If anyone filled out an NCAA bracket, they know this year's tournament was filled with upsets. As a Purdue alum, the school’s first-round loss pretty much blew up my brackets. Spring weather and the upcoming USDA Prospective Plantings report and Grain Stocks report could result in even more unexpected results. I hope your marketing plan is ready for anything.

The first potential day for extreme price movement is the end of the month quarterly stocks and U.S. planting intentions report. The average trade guess for corn planting intentions is 90.9 million acres, with a high-low range of 87.7-92.1. Our AgMarket.Net estimate is 91.35 million acres. Using a trend yield of 181.5 bpa, the difference between these high and low numbers equals 617 million bu. -- roughly 46% of the current ending stocks estimate.

In addition to the acres report, the stocks report has the potential to shock the market well. The average trade guess for the quarterly stocks number is 7.474 million bushels, down 284 mb from last year's estimate. The range of estimates is 590 million bushels, 44% of the current ending stocks, with a high estimate of 7.830 mb and a low estimate of 7.240 mb.

Since 2000, the chances the price moves higher at the close on the report day is 3.1%. The average price change is -3.3% on lower price moves (basis the July corn contract). The market has settled higher than the average price 61% of the time and 39% lower on the day of these reports since 2000.

The trade’s average soybean acreage estimate is roughly 88.3 million acres. Our AgMarket.Net estimate is 87.90 million acres. The estimated range is between nearly 87.4 to 89.6 million acres. Using a trend yield of 52, the difference between these high to low numbers equals 114 mb. That is roughly 54% of the current ending stocks estimate.

Since 2000, the chance the average price moves higher by the close is 2.3% ( basis the July contract). The average price change is -2.2% on a lower close day. The market has settled higher 48% of the time and lower 52 % of the time since 2000.

Slow planting ahead?

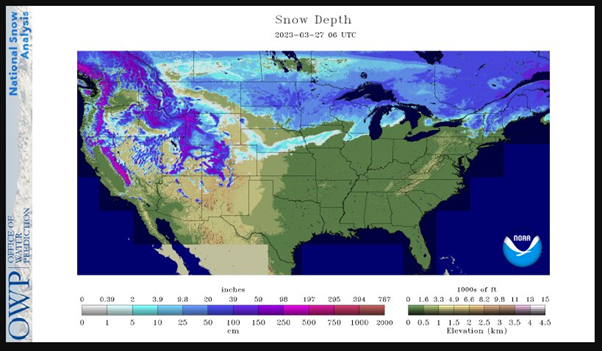

Once we get past the numbers at the end of the week, the trade's attention will turn to planting progress. With the Northern Plains seeing some of the biggest snowpack still on the ground since 1997, the likelihood that we will see prevented plant acres could be high. The forecast continues to call for below-normal temperatures and above-average precipitation (snow) which could delay the winter thaw, spring fieldwork, and planting for this portion of the country.

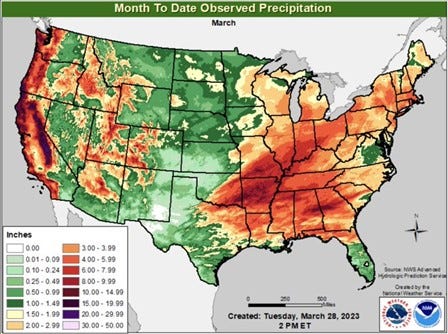

It is not just the Northern Plains which will potentially deal with planting delays. The Eastern Midwest continues to get hit with multiple rounds of rain, with more on the way in the next few weeks. If this happens, the possibility of delayed plating is high as well.

Funds liquidate

The Macroeconomy will no doubt continue to add to the uncertainty of the markets. The past few weeks saw the speculative fund liquidate their long ag positions. According to the CFTC report, the week of March 21 managed money were net sellers of 73,324 agriculture contracts, reducing their long position to just over 106,000 contracts, their smallest position since Aug. 20 of last year. The CFTC reports shows that managed money is short 41,896 contracts of corn. This suggests they have much room to sell, if they so choose, or buy if there was a reason to go back long.

If the macroeconomic situation were to stabilize and the Fed stopped raising interest rates, we would also look for fund investments to move back into commodities.

Mitigate exposure

To manage these potential market-moving events, producers should consider using options to mitigate their economic exposure. If you are heavily sold in the cash or futures markets, you might consider buying weekly or short-dated calls against the position to offset the market risk if the funds come back in and drive the market higher due to a surprised acreage, stocks, or weather problem causing planning delays. If you find yourself on the other side of the coin with little downward price coverage, consider buying weekly or short-dated puts. This will put a floor under your unsold bushels but leave the side open.

If the weather cooperates and the acreage and stock numbers come in "bearish," we could see the market continue to work lower. This is especially if the funds choose to build on their current short corn position and liquidate other long soybean positions.

Remember, the market does guarantee you profit; it is up to you to do that for your operation. Don't hesitate to contact me at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT.

Reach Jim at 815-665-0461, [email protected] or on Twitter: @jpmccormick3.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like