Brad Paisley sings a song about "waitin' on a woman," and the cattle market sings about "waitin' on the cash."

Seemingly, traders can't or won't move until they get a hint of what the 20% of open-market cattle will trade at before deciding as to whether that was too high or not high enough.

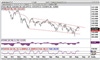

The consolidation at the upper end of the most recent range is viewed as supportive. Marking time until the next cash trade transpires appears entrenched for the time being. This is perceived to be crucial since there is not perceived a fundamental aspect to start a bull market or resume the bear market.

The consolidation at the upper end of the most recent range appears supportive, and with no perceived fundamental reasons to start a bull market or resume the bear market, the next cash trade looks crucial.

Therefore, each week's movement is critiqued and criticized to its fullest extent. So, all in all, there isn't much to anticipate with seemingly such little potential for a move of significance to materialize.

I see little to do at this juncture. A trade down to the mid $112.00 area October won't surprise me. If it does this today or tomorrow, packers may consider being a buyer of October at such a discount.

My analysis on feeders is slightly different than for fats. Not so much the chart pattern, but fundamentals of supply. The anticipated elevated calf crop may hit head on into a shorter supply of feeder cattle this fall than currently perceived. How this materializes will weight the trade significantly in one direction or the other.

This Friday's corn report will also be perceived to have more impact on feeders than the previous three. That is because the cash market is so discounted to the futures that feeding cattle corn appears to produce a better marketing venue for corn than storage or sales. Therefore, farmers may continue to buy feeder cattle on the front end as a home for their corn. That's why there appears to be greater potential for price fluctuation in the feeders than fats at this time.

So, marketing strategy is to use this current strength perceived here for a short period of time to market inventory out to the end of the year. What I am having difficulty with is whether any of these situations that could materialize will be enough to warrant a new contract low.

Therefore, plan hedges carefully and accordingly to your tolerance of risk and the extent of price movement you may anticipate.

Corn is meandering and I anticipate it will continue to meander until Friday's grain report.

An investment in futures contracts is speculative, involves a high degree of risk and is suitable only for persons who can assume the risk of loss in excess of their margin deposits. You should carefully consider whether futures trading is appropriate for you in light of your investment experience, trading objectives, financial resources and other relevant circumstances. Past performance is not necessarily indicative of future results.

About the Author(s)

You May Also Like