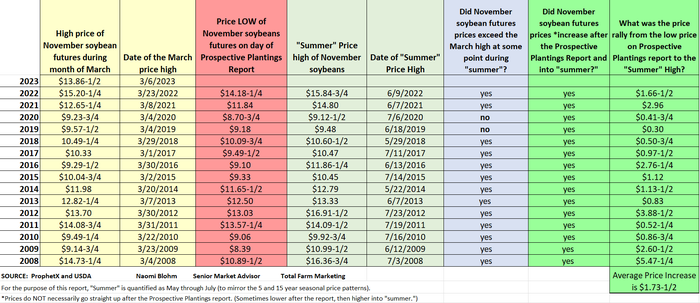

The same friendly price information rings true for new crop soybeans. Looking at seasonals, and historical price data, there are good odds for a price increase heading into late spring/early summer.

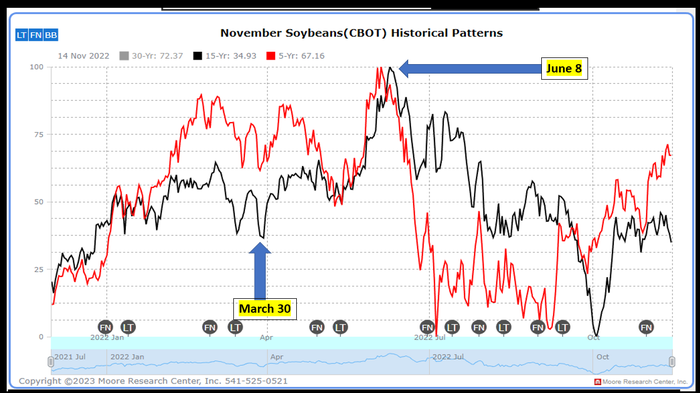

While past performance is not indicative of future results, the seasonal chart for November soybean futures suggests that new crop soybean prices will find an early spring price low soon and will then tend to show a price increase into early summer.

Just like new crop corn prices, please take note of the late May/early June window – that is when we will look to heavily focus on cash sales for new crop soybeans.

What I also found interesting is that when looking at the low price of November soybean futures on the day of the Prospective Plantings report, to the summer high price, the average rally over the past fifteen years has been $1.73.

15 out of 15 years, November soybean futures have rallied after the Prospective Plantings report. (Not necessarily straight up, or immediately, but it has rallied.)

And 13 out of the past 15 years, the summer high price exceeded the price high that the November soybean futures contract showed during the month of March. (Note that some years, the price high for March occurred ON the day of the Prospective plantings report.)

Good news. Decent odds of price rallies for new crop corn and soybeans!

Be ready to act on pricing opportunities as they become available. You will likely be busy wrapping up planting and will be distracted.

Have action plans ready for whatever market scenario unfolds. Remember, marketing is how you get paid for your hard work. Farm market scenario planning is hard work; and those who take time to strategize and execute will realize their pay day.

Finally, look at when those historic price highs and when they tend to occur. Use this knowledge to empower you to pull the trigger on cash sales in the future!

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like