Over the last few years trade news has been all over the place, especially under the new U.S. administration that has somewhat changed the way the U.S. addresses trade.

To illustrate, the U.S. withdrawal from the Trans-Pacific Partnership (TPP), renegotiation of NAFTA now United States-Mexico-Canada Agreement, tariffs on steel and aluminum, back and forth tariffs with China, Mexico, Canada and the European Union (EU-28), and partial trade agreement with Japan to name a few. Almost every day there seems to be news related to trade.

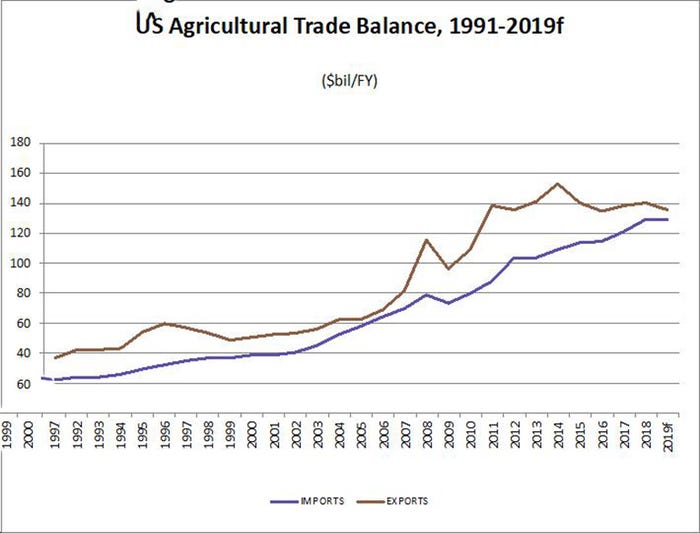

Given the U.S. is the largest agricultural exporter in the world, $139.6 billion in 2018, anytime there is a trade disruption of some sort U.S. farmers are affected, often negatively. Even though many of the trade issues have not been resolved yet, i.e. USMCA has not been ratified by the U.S. Congress as of this writing, and there’s still much uncertainty, there seems to be a gleam of hope that some of the major current trade issues might get resolved, at least partially.

Congress might get to vote on USMCA in the near future. Given that, as with its predecessor NAFTA, it proved to be positive for all member countries. There is no question that USMCA is an overall upgrade to NAFTA.

The agricultural provisions, especially for southern states, has few changes. The question is how big of an upgrade and was it worth it. Time will tell.

OTHER TRADE AGREEMENTS

The U.S. and China has reached a tentative partial agreement to cool down the trade war between both countries, especially for pork because of the Chinese African Swine Fever outbreak.

There is not much information yet on what is exactly in the partial agreement, but U.S. agricultural exports could be a big winner with increases to up to $50 billion worth of agricultural exports to China. However, the devil is in the details and there is not much details on it yet. China stalls on wanting fewer U.S. tariffs, while the U.S. wants more protection of intellectual property rights.

The U.S.-Japan first-stage initial trade agreement could provide U.S. producers enhanced market access to our third largest agricultural export market. When implemented, the agreement will enable U.S. producers to compete more effectively with countries that currently have preferential tariffs in the Japanese market.

The agreement comes in at a very important time given that the U.S. pulled out of the TPP agreement, now CP-TPP, and will match the tariffs that Japan provides preferentially to countries in the CP-TPP.

EXPECTATIONS

Under this agreement, Japan will eliminate or reduce tariffs on $7.2 billion of U.S. food and agricultural products such as fresh and frozen beef and pork, almonds, berries, nuts and grain sorghum among others.

U.S. agricultural exports are projected to reach $139 billion in 2020, up $2.0 billion from the August forecast for 2019. This increase is primarily driven by higher exports of pork, beef, soybeans, dairy and horticultural products.

U.S. agricultural imports in 2020 are forecasted at $132 billion, up $3 billion from the August 2019 forecast primarily due to expected increases in fresh fruits and grain products.

The U.S. agricultural trade surplus is expected to increase by $2.5 billion in 2020 to $7 billion.

About the Author(s)

You May Also Like