November 17, 2022

Rising gasoline prices get the attention of every consumer. And those prices even influence how food buyers see costs in the future, influencing buying habits. Yet there’s some good news for the ethanol industry in a new report from the U.S. Energy Information Administration. The report shows that ethanol helped moderate fuel prices in the wake of the Ukraine invasion.

The EIA report shows that during the summer of 2022, the price of ethanol was lower than gasoline, which led to record-high ethanol blend rates buyers chose to fill their tanks. Part of that use of a higher blend of ethanol in gasoline was due to the emergency fuel waiver the Biden Administration granted in April. Without the waiver, according to EIA, E15 can’t be sold during the summer at retail stations in states with no reformulated gas program.

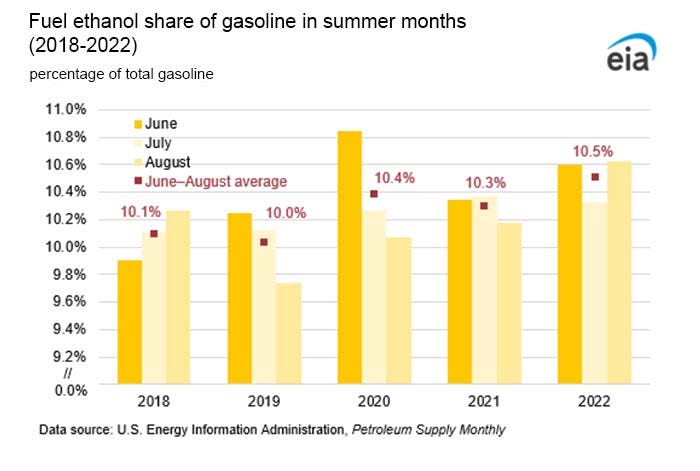

Most gasoline is E10, putting the average blend rate close to 10%. Other blends include E15, which is often sold as unleaded 88 by retailers, E85, which is designed for flex fuel vehicles, and E0 with no ethanol. Since 2016, the average fuel ethanol blend has exceeded 10%, reaching as high as 10.3% in 2021 due to those higher blend choices.

That changed in 2022 when buyers set a new record showing the summer ethanol blend average at 10.5%, and in June and August, that ticked up to 10.6%, EIA reports. Those are the second- and third-highest monthly summer blend rates on record.

EIA reports that fuel ethanol’s price discount to gasoline was one factor that led to a higher summer blend rate in 2022. Though ethanol prices were high in 2022, they have been low relative to gasoline prices which are the highest since 2014. Factor in the renewable identification number credit for blending ethanol with gasoline and ethanol’s discount to gasoline is even stronger.

Those RINs are a compliance mechanism used for the Renewable Fuel Standard program run by EPA, and they sold at near-record prices for much of 2022.

This allowed retailers to offer discounts for higher ethanol-blended fuels than E10. In many locations, unleaded 88 carries a discount to E10, and E85 is often priced significantly lower than E10. Price-sensitive consumers are buying the higher blends, EIA reports.

Ethanol groups respond

In responding to the report, Geoff Cooper, president and CEO, Renewable Fuel Association notes that the new analysis from EIA “confirms that American drivers gravitated toward lower-cost E15 and E85 this summer as war in Ukraine drove pump prices to record highs.”

Cooper says the Biden Administration’s move to issue emergency waivers helped stave off fuel shortages. “And [it] ensured consumers had uninterrupted access to E15, which was typically priced 20 to 40 cents per gallon lower than regular gasoline,” Cooper says. “EIA’s analysis also shows that consumption of lower-carbon renewable fuels increases, as expected, when the Renewable Fuel Standard and its RIN market mechanism is allowed to work as intended.”

He adds that the report underscores the importance of permanently removing the summertime barrier to E15 sales and implementing “robust RFS volume requirements for 2023 and beyond.”

EPA’s announcement of the 2023 Renewable Volume Obligation under the RFS has been pushed back to November 30 as part of a consent decree between EPA and Growth Energy. In announcing the deadline extension, Emily Skor, CEO, Growth Energy, noted: “While any delay is unfortunate, this shift in timing only impact the proposal. Importantly, the deadline for EPA’s final rule remains in place for June 14, 2023.”

Skor adds that if EPA slips on the Nov. 30 proposal deadline, Growth Energy would pursue further enforcement in court. “EPA cannot miss this opportunity to usher in a new era for the RFS and expand the critical role biofuels play in mitigating climate change and lowering prices at the pump.”

Ethanol and the price of gasoline

Ethanol prices have been higher in 2022, but not as high as gasoline. The EIA report shows that between June and August, on the U.S. Gulf Coast, ethanol’s discount to spot gasoline averaged $2.16 per gallon when factoring in the RIN credit. That discount rose as high as $3.11 on June 8, and has been over $1 per gallon all year. “Although ethanol has a lower fuel efficiency than gasoline, the price discounts have been sufficiently high to make fuel ethanol less expensive on a per-mile basis,” the report states.

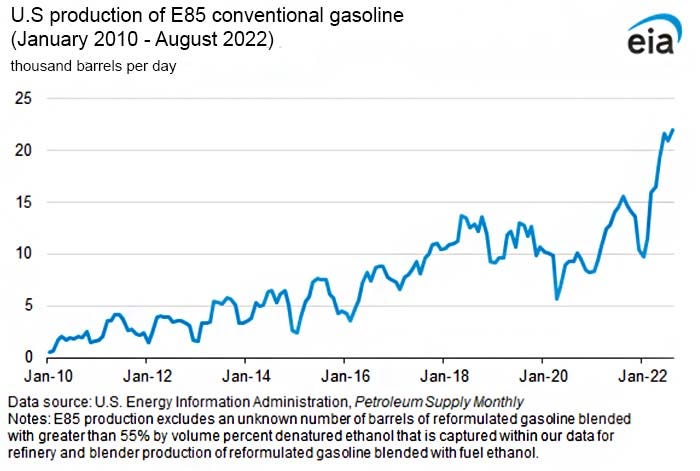

E85 has the highest price differential at the pump, and it appears buyers are responding. While EIA doesn’t collect data on E85 sales, the agency tracks production of E85 from large facilities, and information on conventional finished gasoline produced at biofuel plants. While the data is incomplete, what has been collected shows that from June to August 2022, U.S. production of E85 conventional gasoline was at record high levels topping 21,000 barrels per day for those three months. During the same period in 2021, consumption was 15,000 barrels per day, and generally lower in prior months.

About the Author(s)

You May Also Like