WITH no July cattle inventory numbers from USDA to guide us, most of us watching the cattle markets assume that the industry is still in some form of liquidation mode. The widespread drought of 2012 and the multi-year drought wilting pastures across many cattle-producing regions of the U.S., have likely led to another 2.1% decline in beef cow numbers, according to a mid-year estimate by the Livestock Marketing Information Center (LMIC).

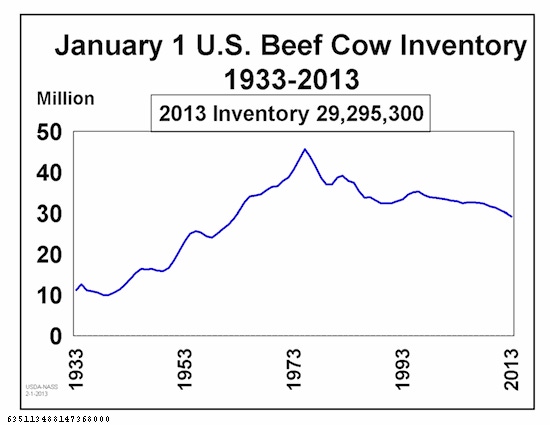

The U.S. cattle inventory has been on a steady decline for several years; 2013 data reflects USDA's January Cattle Inventory report.

Polling members of the group’s technical advisory committee on cattle numbers and trends, the center’s director Jim Robb and Oklahoma State University economist Derrell Peel reported that both nationally and across regions, LMIC members agree that cattle numbers were smaller on July 1 than they were at the same point in 2012. Because of Sequestration-related cutbacks, the U.S. Department of Agriculture will not produce another cattle inventory report until January, having cancelled the traditional mid-year survey.

“The status of cattle inventories in the U.S. is unknown at this time,” the economists explained, sharing estimates compiled from members of LMIC’s technical advisory committee. “Nationally and by region, the group was unanimous that the beef cow herd is down so far this year, with the U.S. assessments ranging from less than 1% to more than 2%. The majority of the group indicated that the beef cow herd was likely down between 1 and 2% as of July 1. Assessments on beef replacement heifers was more variable with some limited view that modest heifer retention was occurring in some areas with a majority feeling that no significant heifer retention was occurring yet or that some heifers earlier retained for breeding had been diverted into feeder supplies.”

As I reported this morning at Feedstuffs.com, beef cow slaughter was down 3.1% year-over-year in the first half of the year, but some of that is likely due to aggressive rates of slaughter fueled by the lingering drought in cow country. Producers had already been culling fairly heavily, in other words, so slaughter numbers had to come down eventually.

The only category not expected to show a decline, according to LMIC’s estimates, is dairy cow numbers, which actually increase by 0.5%, with dairy replacements likely gaining 1.2% compared with the inventory as of July 1, 2012.

Profits coming back soon for cow/calf producers

While beef producers may still be in liquidation mode at this point, LMIC’s Robb says – for the third time in as many years – that profits are coming back to the cow/calf sector in the not-too-distant future.

“We keep waiting for the big pop in cow/calf returns, and for the third year in a row we’re expecting that it will come this year,” he said. “We’ve seen a real worst-case scenario in recent years, though, because of the persistent and widespread drought.”

Robb explained that cow/calf returns were in the red for 2008 and 2009, and despite having recovered somewhat in recent years, have not reached a level that would encourage any expansion in the beef herd. Not surprisingly, the cow herd is at its smallest size in many years, and producers appear to be weighing expansion plans with a heavy dose of caution.

LMIC estimates annual returns per beef cow, figured based on cash costs plus rent, and Robb pointed out that last year’s return of $33.70 per head certainly wasn’t much of an economic signal to retain more heifers.=

“If you multiply that by 500 cows, that’s not giving you much to live on,” he explained. “Drought caused people to liquidate herds, so they’re making less money all the way around.”

But prospects, barring any major black swan-type event, are certainly looking up. With an improving calf market and rapidly falling corn prices, LMIC projects 2013 cow/calf returns at $117.80 per head.

But Robb cautioned not to expect ranchers to be flush with cash quite yet: producers aren’t likely to reap the benefits of improved calf prices until this fall, when they market this year’s calf crop. Given that, he described the mood in the countryside as “a little tense” for the time being.

“This year is going to be a rebound, but we’re still going to be below where we were in the really good years of the early 2000s,” he observed. Returns for 2014, on the other hand, could be “obnoxiously high,” potentially setting a new record near $270 per cow.

Assuming, of course, that the worst-case scenario doesn’t continue.

You can read more about LMIC's estimates for beef industry returns in the Aug. 5 edition of Feedstuffs.

About the Author(s)

You May Also Like