Many grain farmers who were able to sell corn above $7.00 just two months ago are now questioning themselves and wondering why they did not sell more. That is a question that everyone asks once the high of the year is in. But does that mean you will not have any more good selling opportunities?

The ProFarmer crop tour next week will provide the first good look into fields on a broad scale. Private surveys and agronomy day luncheons are all good, however, these are not nearly as broad and scaled as the ProFarmer tour.

USDA’s projected yield at 175.4 bushels per acre is well below the 182 bpa trendline yield used back in February. The agency is trying to keep up with current guesses. The real question will be if yields gain a little from here or if this smaller crop gets even smaller.

Recent rains have definitely stabilized plants, but according to most agronomists and weather analysts, it’s too late for the crop to get larger. Pollination problems are abundant.

Traders have liquidated a long position, putting pressure on values – regardless of any thoughts about the yield. Their main focus is with a change in Fed policy, commodity prices will be deflating – and they are correct.

Fed policy ultimately manipulates value areas and the way the consumer responds to pricing. Sometimes it takes longer and the pendulum swings too far, just like it did on the inflation side when they provided a 0% interest rate and actively bought securities in the world market. But food values will probably be the last item to fall significantly.

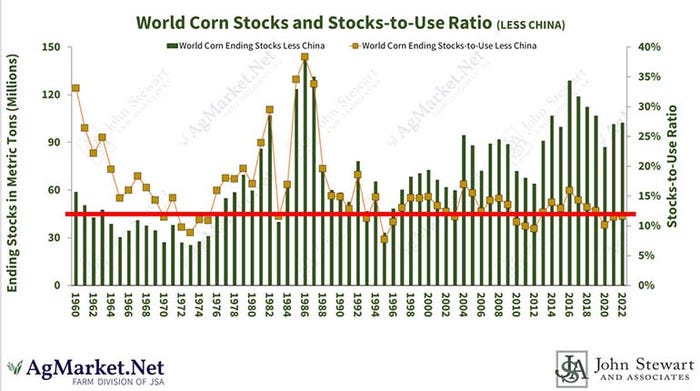

U.S. and world stocks are still so dramatically tight for feed grains and starched commodities that we really need a strong production cycle and a boost in stored inventories to allow the bottom to fall out.

Farmers are not willing to sell below the $6 area. That holds back supply and helps support prices. Demand on the other side is looking at the lack of excess grains, the risk of the crop into harvest, the risk of combines finding yields that may not perform as expected, and the deepening crisis in the European crop.

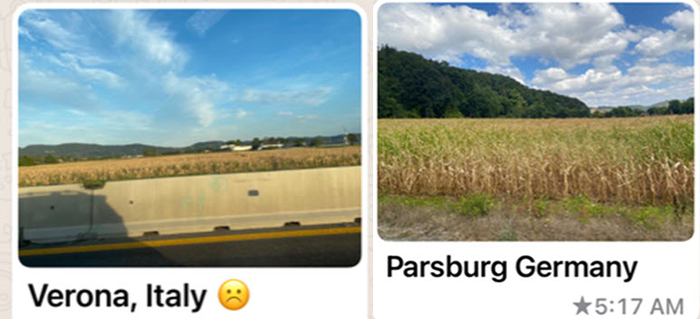

Below are pictures taken in Germany and Italy yesterday. This irrigated crop was green two weeks ago and simply “gave up” due to heat. They are on the same production calendar as Illinois and Iowa. This crop had pollination issues, and now will have light fill and possibly toxin issues. Time will tell, but we do not think the story is over.

U.S. farmers may be beating themselves up. However, if you are one of the many fortunate farmers this year to be producing 240 bpa, today's prices still offer tremendous profit potential. And for the other less fortunate producers who are making 180 bpa, $6 is still near – or above – break-even for most.

It is almost impossible to feel confident in any price outlook given the dramatically negative fed policy against the historically tight supplies we are still dealing with. End users are chomping at the bit to buy corn. If the EU crop gets any smaller, or the upcoming South American crop falls shy of trendline yields due to continued La Nina conditions, we suspect corn will attempt to push towards the upper $6 area by March of next year.

In the meantime, technically, the market must hold at the $5.50 area at all times during selloffs. If that area gives way to selling, the long-term prospects do not look good. If it does hold $5.50 as we expect it to, then this market is likely “not over.”

Please feel free to sign up for our research free for 30 days. Our most popular reports are our weekly videos. You can also call us anytime.

Reach Bill Biedermann at 815-893-7443 or [email protected]

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like