USDA’s March 31 Prospective Plantings and Quarterly Grain Stocks reports issued Thursday by the National Agricultural Statistics Service were nothing short of exciting. We saw monumental and somewhat surprising acreage shifts as growers continue to battle soaring input costs and supply chain headaches, all while navigating food and feed markets amidst the Russian-Ukrainian conflict.

These dynamics have compounded to throw global food security into the limelight over the past month at a time when inflationary pressures in the broader global markets are intensifying. Commodity prices soared to multi-year highs (or record prices in the case of wheat markets), then posted record drops as the uncertainty of supply availability looms large over prices.

This market volatility created a challenging forecasting environment ahead of the March 31 reports. But as I noted in detail leading up to the reports’ release, Farm Futures’ January 2022 and March 2022 farmer surveys suggested high input costs led to acreage decisions as early as Christmastime 2021.

Historic acreage shift

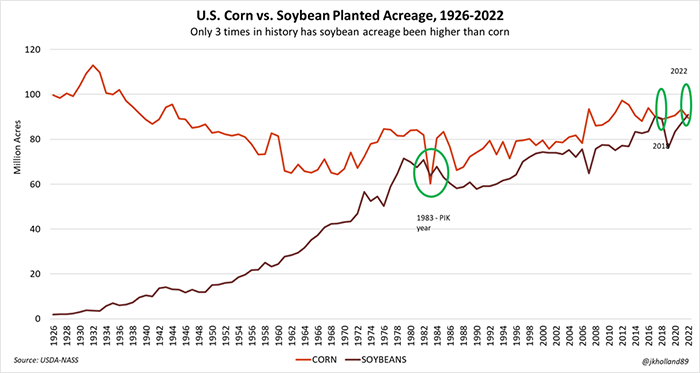

For only the third time in U.S. history, farmers are going to plant more soybeans than corn in 2022. USDA’s prospective plantings report found soybean acreage will rise 4% from last year to 90.955 million acres – beating the previous record high set in 2017 of 90.2 million acres. High input costs and lucrative profit opportunities from alternative crops, especially in regions outside or on the fringes of the Corn Belt, likely contributed to the acreage switch.

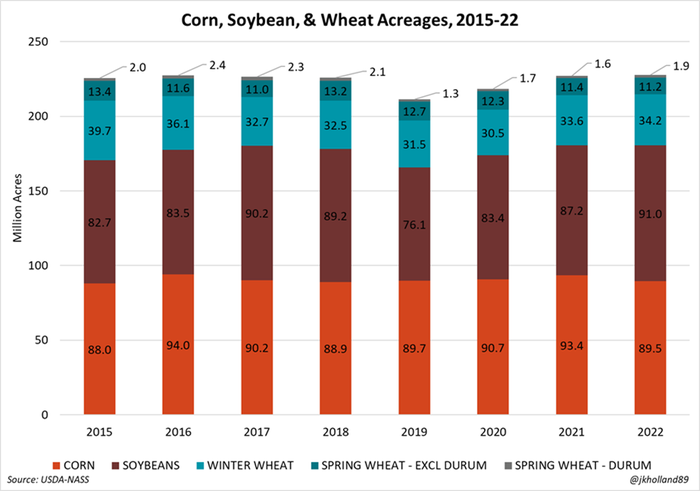

Growers are expected to plant 3.9 million fewer acres of corn this spring. The 2022 projection of 89.5 million corn acres will be the smallest corn crop since farmers planted 88.9 million acres in 2018. Assuming trendline yields of 181.0 bushels per acre, the 2022 crop could rise to 14.8 billion bushels – the third-largest corn crop in U.S. history.

Potential pricing considerations

Farm Futures’ balance sheet calculations project a conservative 2022/23 corn stocks-to-use ratio of 8.6%, which if realized will be the seventh tightest U.S. corn supply on record. That bullish prospect fueled Chicago Board of Trade corn futures prices for 2022 crop contracts to 3.5%-4.3% gains in the report’s aftermath on Thursday.

A record soybean sowing will inevitably lead to a record soybean crop if trendline yields are realized this year. At 90.2 million acres and 51.5 bpa yields, the 2022 soybean crop will eclipse last year’s high (4.4 billion bushels) to a record-setting 4.6 billion bushels.

But amid South American crop shortfalls, tight global edible oil supplies, and an expanding biodiesel industry at home, the extra bushels won’t completely eliminate supply worries. Even though soybean prices fell after the report’s release, the 2022/23 soybean stocks-to-use ratio is only projected by Farm Futures to rise 1.7% to 8.2% – the 25th tightest soybean supply on record.

The cut to corn acreage will result in a combined corn and soybean planted acreage of 180.4 million acres, just a hair behind last year’s record-setting high of 180.6 million acres.

My takeaway: Corn and soybean stocks are going to remain tight for another year, which means farmers should be able to grab strategic revenue opportunities to offset higher input costs (fuel, fertilizer, chemicals, labor, etc.).

Demand for virtually all grains and oilseeds on the global market continues to soar to unprecedented levels, so even if extra acreage is gained for one crop in USDA’s June 2022 acreage report, prices aren’t likely to take a significant hit. One commodity’s loss is another’s gain, as illustrated so clearly in yesterday’s reports.

The bulls settle in for wheat acres

As our team predicted, soaring input costs will limit upward acreage expansion – particularly for spring wheat. USDA’s cuts to 2022 spring wheat reaffirmed that estimation with its 5% annual cut to 2022 spring wheat acreage, leaving it at 11.2 million acres for the year.

USDA slightly trimmed previous estimates for winter wheat acreage, though total planted wheat acreage is expected to rise to 47.4 million acres – a four-year high. That will add some breathing room to 2022/23 U.S. wheat stocks, especially if feed usage creeps lower and global buyers find an alternative – and cheaper – substitute for Black Sea wheat.

Wheat futures largely had these sentiments priced in prior to the report’s release, though the spring and winter wheat acreage cuts most benefited Kansas City hard red winter wheat and Minneapolis spring wheat futures in the Thursday afternoon trading session following the reports.

Markets are going to reward growers who took a chance on winter wheat and soybean double-crop rotations this year. And even though spring wheat acreage is contracting in 2022, expect Minneapolis futures to maintain their premium over Chicago and Kansas City wheat prices especially if dry weather continues to plague prime spring wheat-growing areas.

Where did all these acres shift?

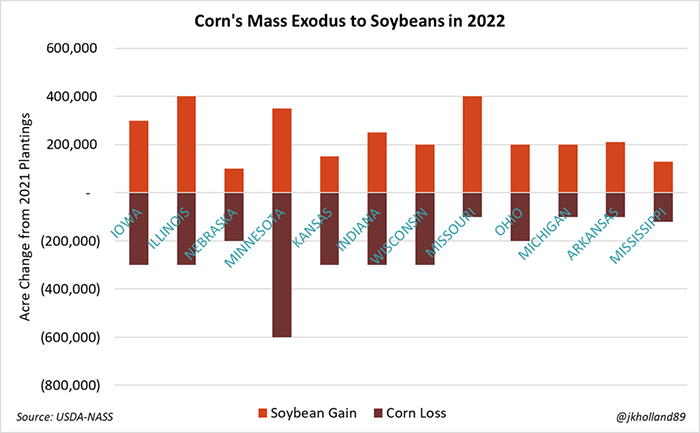

Somewhat surprisingly, the mass exodus of corn acres to soybeans occurred in the heart of the Corn Belt. The top three corn producers Iowa, Illinois, and Nebraska combined to shift 800,000 2021 corn acres into soybeans for 2022. Minnesota gave up a staggering 600,000 2021 corn acres to soybeans, among other crops.

But it was the acreage switches in states on the fringes of the Corn Belt that comprised the rest of the acreage shift. Arkansas and Mississippi also joined the fray. In all, 14 states saw corn acreage reductions of 100,000 acres or more from 2021 plantings.

To that end, North Dakota surprised me the most this year, forsaking corn, soybeans, and especially spring wheat acres in favor of other crops. Canola, sunflower, flaxseed, lentil, dry edible pea, durum, and barley acres replaced those of the big three this year. This perfectly illustrates the market dynamic of competitive alternative crops and high input costs for corn and wheat.

Expansion plans…thwarted?

Combined acreage for the three crops totaled 227.8 million acres. It is the seventh-largest combined acreage for corn, soybeans and wheat, surpassing last year’s total by 541,000 acres thanks to expansions in soybean and winter wheat.

But total crop acreage didn’t expand by as much as analysts predicted.

As I noted in the North Dakota case, high input costs for crops like corn and wheat and other supply chain concerns incentivized growers across the country to take advantage of revenue streams in the form of alternative acreage via small grains. Cotton and soybean acreage also expanded in the South as growers largely shunned corn and sorghum feedstuffs for 2022.

Sunflower acreage rose 10% in response to tight global edible oil supplies while top producer Ukraine’s crop remains in limbo amidst the Russian invasion. Barley sowings are also expected to rise 11% this year to compete with high prices in the wheat complex.

But despite the pre-report trade guess that total principal acreage would see a massive expansion in 2022 due to lucrative commodity prices, the cost factor likely played a crucial role in preventing more acres from coming online this year. To be sure, at 317.4 million acres, 2022 principal crop acreage exceeded that of 2021 by 214,000 acres, but that only represents a fractional 0.07% shift from last year.

Quarterly Grain Stocks

There really weren’t any surprises on the Quarterly Grain Stocks side of Thursday’s reports. USDA’s volumes were reported largely in line with pre-trade analyst estimates.

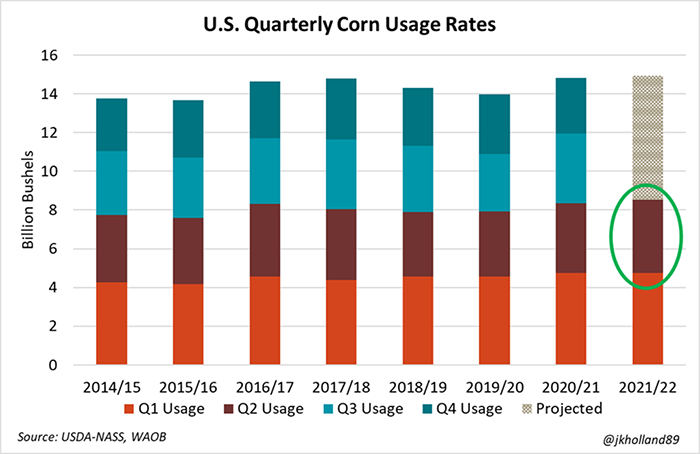

Corn was the biggest star in this realm, however. At just shy of 3.8 billion bushels consumed between Dec. 1 and March 1, this volume beat out its 2016/17 counterpart (3.76 billion bushels) as the largest second-quarter corn consumption rate on record due in large part to ethanol’s resurgence amid strong consumer demand and rising fuel prices.

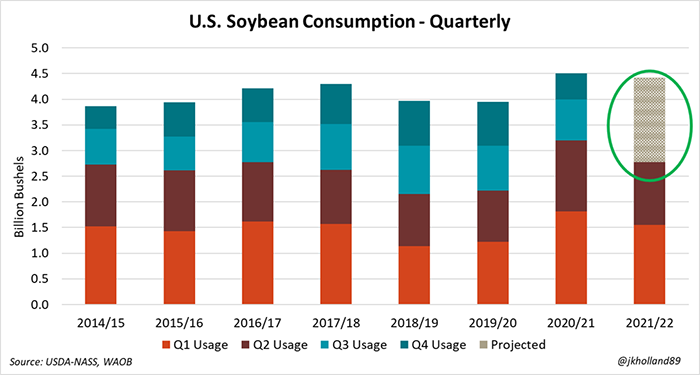

Soybean usage rates for the December – February period were a moderate 1.22 billion bushels. That volume came in on the lower end of the pre-report estimate spectrum though is likely reflective of slower Chinese buying paces.

But here’s the silver lining for anyone who may be fretting after yesterday’s soybean selloff from the 2022 U.S. acreage boost: approximately 37% of 2021/22 supplies will be used in the second half of the current marketing year. That is an uptick from the same time last year and a reversion back to more typical soybean market behaviors.

In short, the higher demand rates for soybeans this spring and summer mean that farmers could see some lucrative cash opportunities for soybean stocks that may still be in storage.

We knew coming into the reports that wheat supplies were going to be low because of last year’s spring wheat crop shortfalls. But we are also starting to see some diminished usage as high prices create buyer resistance. Plus, USDA had already indicated in the March 2022 World Agricultural Supply and Demand Estimates report that wheat growers have already sold most of their 2021 wheat crops.

Even though the price effects were largely overshadowed by 2022 acreage intentions yesterday, the stocks report signaled bullish price prospects for corn and bearish signals for wheat. I took the soybean readings as largely neutral though as it seems likely there will be additional demand opportunities for the soy complex in the second half of the 2021/22 marketing year.

About the Author(s)

You May Also Like