The firmer trade this morning has already spurred comments of, "We've seen this before." This will be repeated most of the way up to the $110.00 area December.

For now the only two things we have to go on are:

1. If the December contract breaks above $110.82 it suggests the decline has reversed.

2. Trade under $93.82 suggests the wave count lower is unfolding further into sub-waves.

I know this price range is excessive when attempting to dial in a reversal or continuation. However, it is this wide and diligence will have to be paid in the interim.

The feeder cattle markets have been hammered down along with live cattle and appear waiting on a direction from fat cattle.

The excessive selling the past two weeks has changed the environment. Not only have significant sales been made, but combined with the excessive price decline, intrinsic value is anticipated to be very near.

Technical indicators are turning with the higher trade this morning. Recall that most have divergence and therefore may be turning from not as low a level as previously. Time is what is needed now to see how much of the price decline was warranted in the terms of consumer demand and how much was over-exaggeration.

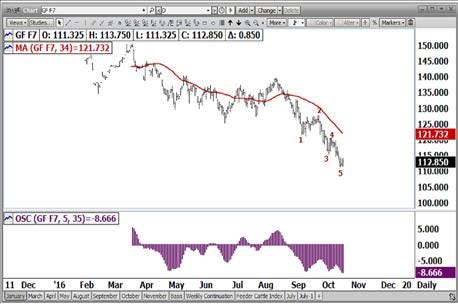

Considering this decline from the August high to be the fifth wave of this decline from historical high, it being a contracting wave pattern and divergence of technical indicators, I recommend lightening up on short positions if still held and lean toward anticipation of a crawl back above the $110.00 level.

The May feeder cattle $120.00 calls continue to trade under $4.00 this morning. I continue to recommend ownership of these calls.

Feeders have the same contracting pattern as do the fats. The extent of the decline was more in feeders than fats. It is has been stated a multitude of times that feeders need to be pulled from the top up with higher fat prices.

With a few minor changes being seen taking place, coupled with the amount of sales that have taken place over the past several weeks, backgrounders are perceived to finally be getting ahead of the sales curve. This will allow for some room for the new calf crop to come in. Between this and the lower calf prices offering some a chance for profit, feeder traders may begin to find it more difficult to sell the market off and have it stick.

An investment in futures contracts is speculative, involves a high degree of risk and is suitable only for persons who can assume the risk of loss in excess of their margin deposits. You should carefully consider whether futures trading is appropriate for you in light of your investment experience, trading objectives, financial resources and other relevant circumstances. Past performance is not necessarily indicative of future results.

About the Author(s)

You May Also Like