I'm back at Penton Agriculture and, coincidentally, cattle are in a bear market for the first time since a harsh downward correction in 2008.

Those of us who've been in agriculture all our lives should be accustomed to these downturns, because they are as regular as the upturns. The old saw, "What goes up must come down," comes to mind.

Human nature, of course, is such that when we're emotionally invested in something -- like the ownership of cattle -- we only want to see the upside and we fear and hate the downside. This is much like the expectation that drought won't happen when it is, in fact, a natural and recurring phenomenon.

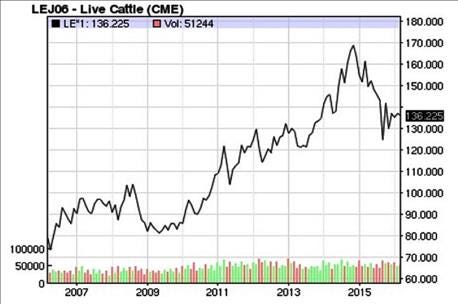

Ten years of live cattle futures prices show the bull market and the downturn into the current bear market.

That attitude of only seeing the side we want to see is a fool's errand, however. It can only lead us to frustration and error. The smart thing to do is plan for both sides of all market moves. Here's the place I normally harp on low-cost production as a hedge against falling prices ... so consider it harped upon.

But I also want to write a bit here about the nature of markets today. First, I'll agree with the claims that markets are manipulated by big money. It would be ridiculous to say otherwise. When that kind of money enters a marketplace, it naturally increases volatility and that increases the size and the speed of movements.

But here's the part many of you don't want to hear: It affects the upside the same as the downside. I have never seen any study or any evidence to the contrary. Therefore, you should be just as angry when the market makes a huge upward move as when it dips into the toilet. It's all manipulated by the big money in the markets and the result is it increases volatility.

Second, when you combine the amount of money and speed of movement with the "free-money" lending policies of the world's central banks, including the Federal Reserve, and the legalized ability of many investment bankers to wager in markets with this free money, you aggravate those results both up and down.

Third, I have come to the conclusion that the markets are much more driven by technical analysis than ever before. The age-old market movements following trend lines, reversing at previous support and resistance points, and retracing 50% of moves up or down, to name a few, are more powerful than ever and happen faster. The commodities futures markets may still discover prices, but I now argue they are driven more by technical features in the short run than ever before because thousands upon thousands of computer-driven trades per day are set to evaluate and make trades upon those signals and to do it very quickly.

I have seen the same trends in other markets and for basically the same reasons. The stock markets continue to be propped up far above any reasonable level by all that funny money. The bankers en masse keep wagering the market will go up and so it keeps going up, although we've seen some brutal downturns in recent months.

Another example is the currency markets. For several years now a friend who trades currency for a living has been teaching me how he trades. As I've watched the currency markets, which are huge and far more liquid than the commodities markets, I've observed they often move in counter-intuitive directions, but more important is the major currencies can be extremely volatile and tend to move a lot during the day but only occasionally close out any given day very far from the previous day's close. They appear very driven by chart signals, in fact that seems to me the only reliable sign indicating the direction of movement.

My friend tells me this: "It doesn't matter why. It only matters which direction."

That is a trader's attitude, but I believe it is the nature of the modern markets, including the beef market.

About the Author(s)

You May Also Like