September 6, 2022

As consumers at home and around the world continue to navigate uncertainty in terms of inflation and future economic conditions, it is encouraging to see demand for U.S. beef remain solid on so many fronts.

Beef exports have only accounted for 12.7% of U.S. beef production for the first half of the year, but the value of those shipments continues to play an increasingly important role in total beef demand.

Export value continues to rise

Consider these changes in beef export volume and value for the first six months of 2022 relative to the first six months of 2021:

overall U.S. beef export volume up 3.6% (value up 33.5%)

volume to largest export market Japan down 0.1% (value up 14.4%)

quantity of shipments to second-largest export market South Korea up 2% (value up 40.7%)

volume to third-largest market China up 15.3% (value up 67.7%)

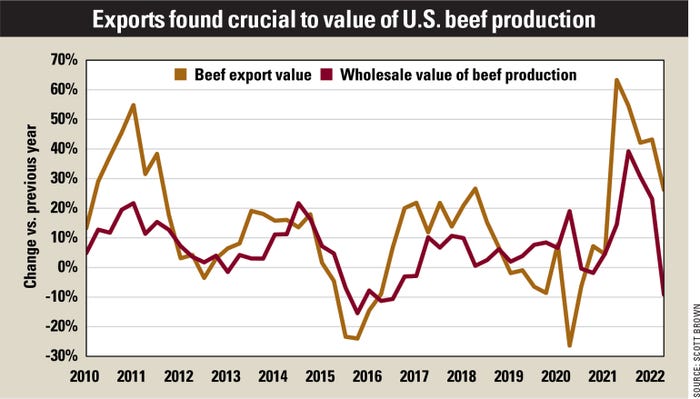

These amazing value gains continue a lengthy period in which export value growth has consistently outpaced the overall rate of growth in the wholesale production value of U.S. beef.

From the beginning of 2010 through the second quarter of 2022, the change in beef export value relative to the previous year has outpaced the change in wholesale beef production value (calculated as commercial beef production multiplied by the comprehensive beef cutout value) more than two-thirds of the time.

The average annual growth in export value since 2010 of 13.6% easily outdistances the average 6.9% annual growth in the wholesale value of beef production.

For the six quarters since the beginning of 2021, the disparity is even greater: a 39% average growth in beef export value vs. 17.2% in the wholesale value of beef production.

Smaller beef herd drives demand

The rate of increase is even more impressive when considering that the U.S. dollar has strengthened against many currencies for much of this period, as a stronger U.S. dollar tends to weaken the purchasing power of consumers in other nations.

For instance, the dollar was 15% stronger against the Japanese yen for the first half of 2022 relative to 2020, and 40% stronger relative to 2010. Of the top five U.S. beef markets, the only nation’s currency that the dollar was weaker against during the first half of this year relative to both 2020 and 2010 was China.

Make no mistake, the most important consumers for the U.S. beef industry reside within our own borders. If the household finances of domestic consumers suffer greatly as we move through the next few years, or if consumer preferences for beef reverse from the upward trajectory that has characterized the past couple of decades, there will be negative ramifications for beef and cattle prices at all levels of the supply chain.

But seeing the phenomenal growth in export values to many key markets helps provide some diversification regarding consumer demand for U.S. beef. And it could set off a bidding war for smaller U.S. beef supplies in the coming years, if demand holds at recent levels.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like