For those who have slept since then, back in September USDA was estimating Argentina’s 22-23 corn crop at a record 55.0 million metric tonnes, up 2 MMT from the prior year. Soybean production was pegged at 7 MMT greater, at 51.0 million.

Now all that has changed.

With the release of its March WASDE report, USDA has subsequently lowered Argentine corn 15 million to 40 MMT; likewise, the soybean crop took an 8 MMT hit from the February forecast, down to 33.0.

The Buenos Aires Grain Exchange (BAGE) late last week published an even more dire outlook, lowering its corn estimate from 37.5 to 35.0 and soybeans from 29.0 down to 25.0. Taking the BAGE’s latest numbers at face value suggests a 20 MMT (780 million bushels) decline in corn production from the initial forecasts and a 26 MMT (955 mbu) reduction to the soybean crop.

Expressing those numbers in a U.S. equivalency would be similar to taking almost 40% off of the 2022 Iowa corn crop of 2.48 billion bushels. And zeroing out last year’s 677 mbu Illinois soybean production along with Missouri’s or Nebraska’s near- 280 million bu. crops!

Implications for corn exports

Argentina is typically the third largest corn exporter behind the U.S. and Brazil (though the #1 and #2 rankings are likely to trade places in the not-too-distant future). A good rule-of-thumb is that about 75% of its production goes into the export market. And with production estimates being down 15 MMT from the initial forecasts, the smaller crop should historically boost/switch export demand by as much as 11 million tonnes/440 mbu to other origins, namely the United States.

If that’s the case, then why have March corn futures lost 50 cents since reaching $6.82 ½ back in mid-February? There may be several reasons and the two graphs below may provide some insight.

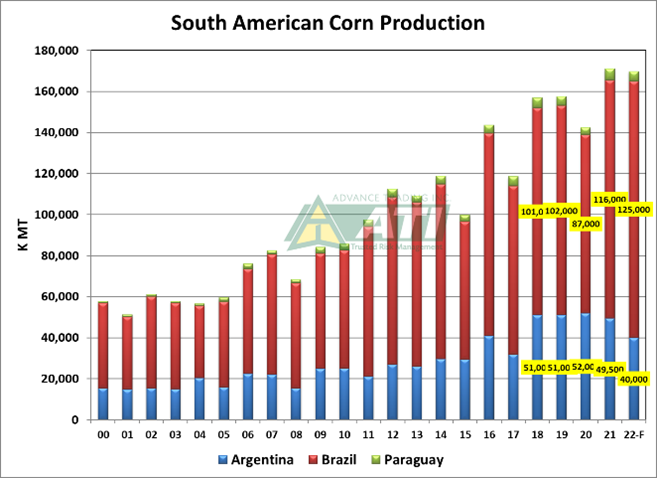

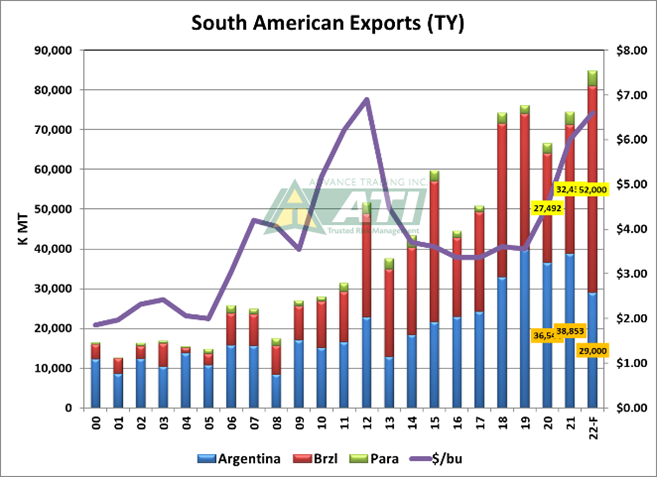

First, the March WASDE production numbers for Argentina, Brazil and Paraguay indicate that despite a 20% decline in Argentine output, good crops in Brazil and Paraguay so far are mostly offsetting the former (See “South American Corn Production”). Secondly, while allowing for a near 10 MMT decline in Argentina’s forecasted exports, a likely 20 MMT boost in Brazil’s estimated trade year (October-September) shipments indicates even MORE corn will be coming out of South America in 22-23.

More bearish news

Brazil and, to a lesser degree of importance, Argentina, have both signed corn trade deals with China. The former is reported to have shipped approximately 1.5 MMT of corn to China during the December-January period and trade talk has China already buying Brazil’s yet-to-be harvested safrinha crop, which will begin moving into the global market by mid-to-end of July.

China took approximately 565 mbu of U.S. corn during 21-22; shipments this year are lagging about 85 mbu. However, it did buy over 80 mbu of U.S. corn the past week. It remains to be seen if they will duplicate last year’s volume of business.

Ukraine, despite the Russian invasion, has been able to ship more corn than most experts had forecast this year and a fair amount of this volume has gone to China.

Importer stock-building?

Here’s an interesting tidbit. Trade data for the 8 or so countries which account for most of the world’s corn exports indicate that non-U.S. shipments during the June-August and September-November periods were up 25% and 57%, respectively! That’s like putting 250 and 335 million bushels more into the world pipeline. The result is year-to-year reductions of 75 and 150 mbu in U.S exports during these same periods.

Finally, and this is something that is a little more difficult to quantify, is increased volumes of feed wheat are being exported from the Black Sea (both Russia and Ukraine) along with Australia into major Far East markets.

What’s it all mean?

This latest corn crop reduction by the BAGE, if it holds up, could boost the 2022-23 corn export forecast from 1.850 to 1.9 bbu which would still leave U.S. carry-out near the 1.3 bbu mark. The export forecast is highly dependent upon sales to Japan for the remainder of the year being double the 21-22 level (85 mbu) and matching last year’s balance of the year sales to China of 85-90 million, in addition to the recent sales.

The Argentine crop is definitely having an impact, but there are several contrasting forces which make it somewhat difficult to get overly bullish U.S. corn export prospects for the remainder of 22-23.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

ArgentinaAbout the Author(s)

You May Also Like