Beef cattle slaughter has almost returned to normal, but there is still a large backlog of fed cattle and probably of cattle out in the countryside.

Further, there is no telling what the entire sequence of recent events surrounding the COVID-19 crisis will do to cattle prices later this year, nor to demand for beef products in the future.

The past two weeks USDA’s Agriculture Marketing Service (AMS) estimated cattle slaughter at almost the same level it was last year, suggesting the coronavirus-related slaughter slowdown in the beef packing industry appear to be over.

The AMS June 12 slaughter report showed estimated weekly slaughter of 658,000 fed cattle, compared with 669,000 head this week last year. That’s says we’re only 1.6% behind.

AMS estimated last week’s total fed-cattle slaughter at 636,000, which compares with 524,000 the previous week and 665,000 the same week one year ago. This would be only a little more than 4% fewer cattle on a year-over-year basis.

In both these reports, however, the tally for the year shows we are roughly 1 million head behind in total slaughter. The argument could be made we could have about that many fed cattle waiting in feedlots.

However, two economists say that isn’t necessarily the case. Derrell Peel, Oklahoma State University livestock economist, was earlier concerned that actual slaughter was not meeting estimated slaughter as packers continued to have worker problems. That appears to be resolving itself as actual slaughter reports, which come out nearly two weeks after the estimated reports, are beginning to align.

At this point, the backlog appears to be close to 1 million cattle, with the current year-to-date slaughter total of 13.9 million. This compares with 14.9 million at this time last year. This could be market-ready cattle sitting in feedlots, but the slowdown in feedlot placements and the advance state of marketing fed cattle before the COVID-19 events together suggest many of these cattle could still be in the countryside, say Peel and Rabobank economist Don Close.

Close notes that feedlot placements, compared with year-earlier figures, were 8% lower in February, 23% lower in March, and 22% lower in April. He says this suggests a lot of cattle that would normally be on feed are actually in the country, and that could set up problems further back down the marketing chain.

There is another bugaboo in this backlog of fed cattle: The current estimated slaughter weights in the June 5 report were 1,373 pounds, whereas one year ago they were 1,310 pounds. Dressed weights are 824 pounds versus 791 pounds one year ago. Carcass weights have been increasing weekly. To a degree, all this additional beef entering the market has helped to decrease the effects of the slaughter slowdown, Peel and Close say. Peel adds that the current level of extra carcass weight is equal to about 30,000 more animals entering the market per week.

I am concerned the events we’ve witnessed this spring, in which the packing industry was undersupplying and overpricing beef, will cost us dearly later. I’ve read studies by economists in the past suggesting beef purchases are fairly insensitive to price changes, but I’m not sure this level of price change has been studies. I must wonder if this kind of price inflation will hurt our demand.

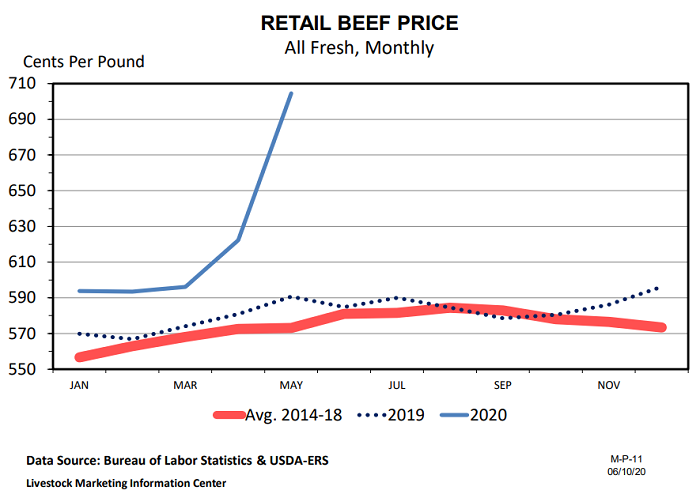

In recent days I’ve read a couple unsettling news items in the Daily Livestock Report by the Steiner Group, produced for the Chicago Mercantile Exchange. Using data from USDA’s Economic Research Service, the report showed the May all-fresh retail beef price jumped to $7.05 per pound, which was 19.3% above last year. (Choice beef went even higher, to $7.58 per pound.)

For comparison, the retail pork price rose 4.2% from last year to $4.05 per pound, making it the highest price since November 2014. The broiler composite retail price rose 8.5% over last year’s price to $2.05 per pound, breaking the record price of $2.03 cents per pound. To reiterate, beef rose 19%, pork rose 4.2% and chicken rose by 8.5%.

Also, the export data from April, released by USDA, showed US beef exports appear to have been hurt by this incident while pork and chicken exports gained. Here are those numbers: Exports of fresh/frozen and cooked beef exports in April were 3.4% lower than a year ago. US pork exports in April continued to post double-digit increases from a year ago with total exports of fresh/frozen and cooked pork 23.4% higher than last year. Total exports of fresh/frozen chicken were 8.3% higher than one year ago.

If beef exports are as vital as we’re repeatedly told, to the tune of about $350 per head, then this seems like concerning news.

The opinions of the author are not necessarily those of Beef Producer or Farm Progress.

About the Author(s)

You May Also Like