December 15, 2021

Who’s buying Illinois farmland? That’s one of the data points that we track and report at the Illinois Society of Professional Farm Managers and Rural Appraisers — and we’ve done so every year since 2005, publishing it in our annual Illinois Land Values and Lease Trends.

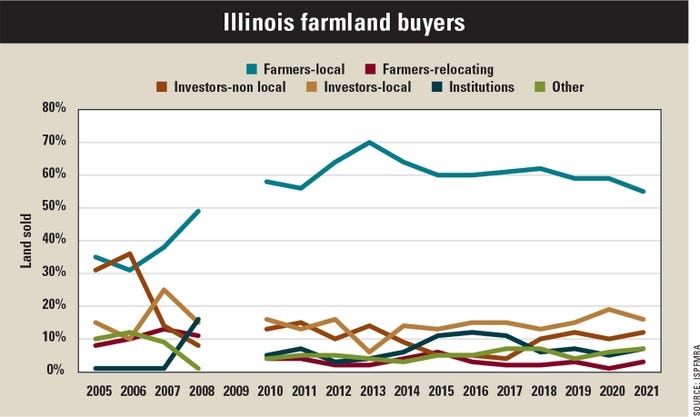

As you’ll see in the chart below, farmers have been and continue to be the largest segment of farmland buyers in Illinois. Interesting to note is that institutional buyers made up a very small portion of those buying farmland in Illinois from 2005 to 2007. The number surged in 2008 as ethanol production mandated by the Renewable Fuel Standard boomed and the housing bust curtailed returns in many other sectors.

So, with the addition of this relatively new capital in the land market, have investors been driving up land prices?

Ray Brownfield, Land Pro, says that is not the case, at least with institutional investors he’s worked with this fall. “We’re seeing a lot of farms bought by farmers and local investors,” Brownfield says. “The institutional buyers are in the market, but not the ones who are buying. They tend to be more data or numbers driven, while local investors and farmers have other motivating factors.”

It was recently reported that a farm being considered by an institutional buyer in McLean County sold to a local farmer who was looking for ground to help the next generation get into the business. When there are other considerations, buyers of farm ground may accept a lower return to achieve their overall goals.

Herb Meyer of Peoria Appraisal Services says, “Institutional buyers have to answer to their investors, and that usually means having a property appraised to ensure the price paid is not over the market.”

In an upwardly moving market, the value of a farm today may not be the value of the farm tomorrow. Brownfield observes, “Some institutional buyers move deliberately slow when investing.”

Institutional investors tend to be cautious and risk averse, preferring to lose a sale than make a bad investment. In rapidly changing markets, more nimble investors like farmers and local investors can move more quickly and capture land that might have otherwise been purchased by institutional investors.

What about Bill Gates?

So, who are the investors or institutions buying Illinois farmland?

Recent stories about Bill Gates as the largest farmland owner in the U.S. begs the question, who are these people? Personally, I spent 12 years of my career working for an institutional investor. When I started in 2007, you could count on one hand the number of players in the market. Since then, there has been a plethora of “institutionals” come onboard.

The historically traditional institutional investor got its start in the mid-’80s. As the farm crisis unfolded and many land purchase loans defaulted, more astute financiers realized that some of the farms they were selling to recoup losses were good investments. Overnight, many bad loans became investments.

Lack of credible, consistent financial performance data for farmland drove these investors to form the Farmland Index portion of the National Council of Real Estate Fiduciaries, allowing for standardized measurement. They published what farmers already knew: Land is a good investment. Over time, it offers high returns through income and appreciation and has lower volatility than other investment mediums. And word got out.

There are new players in the industry. Because farmland is a hard asset class to get into due to the necessity for capital and specialized knowledge, early investors focused on large pension funds and retirement accounts. More recently we’ve seen the entry of family offices that handle investments for private individuals and families (like Bill Gates), and farmland real estate investment trusts (REITS), which allow investors to trade with a smaller capital investment through publicly traded shares. Lately, internet-based, crowd-sourced farmland investment opportunities offer investors the opportunity to purchase fractional interests in specific offerings.

Many of these investors are started, managed or advised by men and women who grew up on a farm or have a farm background. Those are people who may or may not have had the opportunity to farm themselves but appreciate farm culture and lifestyle.

Most institutional investors see farmers as partners, desiring to make farming more productive and sustainable so that future generations can continue to enjoy the blessings of farm life. And while the numbers may not currently allow them to buy, most see farmland as a long-term investment and will be ready to get back into the market when the numbers do make sense.

Lauher owns Rolling Acres Ag Solutions and is a member of the Illinois Society of Professional Farm Managers and Rural Appraisers. Email questions to [email protected]. The opinions of this writer are not necessarily those of Farm Progress/Informa.

You May Also Like