April 18, 2023

With big USDA reports in the rear view mirror there are a lot of moving pieces now to watch in the corn market. Not surprisingly, weather may be the most important, so let’s start there.

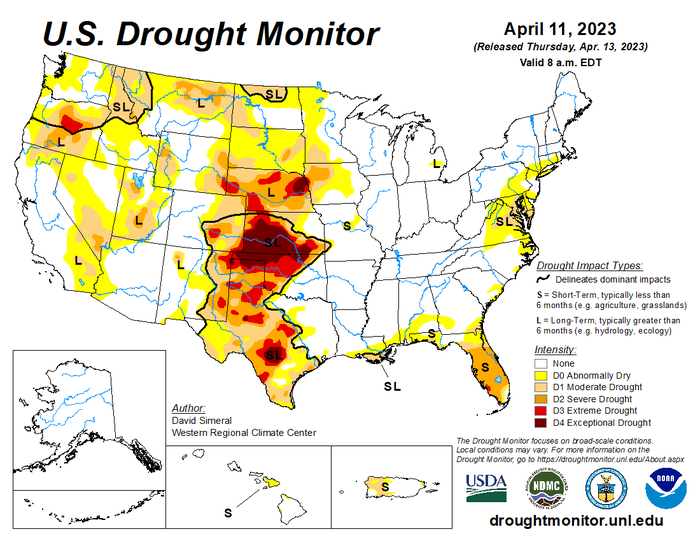

As we roll into mid-April, U.S. weather becomes a big factor to market direction. Traders are watching the Northwest Corn Belt to see how fast the snow melts and what temperatures will do going forward. How long will cool and wet conditions last there, and how will that impact planting?

We also need to look at the continued drought in Western Corn Belt. How fast we get the crop planted, and how timely the rains are, will go a long way in determining market direction. Expect plenty of volatility and sudden changes to market direction, based on weather forecasts.

Supply

For a closer look at supply let’s go back and look at USDA’s March 31 Stocks report. While the overall corn supply is down from last year, corn still on farm is higher. Obviously, the areas affected by drought have lessened compared to last year, but there are several states with more corn on farm today than last year. The Eastern Corn Belt as a whole has 8.2% more corn on farm now vs. last year. If we took Wisconsin out of the total, the percentage jumps to 11.1% more. Missouri, Minnesota, and South Dakota have a combined 13.5% more corn on farm than last year.

This is important because that corn will eventually get sold into the market. Why hasn’t it been sold already when we have very strong basis and no carry in the market? Most likely cause is that the flat price of corn simply hasn’t worked higher since harvest. We have seen a strong rally in soybeans since harvest, and farmers have done a good job of selling beans. They have cash, and likely don’t feel rushed into selling corn at or below the harvest price.

That corn will get sold at some point though. I also feel like if they still have corn from the 2022 crop, they likely don’t have much of any corn sold for the 2023 crop. This alone will eventually put pressure on the market.

Brazil’s corn crop

Another factor to watch is the safrinha corn crop in Brazil. As a whole, they have had some very good weather. The total corn crop in Brazil could be 10% bigger than last year. If this happens, they will compete with the U.S. for world exports and that can affect our demand well into this coming winter.

U.S. planting progress

On paper today, the U.S. intends to plant 92 million acres of corn. With a trendline yield, the prospects are for ending stocks to be 1.8 to 2.0 billion bushels. This alone will make it hard for the market to rally unless weather affects this scenario. Couple that with farmers that still have ‘22 crop to sell and a bigger Brazilian crop, and you can see why it may be tough to rally.

The unknowns

There are other things that can and will affect the market. We have to look at Ukraine and the size of its corn crop for 2023, and if the export corridor stays open in the Black Sea. That being said, it sure looks wise to have a floor in place going forward so you are protected if we go higher. You need that because this is likely the most expensive corn crop you have ever planted.

Most producers can’t afford to see this market fall. However, the U.S. crop isn’t made yet and you have to be prepared for higher market. Using options will help you establish a floor and keep the upside open.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like