Wheat futures have raced higher once again in recent days with the March Chicago, Kansas and Minneapolis contracts all gaining nearly fifty cents in just one week’s time. Buyers have emerged as global weather patterns for major wheat growing areas around the world show signs of struggle for fragile wheat sitting in winter dormancy. Funds have been lifting some short positions and new buyers are beginning to emerge.

Here are three factors to watch to see if wheat can make a run this year:

The threat of smaller U.S. crops

While the February USDA report was slightly bearish versus pre-report expectations, the reality remains that U.S. ending stocks are still snug compared to year-ago levels.

U.S. wheat ending stocks are now pegged at 648 million bushels, up from 628 million bushels on last month’s report. While higher than trade was expecting, this will be the lowest ending stocks in the last 8 years.

Ending stocks were at 845 million bushels in the 2020-2021 crop year, and at 1,028 million bushels in the 2019-2020 crop year.

Traders seem to have one eye on USDA data, and the next eye on weather conditions in the Plains as the winter wheat crop rests in dormancy.

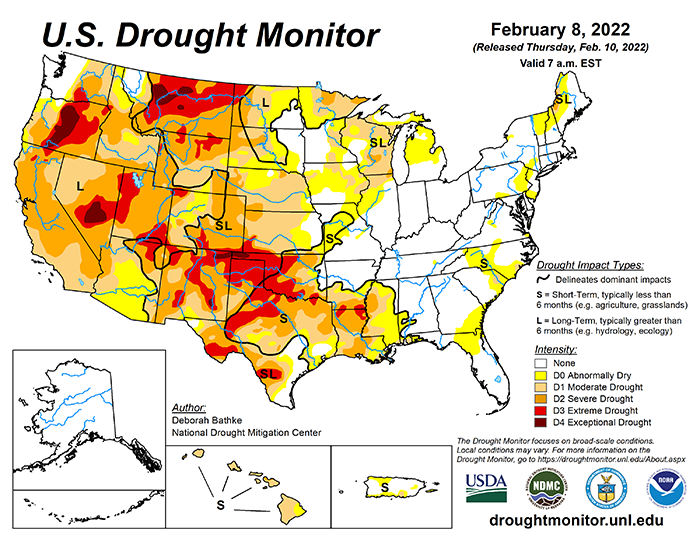

The Plains are depleted of soil moisture with recent snows not doing much to quench thirsty soil conditions. According to USDA’s National Agricultural Statistics Service, the Kansas winter wheat crop is rated at 30% good to excellent, 39% fair and 31% very poor to poor.

Other states’ wheat crops fared worse: good-to-excellent ratings were pegged at 16% in Oklahoma, and 20% in Colorado. The next crop progress and condition report is scheduled for Feb. 22.

Global wheat demand is growing but the wheat crop is not

Earlier this week Stats Canada released its wheat crop stocks estimate. For the Dec. 31 Canadian stocks report, total wheat stocks came in at 15.564 million tonnes as compared with trade expectations for stocks near 17.3 million tonnes. This is 37% below the five-year average of 24.9 mmt, and is the smallest Canadian all-wheat stocks estimated since December 2002!

On the February USDA report, global wheat ending stocks are now 278.2 million metric tons, down from 279.95 mmt last month. Smaller crops in both Canada and Argentina were the culprits for the lower ending stock number. In addition, USDA raised world wheat demand by 2.5 mmt.

Keep your eye on world weather and geo-politics

Dry weather in the U.S. Southern Plains, as well as expanding drought in northern Africa is on traders’ minds. Now that the report is “old news” these weather factors will become more prevalent.

There is not much to report on the Russia-Ukraine situation (though it is far from over at this point). Ukraine ranks eighth in world wheat production. Also, the world wonders what China might be up to once the Olympics are complete.

Short term resistance on the March 2022 Chicago wheat contract is at $8.00, with next resistance at $8.25. One could argue that if corn and soybean futures continue higher, that $9.00 futures may be achievable yet this spring, especially if fund traders continue to exit short positions, and decide to go long -- especially if the U.S. winter wheat crop conditions show little improvement on Feb. 22.

These are historic times

As I have been talking about for months, there are nine grain and oilseed commodities that have tight ending stocks. That by itself, merits support for grain prices. But add to it inflationary concerns, and there is a potential recipe for even higher grain and oilseed prices in the future.

Wheat has been quiet lately and just might be the dark horse to watch coming down the home stretch.

Reach Naomi Blohm: 800-334-9779, Twitter: @naomiblohm and [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

About the Author(s)

You May Also Like