August 31, 2022

For cattle producers reliant on perennial grass pastures, 2022 has been a challenging year. Almost half of the pastureland in Nebraska was rated as being in very poor condition, with another quarter of it in poor condition as of mid-August.

Drought conditions were prevalent across much of Nebraska in 2022, and cattle producers were facing difficult decisions in late summer with access to little or no grazing forage within a reasonable distance of their operation.

Of course, low precipitation and poor pasture conditions raise interest in drought risk management planning. However, for many producers, there are not a lot of options when the drought is as bad and as widespread as in 2022.

Drought risk management planning requires a strategic approach because it is difficult to predict pasture production beforehand for any given year, and once poor conditions materialize, many of the best options to mitigate the problem become too expensive or impossible to implement.

One tool available to livestock producers to transfer some of the risk of drought outside the operation is Pasture, Rangeland, Forage insurance, but it is a tool that takes a strategic approach.

PRF coverage

PRF insurance coverage is available on a calendar year basis with a sign-up deadline of Dec. 1. For coverage in 2022, producers had to sign up for PRF by Dec. 1, 2021. At this point, many people are thinking of implementing PRF as a part of their drought risk management strategy for the 2023 calendar year. PRF insurance is administered by USDA’s Risk Management Agency (RMA) and is available for purchase from local crop insurance agents.

PRF insurance is a single-peril, index-based insurance. It uses precipitation data from the National Oceanic and Atmospheric Administration Climate Prediction Center to provide insurance based on grids 0.25 degrees longitude by 0.25 degrees latitude, or about 16 miles by 12 miles in Nebraska.

If precipitation falls below the insured coverage level, the producer receives an insurance indemnity payment for the productive value of the difference. The insurance provides coverage across producer selected two-month intervals dispersed throughout the calendar year.

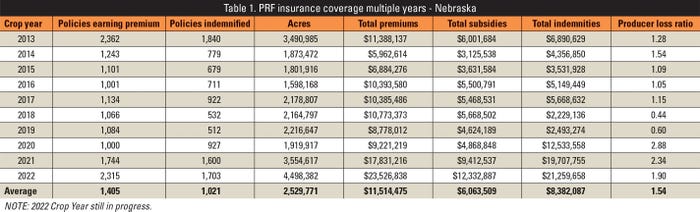

Usage of PRF insurance in Nebraska has more than doubled in the past three years (Table 1). Low precipitation in 2020 resulted in almost 93% of the policies receiving an indemnity and a producer loss ratio of 2.88, meaning the dollars paid out in indemnities exceeded the dollars collected from producers in premiums by a factor of 2.88.

Similar results followed in 2021, and we now see almost 4.5 million acres insured with PRF in 2022. This represents a record high for Nebraska. About halfway through the year, indemnities in 2022 already exceeded those paid out in 2021.

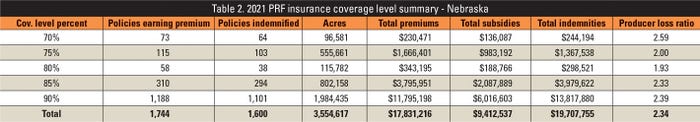

Producers select coverage levels from 70% to 90% of normal precipitation when purchasing PRF insurance. Most producers insure at the 90% level (Table 2). However, overall loss ratios are similar regardless of coverage level chosen because premiums charged are required to be actuarially sound.

The premium subsidies range from 51% to 59% as coverage levels go down. Some people insure at lower coverage levels, willing to trade off the lower indemnity expectations for lower premium charges.

For example, the average producer premium per acre for the 70% coverage level was $0.98 in 2021 versus $2.91 for the 90% coverage level. Of course, location and months insured also affect premium rates.

Ways to use PRF

Strategies for months insured vary by producer. Some prefer to target specific two-month intervals with a majority of the coverage. Producers can put up to 60% of the dollar value of coverage in a single two-month interval. Other producers prefer to spread the coverage evenly throughout the year, increasing the chance at least some indemnity will be paid.

PRF insurance use continues to grow in Nebraska. The past three years, it has provided significant financial compensation to producers to alleviate some of the negative impacts of drought. Strategic use of PRF involves selecting coverage levels, months to insure, and acres to insure with a plan in mind of how you want the product to work for you.

Tools are available on the RMA website, rma.usda.gov, to explore various coverage options. PRF is purchased through crop insurance agents who can help with formulating strategies that match your risk management needs.

Parsons is a farm and ranch management specialist at the University of Nebraska-Lincoln.

You May Also Like