If you are looking to buy farmland this year, there might be some room for negotiation. A new report issued today by Farmers National Company, a farm management service, showed that farmland values in much of the Midwest slipped from the highs of several years ago. The report states the decline is in relation to falling commodity prices.

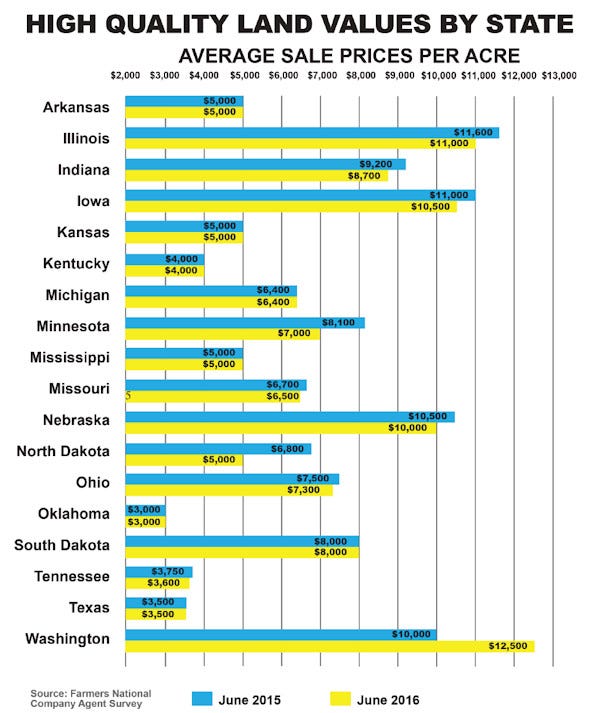

Eight of the 11 Midwest states surveyed showed a decline in average sale prices per acre between June 2015 to June 2016, with the exception of South Dakota, Michigan and Kansas, where values remained the same.

Minnesota had the biggest drop in high-quality land values, falling from $8,100/acre in 2015 to $7,000/acre in 2016. Illinois and Iowa, the two states with the highest land values, also showed declines. Illinois land values fell from $11,600 to $11,000/acre, while Iowa fell from 11,000 to 10,500.

There's a chart at the end showing the year-over-year change.

Still, buyers remain cautious, according to the report. Randy Dickhut, senior vice president of real estate operations for Farmers National Company, says farmers and ranchers, who were the predominant purchasers of land that came on the market during the past decade, are not being as aggressive now when compared to recent years.

“Farm and ranch profits are down and lenders are being more careful in what they will lend on land purchases,” Dickhut says in a news release issued today. “Furthermore, investor interest in farm and ranch land declined as land values moved higher during the last four to five years and the return on investment slipped. But individual and fund investors are moving back into the land market as land prices soften. “

To access land values reports for a particular state or region, visit albr.co/fnc-jun-2016. Farmers seeking investment services can contact Farmers National at farmersnational.com.

About the Author(s)

You May Also Like