There’s an awful lot going on in the world right now. Liquidity and global growth are in decline, while global supply shortages are rapidly rising. That last statement sounds an awful lot like stagflation, which occurs when inflation is high, the economic growth rate slows, and unemployment remains steadily high.

The Food and Agriculture Organization tracks the monthly change in international prices of a basket of food commodities which predominantly include cereals, vegetable oils, dairy, meat and sugar. This FAO Food Price Index rose 1.2% in September to 130 points, which is 32.8% higher than September of 2020. The index was led by cereals and vegetable oils, while dairy and sugar prices were also firm.

The only sub-index that has remained stable is the price of meat. Looks like food inflation to me.

Energy higher too

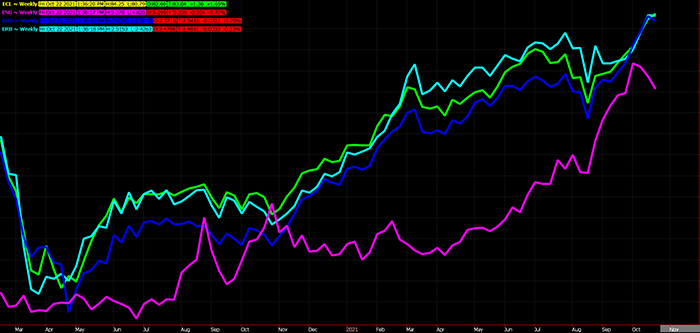

A brief look at the weekly chart of energy futures values, pictured below, makes it painfully obvious that the price of food isn’t the only thing moving higher. It’s funny how talking heads have suggested over the last several months that if food and fuel values are taken out of the equation, inflation isn’t that bad. In other words, if we can just ignore the price of goods we need to survive, everything is fine.

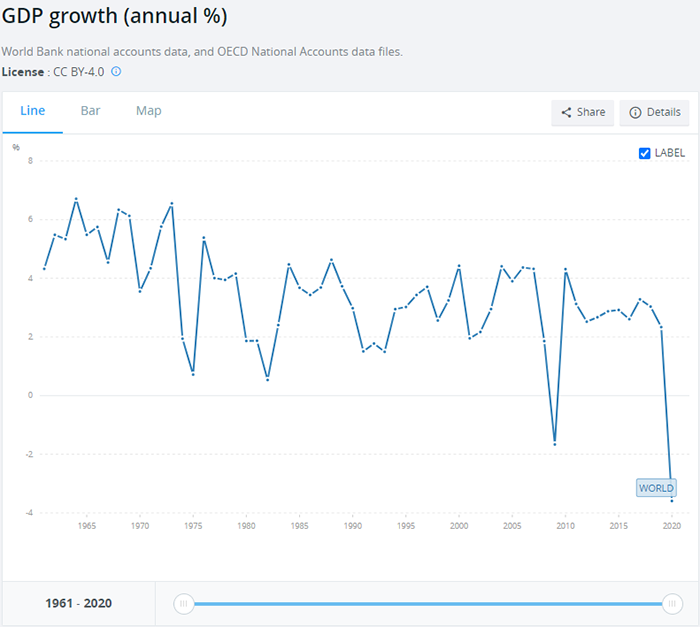

The chart below shows Global GDP growth over the last 60 years. While the trend has been down, the recent acceleration lower is cause for concern.

Concerns regarding China’s growth have recently resurfaced. China’s credit impulses have been a mainstay as an indicator of global expansion and contraction. While America’s focus is generally on the Federal Reserve and its ongoing mission to inflate asset bubbles forever, China’s credit bubble is no longer expanding.

It appears we have identified inflation in the products that matter to the day-to-day existence of humans. A decline in global growth has accelerated due to COVID, and more recently, global supply chain shocks. The Just-In-Time logistics model that once appeared to showcase efficiency has all along been a fragile and tighly interconnected system of codependancy.

And now, unemployment

The last part of the stagflation equation is unemployment. Most recent unemployment figures from September showed the unemployment rate dropped to its lowest rate (4.8%) since it peaked at 14.7% due to COVID and the restrictions that followed. While this sounds peachy, the Labor Force Participation Rate has been in decline since the turn of the century.

The conditions for stagflation appear to be set. Considering that stag is a term for a lone male deer from the late 12th century, if stagflation truly sets in, we’re all on our own. As always, feel free to contact me directly at 815-665-0463 or anyone on the AgMarket.Net team at 844-4AGMRKT. We are here to help.

Reach Brian Splitt at 847-946-2080 or [email protected].

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like