January 7, 2019

There is plenty of reason to look at the growing strength of beef demand in recent years and believe that a new and exciting trend is in place. But at the same time, understanding that some of the factors driving this trend are at a higher risk to slow or reverse in the next year or two will be wise for those whose livelihood depends upon beef and cattle prices.

Beef production grew by 3% in 2018, following production increases of 4% and 6% the previous two years. Although beef exports have grown by an average of around 300 million pounds per year during this period, the amount of beef available for U.S. consumers has increased each of the past three years and was about 6% higher in 2018 than in 2014 and 2015. Yet the choice boxed beef price posted its second straight increase in 2018, and retail beef prices averaged a level very similar to 2016.

We can look back and conclude that beef demand has been strong, but will it continue?

Economy in play

With the strongest growth in demand occurring in the highest-quality prime grade, a growing U.S. economy has certainly provided a big boost. Lower unemployment, more disposable income and a larger percentage of meals consumed away from home all favor beef demand, particularly prime and upper-choice.

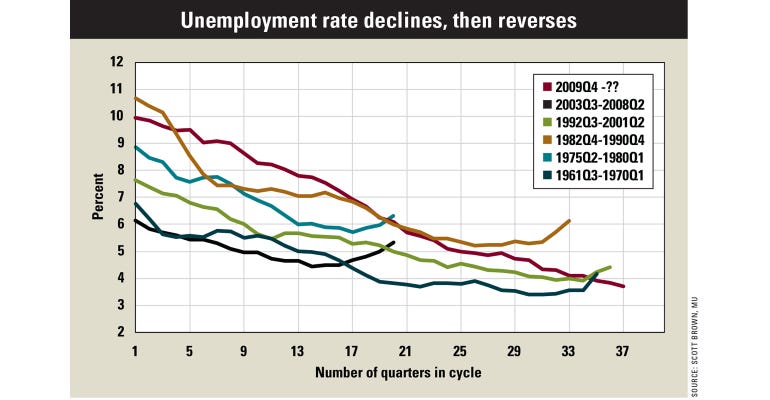

While most economic projections for the next couple of years expect slower growth in the U.S. economy, few show a significant downturn. A note of caution is in order regarding unemployment rates, however. We have seen unemployment in a general decline for 36 quarters now, the longest stretch in at least 60 years. If the domestic economy struggles more than expected next year, the demand for higher-quality beef could quickly plateau, if not decline.

Exports are essential

The bulk of U.S. beef export gains in the past couple of years have occurred in the markets of Japan and South Korea. In fact, 88% of U.S. export growth in 2016 occurred in these two markets, followed by 61% in 2017 and 69% for the first ten months of 2018.

There is reason for optimism about continued growth in these markets, as the per capita beef consumption of South Korea is currently around 36 pounds per person on a carcass weight basis, and Japan only 23 pounds per person. This compares to 82 pounds per person in the U.S.

However, there will become a time when these markets have reached a satiation point for U.S. beef, just as is the case with the explosion of prime beef demand among U.S. consumers. Let’s hope that day does not arrive anytime soon, given the supplies of beef and total meat expected in 2019.

Producers should enter the new year with optimism for the beef industry, but also a strong sense of caution in that optimism.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like