December 20, 2021

As we approach the end of one year, it is good to reflect on what has transpired over the last twelve months while at the same time look forward to the next year with the hopes and challenges that are on the horizon.

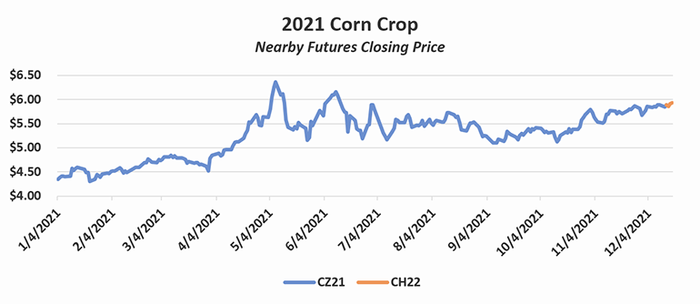

To start off, let’s reflect on what prices have done over the past year. Corn futures for the 2021 crop started off the year at $4.35. The closing futures hit a high of $6.37 in early May, dipped back down towards $5.10 in early September and have now found their way back up towards that $6.00 mark.

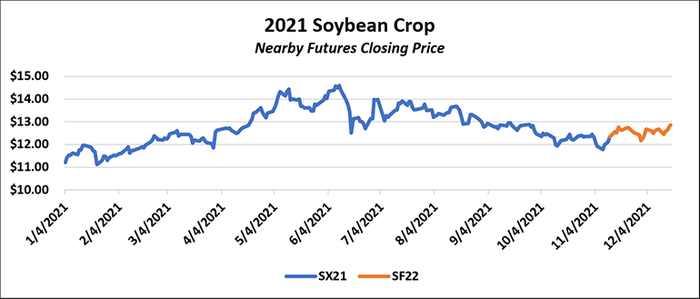

Soybean futures for the 2021 crop year started off at around $11.20. They hit a closing high of around $14.60 in June, retreated below the $12.00 mark in October and November and now have risen back up towards $13.00.

With lower production costs on the 2021 crops, we have had ample opportunities to sell at profitable levels this year. Considering we have struggled for multiple years to stay much above $4.00 on corn and $10.00 on beans, we can truly be thankful for selling opportunities at profitable levels.

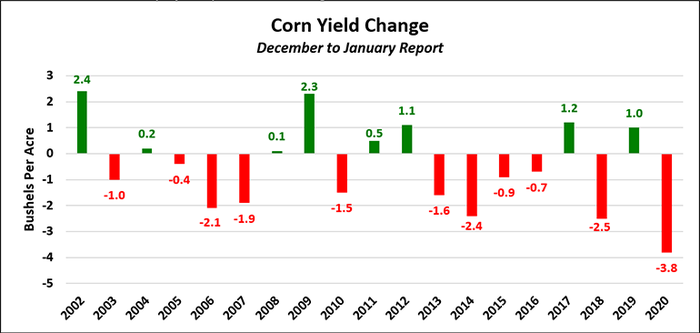

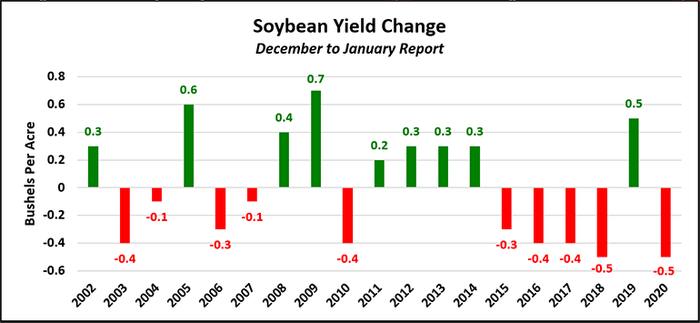

Turning our heads towards the horizon, we have a couple big milestones in the near-term future to look at that will have an impact on the year in front of us. The first is the January crop report where the USDA will make their final estimate on the yield for the 2021 crop year. Historically there have been sizable changes in the yield estimates from previous crop reports.

The chart below shows the change in the corn yield from the December to January crop reports. The average yield increase over this time has been around 1.1 bushels per acre and the average decrease has been 1.7 bpa. Applying that average increase/decrease against the USDA’s current harvested acres could mean another 100 million more bushels of corn production or around 150 mllion bushels less. You can see in some years these increases/decreases have been in the 2-3 bpa range which would further amplify the production change.

Soybean yield changes, while historically not as large as the corn yield changes from December to January, can still have a positive or negative effect on prices when coupled with demand changes. The average increase to soybean yields has been around 0.4 bpa and the average decrease around 0.3 bpa.

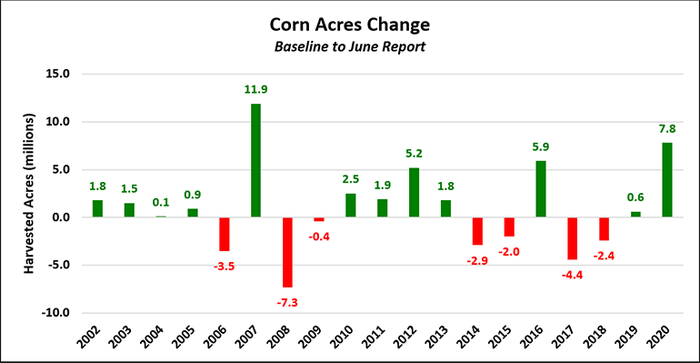

After the January crop report, more and more attention will be focusing on the acres for the 2022 crop year. Below is the change in the harvested corn acres from the baseline acres estimate to the June planted acres report. The average increase in corn acres is around 3.5 million with the average decrease at around 3.2 million. Using a yield of around 180 bpa, that could mean another 600 bushels more of production or 600 million less.

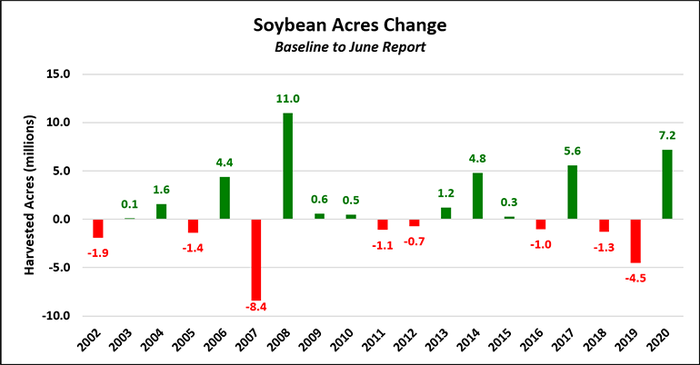

Soybean harvested acres have an average increase of around 3.4 million acres and an average decrease of 2.5 million acres. Applying a yield of around 50 bpa, that could mean another 150-200 million more bushels or 100-150 million less bushels.

To summarize, we have just gone through a very exciting year. We have enjoyed higher prices that likely translated into better selling opportunities and improved balance sheets. There are a lot of moving pieces for the next crop year that include higher input costs, questions on where planted acres are going to go, what demand for our crops is going to look like, and a host of other items that I haven’t mentioned or that we can’t see coming around the corner. What we do know is that Dec22 corn is trading around $5.50 and Nov22 beans are trading around $12.50. Historically these have been very good prices.

What we want to avoid is having a great year like 2021 and then see a market decline in 2022 that causes us to give back a lot of the profit we made last year. There are ways to position yourself to avoid that scenario. Find someone who can help position you to protect that balance sheet if prices go down yet maintain flexibility for higher prices. A good plan doesn’t have to be complicated. Take that first step and get your plan created for 2022.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like