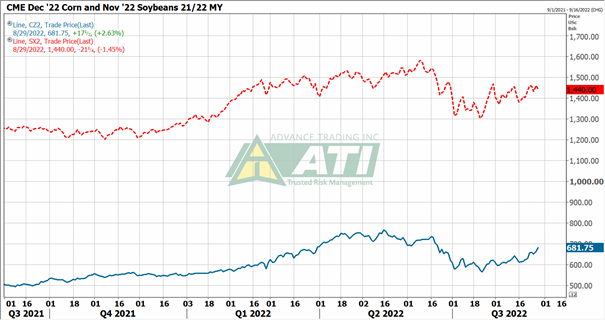

The 2021/22 crop year for corn and soybeans will end Aug. 31. The end of the crop year provides an opportunity to look back and review some marketing lessons learned for corn and soybeans.

This past year has included many surprises. Take a look at these marketing lessons from 2021/22 and think about how to implement a comprehensive risk management strategy for 2022/23.

Monitor closely what happens in South America

A year ago, a drought severely reduced Brazil’s corn crop. This year, however, was a much different story as corn production in Brazil was record large and 33% above the year-ago level. Plus, corn production in Argentina was also a record high, up 2%. Thus, South America will provide fierce competition this fall to U.S. corn in export markets. This underscores that what happens in South America has never been more important than it is today.

Market highs can occur at any time

After peaking at $15.10 ¾ on June 7, 2021, September 2021 soybean futures plummeted to $12.76 ½ on Sept. 14. Those anticipating a repeat in September 2022 soybean futures have been surprised, however, as the contract made a new high of $16.14 on Aug. 26, 2022 on projections for tight ending stocks of U.S. beans. Uncertainties about yield prospects for the 2022 U.S. soybean crop have also provided support. This is a prime example that price is unpredictable and market highs can occur at any time.

Use risk management tools that provide downside price protection and upside opportunity

As noted above, September 2022 soybean futures made a contract high only days prior to the end of the 2021/22 crop year. This is an important reminder that getting control of bushels at harvest by utilizing risk management tools that provide downside price protection—and upside opportunity—is a key to successful marketing.

Be prepared for market reaction to USDA reports

Preparation is better than reacting to the numbers. The trade believed that the USDA’s June 30 Acreage report would show only a slight drop in 2022 U.S. soybean acres from March. The report, however, pegged acres well below the March estimate and futures initially rallied post-report. After trading nearly $0.30 higher, November 2022 soybean futures fell $0.50 to close $0.20 lower that day at $14.58. This serves as a reminder to be prepared for market reaction to a USDA report, rather than react to the numbers.

Change happens — sometimes very fast

December 2022 corn futures rallied to $7.49 ¼ on June 17, 2022 on crop concerns. A change to favorable weather stalled the rally, however, and December futures plummeted to $5.78 ½ by July 5—a decline of nearly $1.71 (23%) in just 10 trading days. While the market is staging a pre-harvest rebound, it has yet to recover all those losses. Change happens and can be very fast. Those executing a disciplined risk management strategy are positioned to manage increased price volatility.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like