October 31, 2022

There remains a high probability for elevated cattle prices in 2023 due to tighter beef supplies, even as the outlook dims for U.S. economic growth. However, despite the supply side of the economic ledger putting upward pressure on prices, the odds are that the demand side will dampen the cattle price outlook.

Under this scenario, it is worthwhile to consider what has been the outcome in previous years of similar economic forces. Looking at both supply and demand factors should help focus producers on how to manage risk in the uncertain environment they will face in 2023.

GDP impact on beef prices

The outlook for cattle prices is usually described in nominal terms, yet this article considers fed-steer price in real terms, adjusted for inflation. This is necessary not only because of the current inflation environment, but also because over time, even modest levels of inflation make it difficult to compare price levels from periods over several decades.

Looking at the annual change in real fed-steer prices from 1980-2022, we see an average change of -0.7%, with a notable difference between the 1980-98 average of -3.8%, and the average of +1.7% from 1999-2022. But how did prices tend to change in years with supply and economic factors similar to what we expect to see in 2023?

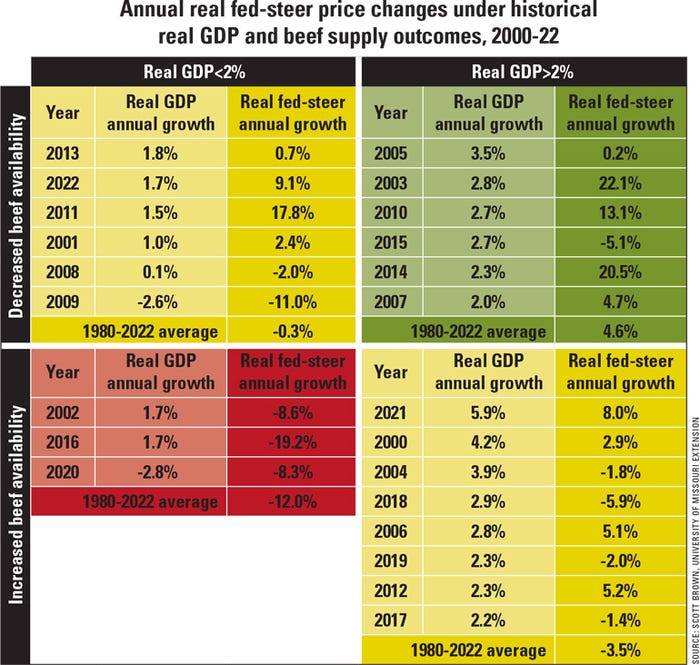

The table highlights the 2000-22 observations and is divided into four quadrants based on real GDP growth (above or below 2.0%), and the per-person availability of beef (more or less). It is useful to consider per-person availability as a supply metric as opposed to beef production because it accounts for changes in net trade, as well as population growth over time.

As we would expect, we see the highest annual average change in the real fed-steer price (+9.3%) in the portion of the table with relatively higher GDP growth and less beef availability, and the lowest price change (-12.0%) in the portion with weaker GDP growth and more beef availability.

But to examine the outcomes most similar to what we expect for next year, we examine the portion of the table with less beef availability and weaker GDP growth.

Inflation effect on cattle values

Ten times since 1980 we have seen the combination of real GDP growth below 2.0% and less beef available per consumer. There is a wide range in price change outcomes over the 2000-22 period.

As these price outcomes are sorted by GDP growth, one can see that the positive price changes were all associated with GDP growth of at least +1.0%, while real prices declined every year in which real GDP declined.

Given the number of economic prognosticators who are now calling for a decline in 2023 real GDP, this lends some caution to price expectations next year if a recession does indeed occur.

Remember that these are real price levels. With this year’s GDP deflator on pace for 9% growth, even a relatively strong bump in the 2023 fed-steer price could turn negative in real terms if strong inflation persists.

Also note the wide range of price outcomes present in each section of the table. We often see intervening factors drive prices away from what these two economic measures might suggest for short periods of time.

Taking into account the far greater beef demand strength today than what existed for much of the 1980s and 1990s certainly lends optimism to a relatively tight supply outlook. But note that if we do end up with the combination of a decline in real GDP next year and higher real fed-steer prices, it would be a first in our lifetime event for many of us.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like