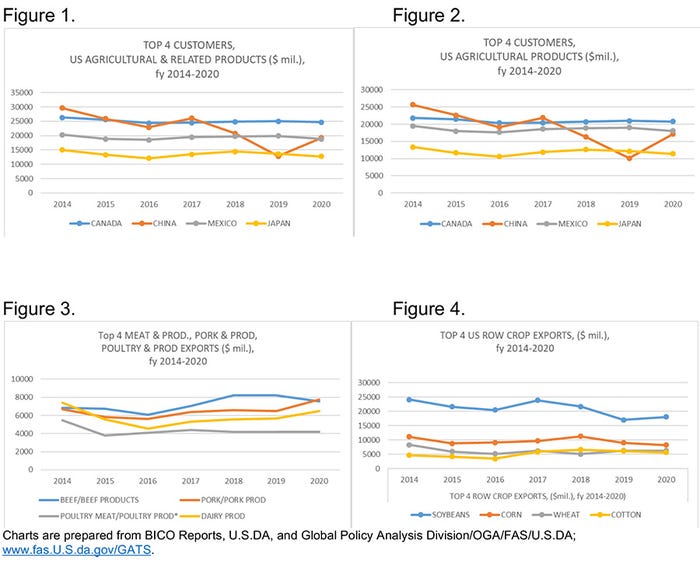

If there was one thing President Trump excelled at with respect to trade, he was the Disruptor-in-Chief, sometimes bordering on chaos. Hopefully, President-elect Biden will be looking to be a stabilizer for trade opportunities. In the first few years of his presidency, Trump announced he was terminating, or re-negotiating several major trade agreements with our top trade partners. Make no mistake, there is money to be made in the high-risk world of chaotic trade uncertainty and hoping that the other side will blink first. However, the passage of the U.S. Mexico Canada Agreement (USMCA), a trade agreement with Japan, and the signing of the Phase I agreement with China will hopefully help restore confidence and lead to more stability in markets.

If there was one thing President Trump excelled at with respect to trade, he was the Disruptor-in-Chief, sometimes bordering on chaos. Hopefully, President-elect Biden will be looking to be a stabilizer for trade opportunities. In the first few years of his presidency, Trump announced he was terminating, or re-negotiating several major trade agreements with our top trade partners. Make no mistake, there is money to be made in the high-risk world of chaotic trade uncertainty and hoping that the other side will blink first. However, the passage of the U.S. Mexico Canada Agreement (USMCA), a trade agreement with Japan, and the signing of the Phase I agreement with China will hopefully help restore confidence and lead to more stability in markets.

U.S.-China Phase I

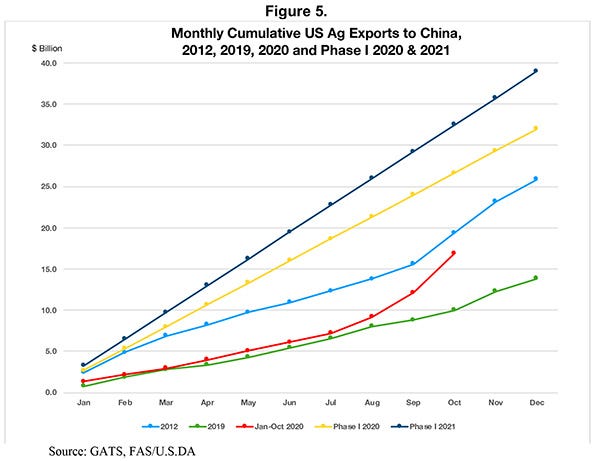

U.S. exports to China from January to October 2020 reached $16.9 billion, a 69% increase during the same period last year. Overall, China is the third-largest market for U.S. commodities, but number one destination for pork, soybeans, sorghum and cotton, and second-largest market for poultry in 2020 through October. Although year over year U.S. exports to China has been higher, with October sales reaching almost $4.8 billion, they still account for 63% of the agreed amount for 2020 under the Phase I agreement. Figure 5 shows monthly cumulative amount of U.S. exports to China for 2012, 2019, 2020, and Phase I 2020 and 2021. U.S. exports to China in 2012 were the largest amount exported ever, around $26 billion, while Phase I 2020 and 2021 amounts were agreed at $32 and $39 billion, respectively. The red line represents 2020 exports through October and is well above 2019 exports (green line), but still below 2012 and well below Phase I numbers. There is some seasonality on U.S. exports to China, where exports increase above the normal trend around August and September through the end of the year and 2020 exports were not the exception, especially the last couple of months, so hopefully, they are a good sign of things to come towards the end of 2020 and into 2021.

U.S. Mexico Canada Agreement (USMCA)

While there were gains in the non-agricultural provisions, dairy and poultry provisions between Canada and the U.S., and some for biotechnology, very little changed for agriculture between the U.S. and Mexico. Canada and Mexico continue to be the top agricultural export markets for the United States. That will continue until the agreement with China settles into something both countries can rely upon, and in which consumers can have confidence. While the USMCA is only two years old, its predecessor NAFTA has been around for more than 20 years and provided a strong foundation of familiarity with traders and consumers alike.

U.S.-Japan Agreement

Shortly after President Trump took office, another of the trade deals from which he withdrew the U.S. was the Trans-Pacific Partnership (TPP), again saying it was one of the “worst deals” the U.S. had gotten into. When it looked as if Japan and the UK were going to ink a trade deal that would effectively lock the U.S. out of free trade with the TPP-11 countries, the USTR completed negotiations with Japan that gave U.S. agriculture more market access to Japan’s market. It would also allow American producers to compete more effectively with the TPP-11 countries that have preferential tariffs in the Japanese market. U.S. products benefiting from tariff reduction include fresh beef and pork, and frozen beef and pork. Preferential market access will be provided through the creation of country-specific quotas for Japan to import specified quantities of wheat and wheat products and other products such as malt, glucose and fructose.

Source: is Oklahoma State University and Texas A&M University, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like