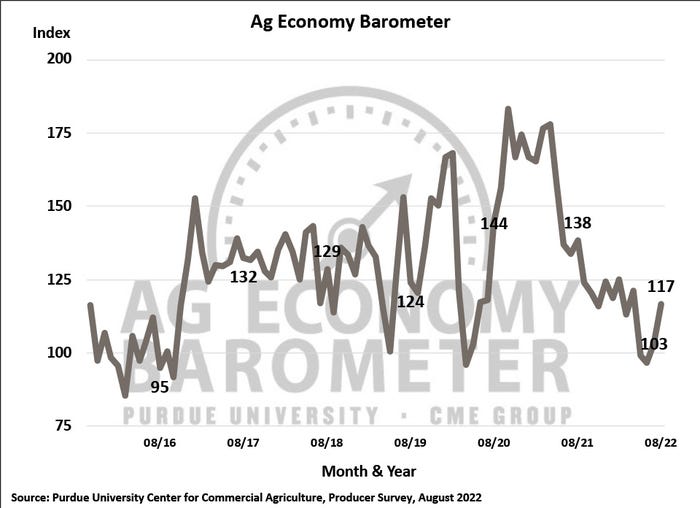

The Ag Economy Barometer improved in August to a reading of 117, up 14 points from the July reading. The rise in farmer sentiment stems from fewer worries about farm financial situations than last month.

Over the past two months, the Ag Economy Barometer has jumped 20 points. Despite the positive shift, the current reading is still 15% lower than this time in 2021.

Even though positive farm financial outlooks helped boost farmer sentiment in August, farmers show significant concern about how much it will cost to get their 2023 crop in the ground.

Farm finances

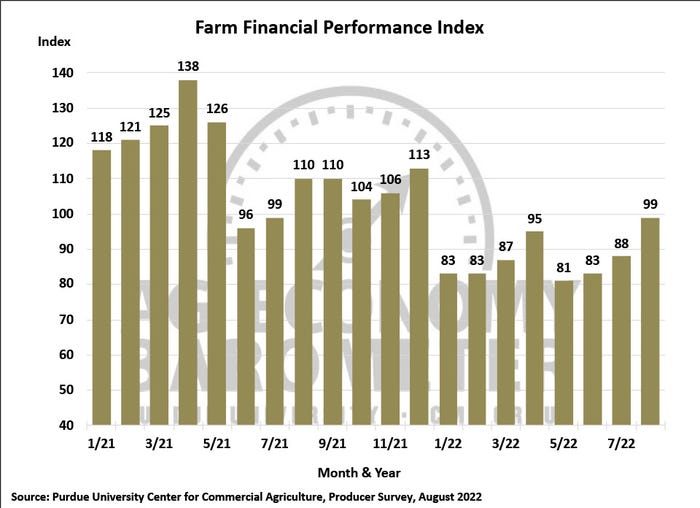

The Farm Financial Performance Index rose 11 points in August – the largest jump month-over-month jump seen in the past year.

Corn and soybean prices rallied from their July lows into mid-August. Compared to the prices at the time of the July survey, the August survey’s end date saw prices for fall delivery of soybeans about $1.50 per bushel higher, while prices for fall delivery of corn rose by about $0.25 per bushel.

The boost in commodity prices paired with an optimistic yield outlook explain the improvement in financial performance expectations.

2023 outlook

Farmers also expect improved financial performance next year. Survey respondents were more optimistic about the U.S. agricultural economy as a whole in the upcoming year.

It comes as no surprise that the majority of farmers say their biggest concern for next year is higher input costs. Other concerns included rising interest rates, input availability, and lower output prices.

When asked about price expectations for 2023 crop inputs, 60% of farmers expect to see price hikes compared to what they paid for the 2022 crop, and 28% of producers forecast prices rise by at least 10%.

Bad time for big investments

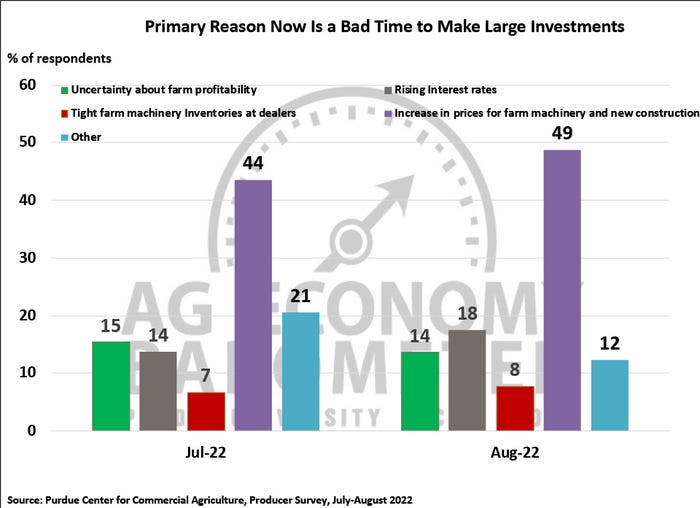

The Farm Capital Investment Index saw a slight rise of 3 points to a reading of 39 this month. The reading still pales in comparison to last year’s August reading of 53 and the 2021 August reading of 65.

Around half of producers say increases in prices for farm machinery and new construction are the primary reason to avoid large investments right now, while a fifth said rising interest rates are holding them back.

Despite the negative sentiment expressed about this being a bad time for large investments, the percentage of farmers who say they plan to reduce their farm machinery purchases has been declining since spring.

The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from August 15-19, 2022, which was after USDA released both the August Crop Production and World Agricultural Supply & Demand Estimates reports.

About the Author(s)

You May Also Like