The latest USDA Cattle on Feed report showed a June 1 feedlot inventory of 11.699 million head, almost unchanged year over year from 11.671 million head in 2020; and fractionally lower than the June 1, 2019 level of 11.728 million head. May marketings were 1.87 million head, up 23.4 percent year over year and down 9.7 percent from the May 2019 level. Feedlot placements in May were 1.911 million head, down 6.9 percent year over year and down 7.4 percent from 2019 levels. The placement number was slightly smaller than expected but within the range of pre-report estimates, while the marketings and on-feed totals were very close to expectations.

The big question is whether the feedlot situation is improving to a point where the fed cattle market can emerge from the capacity cap that has limited the market in 2021. The answer is that, yes, the situation is improving but we are not quite there yet. The February 1 on-feed total was the highest of any month since February 2006 and reflected the buildup of feedlot inventories carried over from pandemic disruptions last year. Feedlot inventories have dropped by 3.4 percent from February to June, the largest decrease in that period since 2012. The average change in feedlot inventories from February to June in the five years from 2016-2020 has been a slight increase of 0.3 percent.

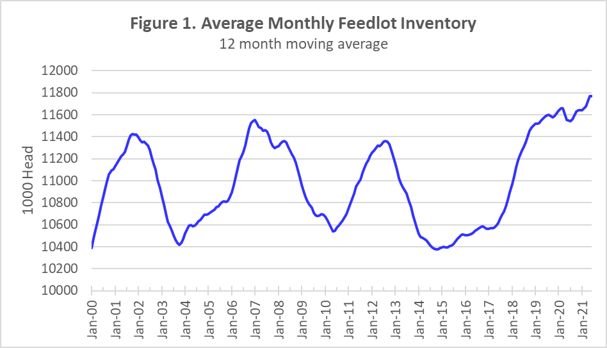

Figure 1 shows the twelve-month moving average of feedlot inventories. This provides a longer-term view of the feedlot situation by removing seasonal variation and allowing month-to-month comparisons of average feedlot inventories for the previous 12 months. Since March of this year, the twelve-month moving average has been at record levels, increasing each month. The most recent value for June 2021 is higher again at another record level. This shows that the feedlot industry has not yet turned the corner to begin reducing average feedlot inventories. I expect this will happen in the next month or two. The decline in monthly feedlot inventories since February is encouraging and represents progress in moving to cyclically smaller feedlot production.

The current fed cattle market will show improvement faster than the moving average in Figure 1 (which takes time to reflect changing conditions) and that appears to be happening. Cash fed cattle prices last week averaged $122/cwt., the highest level in eight weeks. Barring some new disruption, feedlot inventories should drop below 2020 (and 2019) levels in the next month or two and remain there going forward. However, the ongoing drought could represent such a disruption if dry conditions force feeder cattle into feedlots sooner than usual. Drought could slow down the process of tightening beef supplies in 2021 but increased cowherd liquidation would lead to even smaller supplies in the coming years.

Source: Derrell Peel, Oklahoma State University, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like