USDA’s Illinois Department of Agricultural Market News Service released updated bi-weekly retail costs for crop inputs across the state last Thursday. Illinois is the country’s largest soybean and second largest corn producer – a key consumer of fertilizer products.

But unlike previous weeks, prices for all products measured by the dataset skyrocketed considerably over the past two and a half weeks. The ongoing supply chain narrative is largely to blame.

A combination of surging seasonal demand, tight global supplies, and backlogs in production schedules continue to drive prices higher. Here’s a look at what to expect from the fertilizer market in the coming weeks.

How did we get here?

China took more definitive action over the past two weeks towards restricting its own phosphate and urea exports in an effort to ensure domestic supplies.

China is the world’s largest producer of phosphate. Few of its supplies are exported to the U.S. But amid geopolitical discourse between the U.S., Russia, and Morocco, the global customers that purchase some 30% of China’s phosphate production are now direct competitors with the U.S. for what dwindling phosphate supplies remain available across the rest of the world.

And global trade flows have not yet recalibrated in the U.S.’s favor for the phosphate (the ongoing 2020 tariff dispute with Russia and Morocco), UAN (new this summer – a tariff dispute with Russia and Trinidad and Tobago), and potash (the U.S. levied economic sanctions on the country this year following the government’s inhumane treatment of political dissenters) markets.

Trade rumors suggest that the U.S. has been booking phosphate shipments from Russia and Morocco recently, with buyers paying both countries for the tariffs simply to ensure adequate supplies. While that could provide some price relief for farmers, until the tariff situation can be successfully absolved, farmers will continue to be subject to extreme price volatility in the phosphate markets.

A massive global acreage expansion sucked up what excess supplies were available over the past year and production has not been able to keep up. China will produce 5% more corn and 2% more soybeans this year as its government doubles down on increasing acreage to ensure domestic food security.

Brazil farms are expected to use 43.8 million tonnes of fertilizer in 2021 as the South American country continues to grow its row crop acreage, an 8% annual increase and a new record high. Brazil is likely to plant 200 million acres of corn, soybeans, and cotton by 2030.

The U.S. barely planted 192 million acres of those three crops this year. For corn and soybeans, that was a 4% acreage increase from last year. And with more acres of corn, soybeans, and wheat expected next year according to the August 2021 Farm Futures survey, demand for fertilizer is not going to relent in the next year.

With harvest and fall application in full swing across the entire Northern Hemisphere right now, that seasonal pressure on fertilizer supply chains has only been intensified amid the backdrop of ongoing issues.

The energy conundrum

But the chief driver of the blistering uptick in fertilizer prices has been the global energy crunch. Last Wednesday, natural gas futures prices traded 33% higher than two weeks prior before Russia announced it would increase production to stave off a complete energy crisis for Europe. Wednesday’s high matched natural gas prices not seen since December 2008.

Natural gas futures dropped $0.689/mmBTU (11%) between last Wednesday and Friday but remain at an eight and a half year highs. Natural gas is the primary fuel source for fertilizer plants across the world and is a key ingredient in anhydrous ammonia production, so its rally amid dwindling global energy reserves is having noticeable impacts at the farmgate.

Flooding at Chinese coal mines has further tightened fuel supplies in the world’s second largest economy amid ongoing energy shortages. Factory production – including that of fertilizer producers – was halted in China a couple weeks ago in an effort to conserve energy supplies. That will ultimately constrict fertilizer supplies destined for both Chinese and Brazilian farmers.

Brazil has already faced fertilizer shortages in the wake of China’s plant closures and fertilizer export restrictions as well as sanctions Brazil also levied against top potash producer Belarus. Potassium-based fertilizer prices in Brazil are 200% higher than last year and delivery delays are already causing concern for smaller and late-planted soybean crops.

In the U.S., Hurricane Ida significantly altered production schedules and output at several key petrochemical and fertilizer processing facilities across the region. Seed reps I have spoken with recently are concerned about being able to source their growers enough glyphosate next spring after Bayer’s Louisiana plant shut down in the aftermath of Ida.

Across the Gulf, fertilizer production has already been struggling to return to scheduled output levels after the February cold snap also shut down production amid natural gas shortages. Limited barge availability at the Gulf this fall also contributed to higher shipping costs and additional delays.

With a cold winter forecasted in the Northern Hemisphere and OPEC reluctant to increase oil production in response to the urgent expansion signals, it does not seem likely that global energy output will be able to keep up with rising demand as the increasingly vaccinated world emerges from the pandemic. Farmers should expect to see a continuation of higher fertilizer and energy prices in the months to come as a casualty.

The fallout

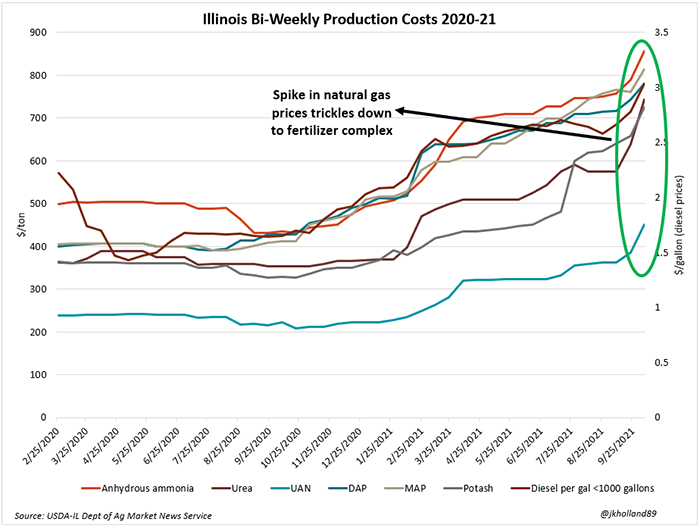

So, it should come as no surprise that last Thursday’s report from the Illinois USDA shows staggering increases for all fertilizer products used across the Corn Belt, as illustrated below. The price index for the bundle now stands over double the cost of prices from last year.

Most notably, anhydrous prices are quoted 97% higher than the same time a year ago when global supplies were plentiful. Urea prices saw the largest weekly jump this week on China’s export restrictions. UAN prices are twice the price of a year ago as the nitrogen complex bears the brunt of the recent natural gas price rally.

Phosphate prices have more than doubled in the past year. And dwindling potash supplies amid geopolitical tensions with Belarus have sent farmgate prices in Illinois 2.2 times higher than prices this time last year. In fact, since July 1, potash prices have risen 55%.

Farm Futures Contributing analyst Bryce Knorr predicts these increases could erode up to $0.35/bushel from 2022 operating margins. Ongoing supply chain issues are likely to prevent input prices from abating anytime soon.

Fertilizer production slowed in the Gulf over the past month after Hurricane Ida knocked power out at many processing facilities. And pandemic-induced closures at fertilizer plants across the world this year has limited global fertilizer production expansion, even though the price signals are coaxing fertilizer producers into increasing output.

USDA found more 2020/21 crop corn and soybean supplies in last week’s Quarterly Stocks report. And with increasing chances of higher 2021 corn and soybean yields, the swelling supply forecast could place a ceiling on 2022 revenue expectations after today’s WASDE report.

Paired with this latest sharp rise in input costs, operating margins at the farmgate will likely be pressured as fall application season ramps up. If you haven’t spoken to your ag retailer about 2022 input supplies, I would recommend doing so soon. And then call your broker to book 2022 sales to pay for it before USDA updates supply numbers in today.

About the Author(s)

You May Also Like